Classical economists can’t explain why interest rates can stay near zero. They always believed interest rates protected against inflation and offered a return on investment. But, since 2008, short-term rates have been close to zero. In some countries, they’ve been negative. With low rates, investors are losing money after inflation.

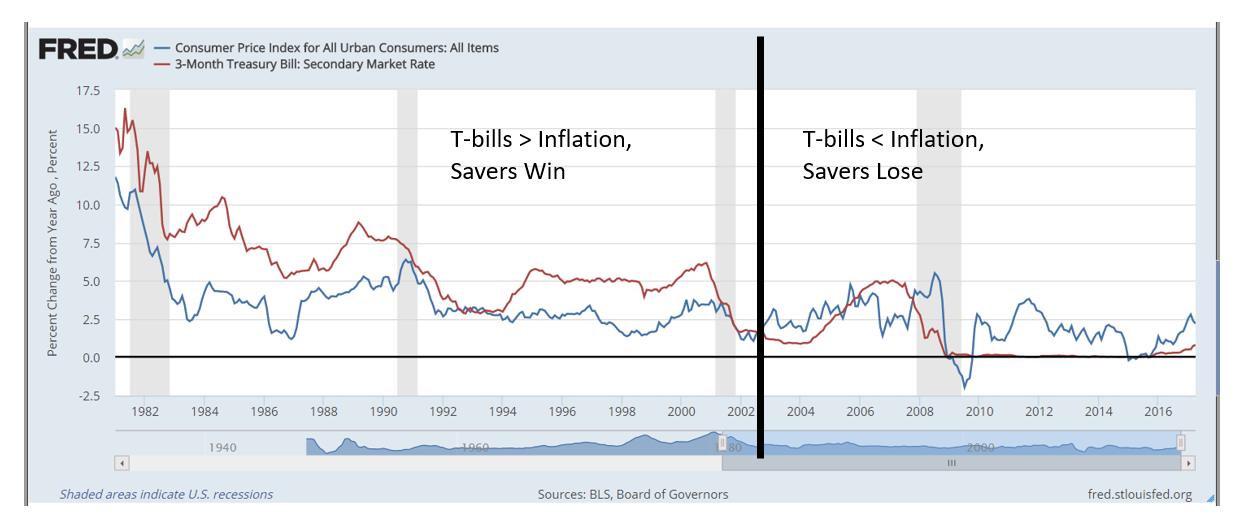

Standard theories can’t explain why this happened. However, last week, Federal Reserve economists released a paper explaining low rates. Banks value safety and liquidity more than ever before. The banks’ actions explain why interest rates fell below zero for the first time in 5,000 years. Research also explains the chart below, which shows that consumers who save money are losing buying power.

(Source: Federal Reserve)

The red line is the interest rate on three-month Treasury bills. Yields on savings accounts and certificates of deposits (CDs) are usually tied to this rate. The blue line is the year-over-year change in inflation. Prior to 2002, the red line was consistently above the blue line — interest rates were higher than inflation. Owners of CDs and savings accounts saw their wealth increase.

Normally, interest rates briefly fall below inflation during recessions. The Fed does this on purpose to try to force consumers to spend rather than save. When recessions end, rates rise back above inflation.

In 2002, something changed. That year, inflation inched above short-term interest rates. Savers lost money as their buying power disappeared. If they had $1,000 in a savings account, that money was worth less than $1,000 within three years because of inflation. Inflation eats away at savings.

Fed researchers finally explained what happened. Banks valued safety more than they did in the past. They held Treasury bills no matter what they paid, and their demand lowered interest rates for everyone.

The reasons for this change in behavior aren’t fully explained. It could be related to regulations, or it could be a reaction to increased risks that developed as globalization increased. But the reasons why it happened are less important than what it means to investors.

Fed economists concluded that low rates could last for years. This means savers will lose money after inflation, and they must consider stocks and other investments instead of savings accounts.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader