Happy new year! You will spend this year hearing about how much more expensive all our “stuff” will become thanks to rising commodity prices. Oil, copper, lead, zinc, etc. … it’s all going to go up.

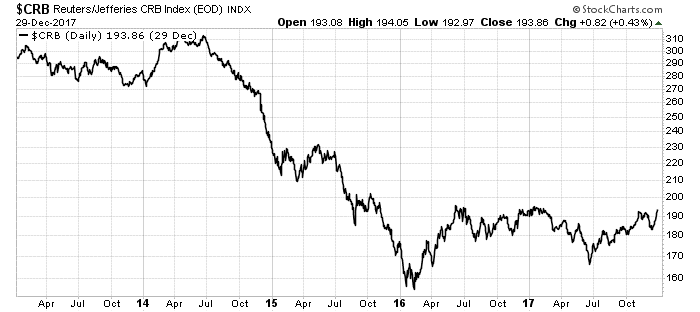

The reason is simple. While the market spent the last five years ripping higher, commodity prices have not. The chart below tells the tale:

This is a chart of the Commodities Research Bureau (CRB) Commodity Index. It’s made up of 19 fundamental commodities. The table below shows the breakdown:

| Index Components | Percentage: |

| Energy | 39% |

| Agriculture | 34% |

| Metals | 20% |

| Livestock | 7% |

As you can see above, the entire commodity sector lagged the rest of the stock market. That trend is now over. Copper, zinc, lead, nickel and oil went up 32%, 30%, 24%, 25% and 15%, respectively.

That’s just the beginning. This year should see those commodities (and others) soar.

The reason is simple … commodity prices are too low right now.

If you are a fund looking for a solid return on your investment, those numbers are attractive. They will attract investment, which will drive the price higher.

The straightforward way for us to play that trend is to buy a general commodity exchange-traded fund like the PowerShares DB Commodity Index Tracking ETF (NYSE: DBC) or the iShares S&P GSCI Commodity-Indexed Trust ETF (GSG). Both funds track the trend in commodities well.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist