One of my favorite sci-fi movies is The Fifth Element.

In it, Bruce Willis is a New York City cab driver.

Except the year is 2263. So he’s not a cabbie as we know it. Instead, he drives a flying cab.

In fact, there are flying cars all over this 23rd-century New York City.

And there are several layers of flying cars — each at a different altitude.

This makes sense as a futuristic idea that seeks to solve current traffic problems.

Many layers of traffic, instead of just one, can reduce congestion.

But this may no longer be a sci-fi concept.

Flying cars are an idea that’s gathering a lot of interest and funding.

And we definitely don’t have to wait until the 23rd century for it.

EVTOLs Brought in a Record Level of Funding in 2021

Several companies are working on flying cars.

These are concepts called electric vertical take-off and landing (eVTOL) vehicles.

The vehicles are electric, quiet and can fly.

This means they cut down on carbon emissions, noise pollution and traffic congestion.

The eVTOL industry had a big 2021. Several companies went public, and several others received millions in funding.

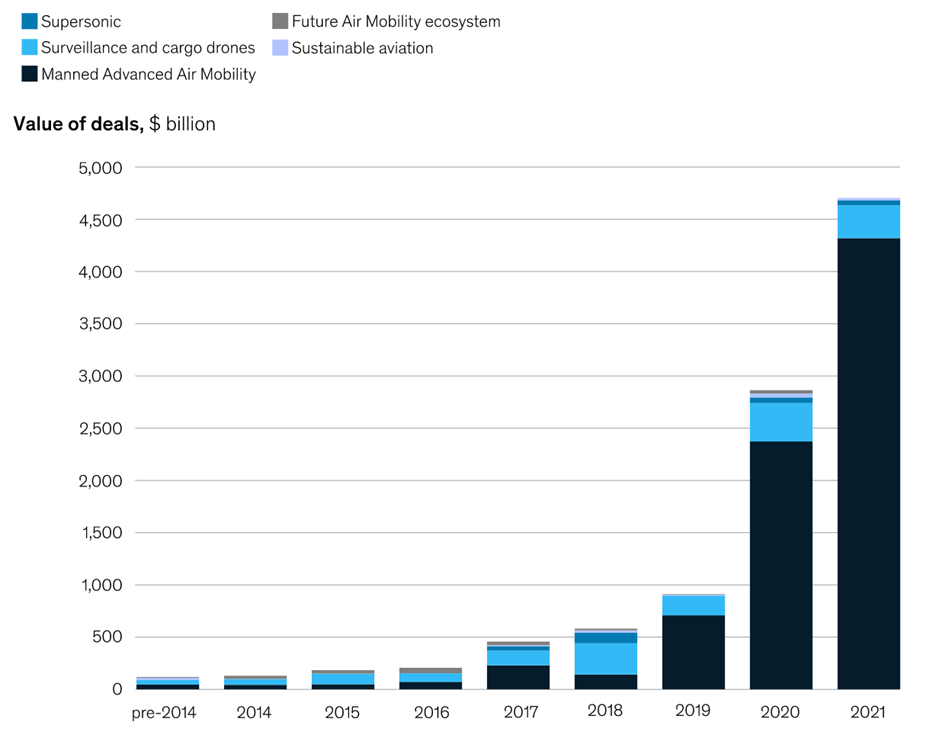

(Source: McKinsey & Company.)

As the chart above shows, funding for aviation innovation has been booming since 2014.

And in recent years, the Manned Advanced Air Mobility segment has taken off.

This segment refers to eVTOLs and other related solutions.

In 2021, aviation innovation brought in $4.6 billion in total funding.

And eVTOL solutions accounted for nearly 80% of it.

EVTOLs Are Making Great Progress

It’s impressive to see the billions the eVTOL industry has received.

But it’s even more impressive to see how far individual companies have come.

These include:

- Joby Aviation Inc. (NYSE: JOBY) — backed by Uber.

- Lilium NV (Nasdaq: LILM) — backed by early Tesla investor Baillie Gifford.

- Vertical Aerospace Ltd. (NYSE: EVTL) — backed by Rolls-Royce and Honeywell.

With this level of progress and funding, it’s no wonder that industry experts see great potential.

Morgan Stanley projects a $1.5 trillion market by 2040. And Deloitte expects $115 billion in revenue by 2035.

But it’s important to note that the industry is still very young.

None of the companies in the space currently generate revenue. And eVTOLs won’t deploy until 2025 at the earliest.

So it may be a bit too soon to invest in these companies. But it’s not too early to keep an eye on them.

We’ll keep you updated as this industry grows. In the meantime, there are other opportunities.

Whether they have wheels or propellers, all electric vehicles need certain components.

To find out how to invest in these, check out Ian King’s Strategic Fortunes service.

Regards,

Research Analyst, Strategic Fortunes

Morning Movers

From open till noon Eastern time.

BlackSky Technology Inc. (NYSE: BKSY) provides geospatial intelligence, imagery and related data analytic products and services. The stock skyrocketed 105% after the company was awarded a 10-year contract by the U.S. government to develop next-generation satellite imagery capabilities.

StoneMor Inc. (NYSE: STON) owns and operates cemeteries and funeral homes in the U.S. The stock jumped 51% on the news that it is being acquired and taken private by its largest shareholder, Axar Capital Management.

Höegh LNG Partners LP (NYSE: HMLP) owns, operates and acquires floating storage and regasification units, liquefied natural gas carriers and other LNG infrastructure assets. The stock rose 31% on the news that it is being fully acquired by its parent company, Höegh LNG Holdings Ltd.

Caleres Inc. (NYSE: CAL) offers licensed, branded and private-label athletic, casual and dress footwear products internationally. It is up 29% after delivering its best-ever first-quarter performance for sales, gross profit margins and earnings.

Redbox Entertainment Inc. (Nasdaq: RDBX) operates a network of self-service kiosks where consumers can rent or purchase new-release DVDs and Blu-ray Discs. It is up 18%, continuing its recent uptrend as a meme stock.

Abercrombie & Fitch Co. (NYSE: ANF), the apparel retailer, is up 18% today. The stock is on a rebound after dropping Tuesday when it missed first-quarter earnings estimates due to inflationary pressures and higher operating costs.

Kohl’s Corp. (NYSE: KSS), the department store operator, is up 16% this morning. The stock moved on reports that the company is attracting fresh buyout bids with big names such as Sycamore Partners, Simon Property Group, Acacia Research and Brookfield Asset Management.

Maxar Technologies Inc. (NYSE: MAXR) provides earth intelligence and space infrastructure solutions internationally. It is up 15% because it is another space company that was awarded a 10-year contract by the U.S. National Reconnaissance Office to developed advanced satellite imagery capabilities.

Dycom Industries Inc. (NYSE: DY) provides specialty contracting services to the telecommunications and infrastructure industry. The stock is up 14% after the company managed to beat both top- and bottom-line estimates for the first quarter by a wide margin.

Carvana Co. (NYSE: CVNA) operates an e-commerce platform for buying and selling used cars in the U.S. It is up 13% on a rebound from its recent lows caused by declining sales and layoffs as insiders buy up more stock in the company.