On Bloomberg Television Monday morning, one of the guests made a comment to the effect that gold wasn’t as good an investment as stocks. I yelled at the television.

I often hear people repeat the idea that gold isn’t an investment … that investors are better off in equities. I disagree.

Every investor should hold some gold in their portfolio. It’s a great hedge against a collapse in the market. In this environment of ever more paper money, gold has a place in your portfolio today.

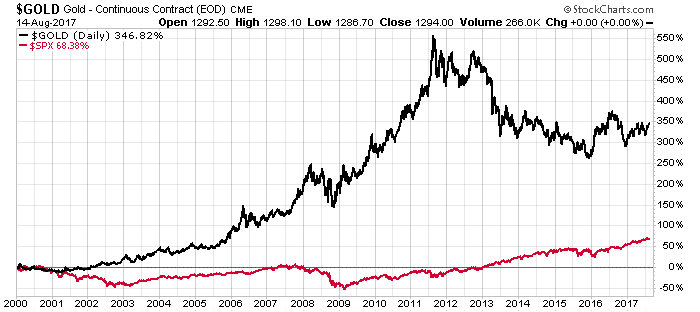

The chart below explains everything you need to know about why you should own gold. It puts the current bull market into perspective.

This is a chart of the price of gold (black line) versus the S&P 500 (red line). As you can see, since 2000 gold has returned 350%. The S&P 500 is up just double digits.

Gold is an easy thing to own and store. Buy some, stash it in your safe-deposit box and let it protect some of your portfolio.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist

Editor’s Note: Another avenue for adding physical gold to your portfolio is the EverBank non-FDIC insured Metals Select® Allocated Account. Purchase gold, silver, platinum or palladium for as low as $5,000 for unallocated accounts, and $7,500 for allocated accounts.

For more information, and to view important disclosures, click here.

For the sake of full disclosure, we receive a marketing fee based on our relationship with EverBank. But, honestly, we’d work with them regardless.