Back in early April, bitcoin was down over 30% from its all-time high.

And the rest of the crypto market was down significantly.

News headlines used phrases like “crypto winter,” which didn’t help any.

That’s why I looked forward to attending the Miami NFT Week conference at the time.

I wanted to talk to people in the crypto space and see how worried they were.

But as I walked away from the conference, I didn’t just feel reassured.

I actually felt more upbeat than ever about the crypto market.

Here’s why…

Private Investors Aren’t Worried About the Drop in Cryptos

At the NFT conference, there was only one group that was nervous about the state of the market: public market investors.

The developers were unfazed. They were focused on making their projects a reality.

And the private market investors brushed off any concerns about a “crypto winter.”

It’s not that they thought it couldn’t happen. It’s that they weren’t really worried if it did happen.

Their focus was on funding the best crypto projects that would make them money in the long term.

With that long-term perspective, any short-term volatility doesn’t really matter.

In fact, most of them believed that market downturns bring about some of the best startups.

That’s why I find it a good idea to check in on the health of the private markets.

Especially when the crypto market looks the way it does now.

The Private Market Is Setting Records

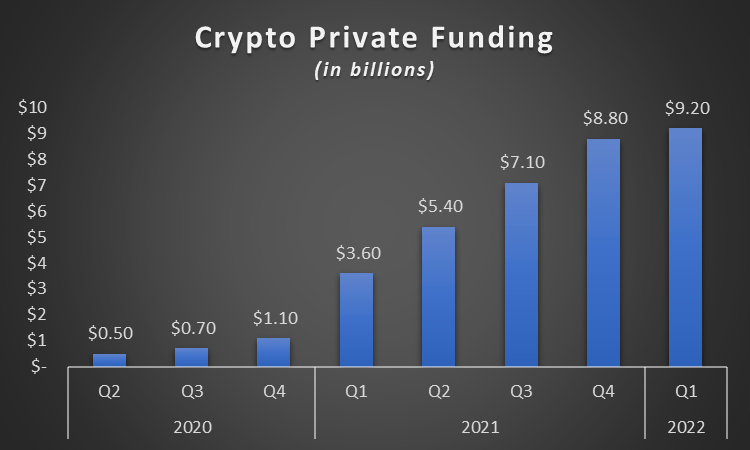

The amount of private funding for crypto projects keeps rising each quarter.

Crypto prices declined in the first quarter of 2022. But private market funding rose to a record $9.2 billion.

(Source: CB Insights.)

And that’s not the only noteworthy thing in the first quarter.

There are currently 62 crypto “unicorns” in the world. These are private companies valued at $1 billion or more.

Fourteen of those unicorns are new entrants that were established in the first quarter.

But don’t think that it’s just a few crypto startups raking in all the money.

A record high of 461 companies brokered deals for private funding in the first quarter.

Meanwhile the average size of these deals remained flat over time.

In other words, venture capitalists and other private investors are finding plenty of opportunities in the crypto world.

Cryptos Have Incredible Potential

Although the picture looks disappointing in the public markets, these private deals tell us two things.

First: Even in these conditions, private investors still see the great potential of cryptos.

Second: As these startups mature, they’ll turn into a whole new set of cryptos that enter the public market.

But you don’t have to wait that long to invest in cryptos.

As a matter of fact, the best time to get involved is when the market pulls back like it just did.

That’s why you need to watch Ian King’s presentation on the “Next Gen Coin” if you haven’t already.

Ian believes this crypto will be 20X bigger than bitcoin. So you want to get in now before the big institutional money moves in.

Click here to watch Ian’s presentation now.

Regards,

Research Analyst, Strategic Fortunes

Morning Movers

From open till noon Eastern time.

Bright Green Corp. (Nasdaq: BGXX) grows, manufactures and sells cannabis and cannabis-related products for research and pharmaceutical applications. It is up 28% continuing on the excitement from Tuesday when it surged 216% on its first day of trading.

DLocal Ltd. (Nasdaq: DLO) operates a payments platform that enables merchants to connect with consumers, accept payments, send payouts and settle funds. The stock is up 22% after the company beat revenue estimates for the first quarter and said that it is bullish on new client opportunities as it expands to more emerging markets.

Magnachip Semiconductor Corp. (NYSE: MX) designs, manufactures and supplies analog and mixed-signal semiconductor platform solutions. The stock climbed 14% on a report that South Korea’s LX Group and private equity firm Carlyle jointly submitted a letter of intent to acquire the company.

Vinco Ventures Inc. (Nasdaq: BBIG) is a consumer products and digital marketing company that is up 13%. The move came after the company successfully spun off its cryptocurrency and NFT business Cryptyde, which started trading today as a separate entity.

Siemens Gamesa Renewable Energy S.A. (OTC: GCTAY) supplies wind power solutions worldwide. The stock rose 12% on the news that the Siemens Energy is considering buying all the shares it does not already own in Siemens Gamesa in an attempt to gain full control over the company.

Lulu’s Fashion Lounge Holdings Inc. (Nasdaq: LVLU) is an online retailer of women’s clothing, shoes and accessories. The stock is up 12% after the company reported strong first-quarter results with record net revenues.

Agilysys Inc. (Nasdaq: AGYS) operates as a developer and marketer of hardware and software products and services to the hospitality industry. It is up 11% after the company met fourth-quarter expectations despite lingering pandemic related and other business environment challenges.

Celularity Inc. (Nasdaq: CELU) develops placental-derived allogeneic cell therapies for the treatment of cancer, immune and infectious diseases. The stock jumped 10% on the news that it entered into a private placement deal with an institutional investor for total gross proceeds of $30 million.

Allot Ltd. (Nasdaq: ALLT) provides network intelligence and security solutions. It is up 8% after it beat first-quarter earnings estimates by a wide margin despite headwinds from the war in Europe and foreign exchange rate fluctuations.

The Container Store Group Inc. (NYSE: TCS) is a retailer of storage and organization products and solutions. The stock rose 8% after the company reported fourth-quarter results that capped off the best year of sales and profitability in company history.