On August 30, as Warren celebrated his 94th birthday…

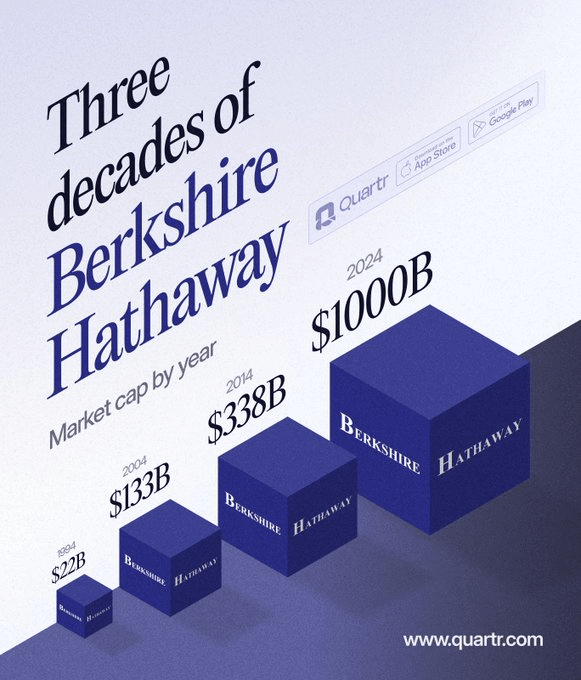

His company, Berkshire Hathaway, crossed the $1 trillion market cap threshold.

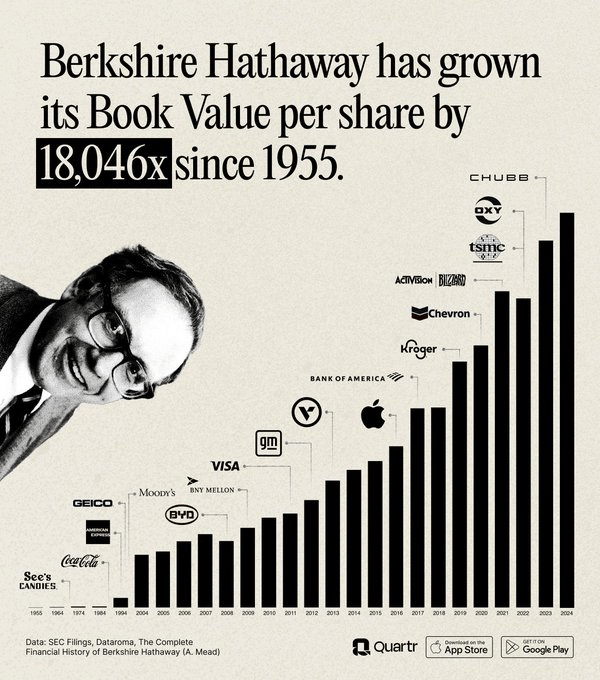

In 1965, Buffett transformed Berkshire Hathaway, an aging textile manufacturer into a major conglomerate.

In fact, it’s the ONLY non-tech company to join the coveted $1 trillion club.

Many people are a lot richer because of him.

Buffett’s first investors were family and friends in his hometown in Omaha Nebraska.

If you were fortunate enough to invest $10,000 with him, it would now be worth over $370 million!

That’s the reason Buffett is called the “Oracle of Omaha.”

Both Berkshire A and B shares made an all-time high on Buffett’s birthday. Perhaps it was Mr. Market’s birthday present to Warren. The A shares closed at $715,000.

Imagine just buying three shares back in the late 1980s when they traded for less than $1,800?

(I was about to do just that and put them in my newborn daughter’s custodial account. Today she would’ve had more than $2 million! Instead, we bought a piece of artwork for her room. This was my biggest investment blunder.)

In my introduction to my book, Getting Started in Value Investing, I wrote how I owe an enormous debt of gratitude to Buffett.

Buffett, just like his teacher Ben Graham, continued the tradition of passing on an investment philosophy to all those who would listen.

Upon receiving the manuscript, Buffett responded that he really appreciated the dedication…

“It is certainly true that I am where I am today because I had a great teacher in Ben Graham. If I can pass on a fraction to others of what he passed on to me, I will be happy.”

So, in honor of Buffett’s Birthday…

Here are three big takeaways I learned from Buffett that changed the way I think … and have made me boatloads of money.

Now, I want to help you do the same.

No. 1: Stocks are a Piece of a Business

“If you own your stocks as an investment — just like you’d own an apartment, house or a farm — look at them as a business. If you’re going to try to buy and sell them based on news or something your neighbor tells you, you’re not going to do well… Find a good bunch of businesses and hold them.”

— Warren Buffett

Buffett never made predictions. Instead, he asked himself if he’d like to own a quality business and hold it.

Stock price tells you nothing about the business.

Behind every ticker, there’s a company.

Figure out the worth of the company and buy the stock when it is trading below that value.

Eventually, the stock price follows the business.

Nothing more complicated than that.

No. 2: Volatility is Your Friend

“The stock market is there to serve you and not to instruct you.”

— Warren Buffett

I call it ETV: Embrace the Volatility.

Mr. Market usually does a pretty good job pricing stocks.

He keeps the stock price pretty close to the underlying worth of the business.

Most of the time, he gets it right … but once in a while, he’s way off the mark.

And when that happens… Mr. Market offers us great prices.

I don’t sit around sucking my thumb. Instead, I take advantage of the mispricing immediately.

And the reason is simple: I don’t know how long the stock price will stay at a great price.

Because other intelligent investors will eventually buy the stock, bidding the price higher and the opportunity is over.

One example from my Alpha Investor portfolio is Uber Technologies (NYSE: UBER).

Uber was added to the portfolio at $47.

It dropped all the way to $20 making it one of our worst-performing stocks… but we continued to like the stock … even more.

Why? The stock price was trading at an even greater bargain than when we recommended it.

Besides, we’re long-term investors and we won’t be shaken out by panic.

Instead, we looked at the drop as an opportunity. I told subscribers to buy — because Mr. Market screwed up.

Uber is now at $72 … making readers who bought when it was trading near $20 per share more than 260% returns!

No. 3: Mega Trend Tsunami

“To swim a fast 100 meters, it’s better to swim with the tide than to work on your stroke.”

— Warren Buffett

The Real Talk is … mega trends take time.

They start off like little ripples and develop into tsunami waves.

The way to make money with them is finding the best business in the industry and riding the wave.

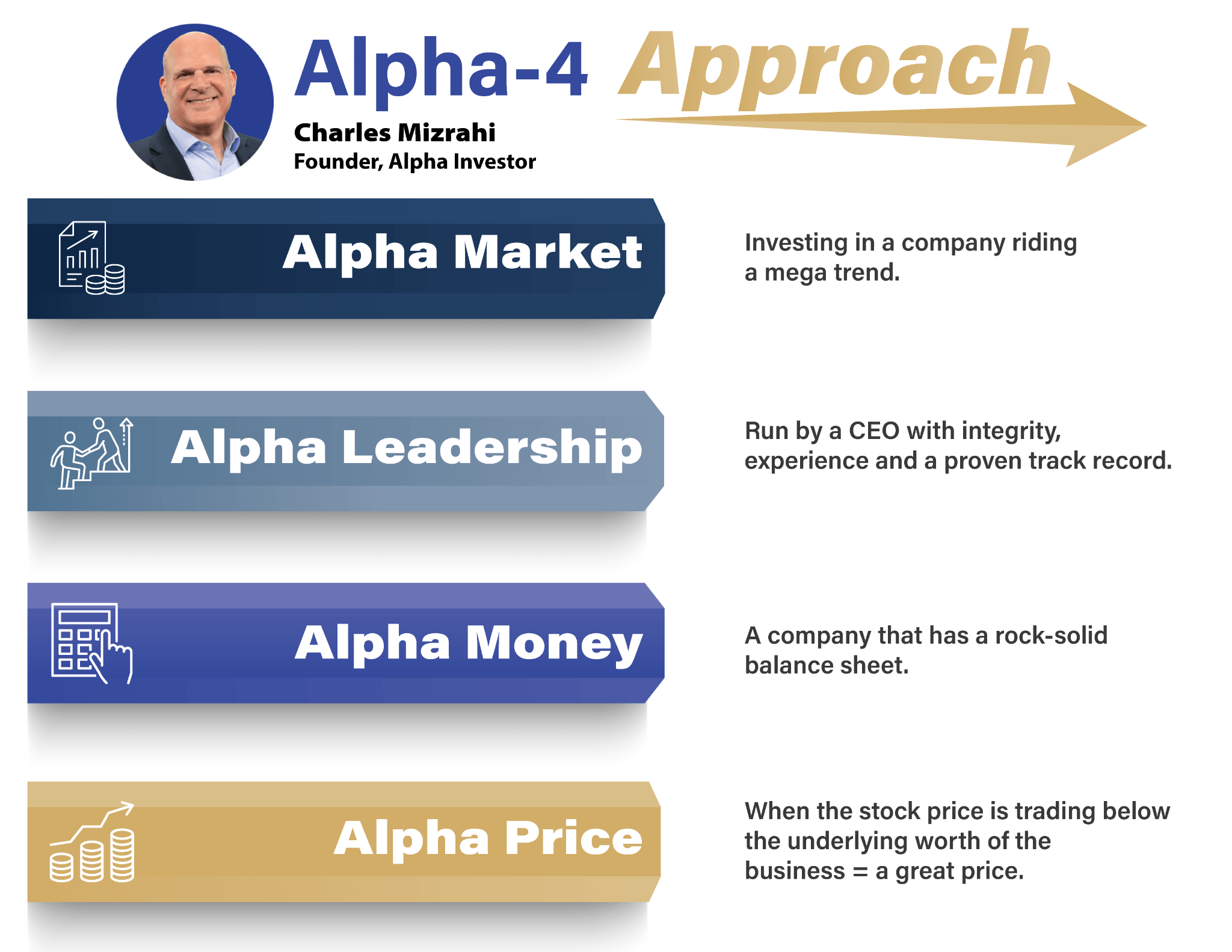

That’s why the first criteria in my Alpha-4 Approach to identify the Alpha Market — the next mega trend:

These are decades-long trends.

The Alpha Way

Warren Buffett is the GOAT investor — the greatest of all time. He has shaped my career and his wisdom impacted my life.

And I hope to use his lessons to help you make wheelbarrows of money by making investing simple.

You won’t hear me throw Wall Street jargon at you. Just the Alpha Investor way…

- We don’t invest because others agree or disagree with us.

- We invest because our facts and analysis are right.

- We are confident in our decisions and don’t need confirmation.

- We don’t stay in the middle of the pack … we lead.

- We are not afraid of stepping out.

- We think differently than other investors.

THAT’s how we make money.

And I hope you echo these lessons back to me on my 94th birthday. 🙂

Regards,

Charles Mizrahi

Founder, Alpha Investor