In the past few weeks, more than 90% of companies in the S&P 500 Index reported first-quarter earnings … and the results are the best we’ve seen in more than five years.

Three-quarters (75%) of the companies reporting so far beat analysts’ estimates for earnings per share (EPS). Of course, most companies beat expectations every quarter. But a beat rate of 75% is a better-than-average quarter. Over the past five years, on average, 68% of companies beat earnings estimates.

The size of the average earnings surprise is also better than average. Companies beat expectations by an average of 6%. The five-year average is 4.1%.

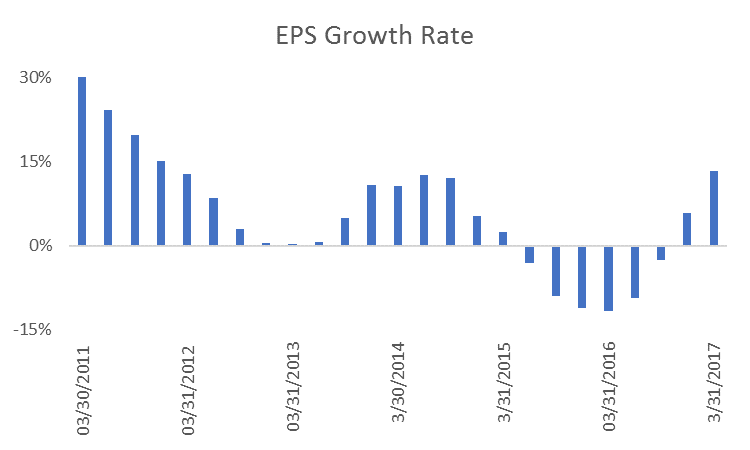

More beats than average and bigger-than-average earnings beats led to the best earnings growth in more than five years. Overall, EPS for the companies in the S&P 500 increased by 13.6%. This is the biggest gain in year-over-year earnings since the fourth quarter of 2011.

(Source: S&P)

Earnings growth is good news for the bulls, but the quality of the growth is even better news. The growth was largely driven by increased sales, which is better in the long term than earnings growth driven by cost reductions.

For the quarter, revenue increased 7.8% compared to a year ago, the highest year-over-year growth since the fourth quarter of 2011. The first quarter of this year was also the first time that sales increased for three consecutive quarters since the fourth quarter of 2014.

Increased sales are a sign that the economy is strong. This indicates we should see continued earnings gains, and that could be the best news in the stock market this week.

Long-term trends in the stock market are driven by many factors. But in the long run, earnings are the most important. As earnings season winds down, this all-important factor is bullish. That means, looking ahead, dips in price — scary as they might be — are buying opportunities.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader