Copper prices dropped 13% in 14 trading days. That was enough to wipe out the last five months of gains.

That drop is too fast.

It tells me a rebound is coming. And that gives us the chance to make double-digit gains by June — with even more upside beyond that.

I expect this rally to be as good as 2016’s, which saw copper climb 47% to its 2018 highs.

But the biggest gains come at the beginning of a rally. And right now is our chance to get in early.

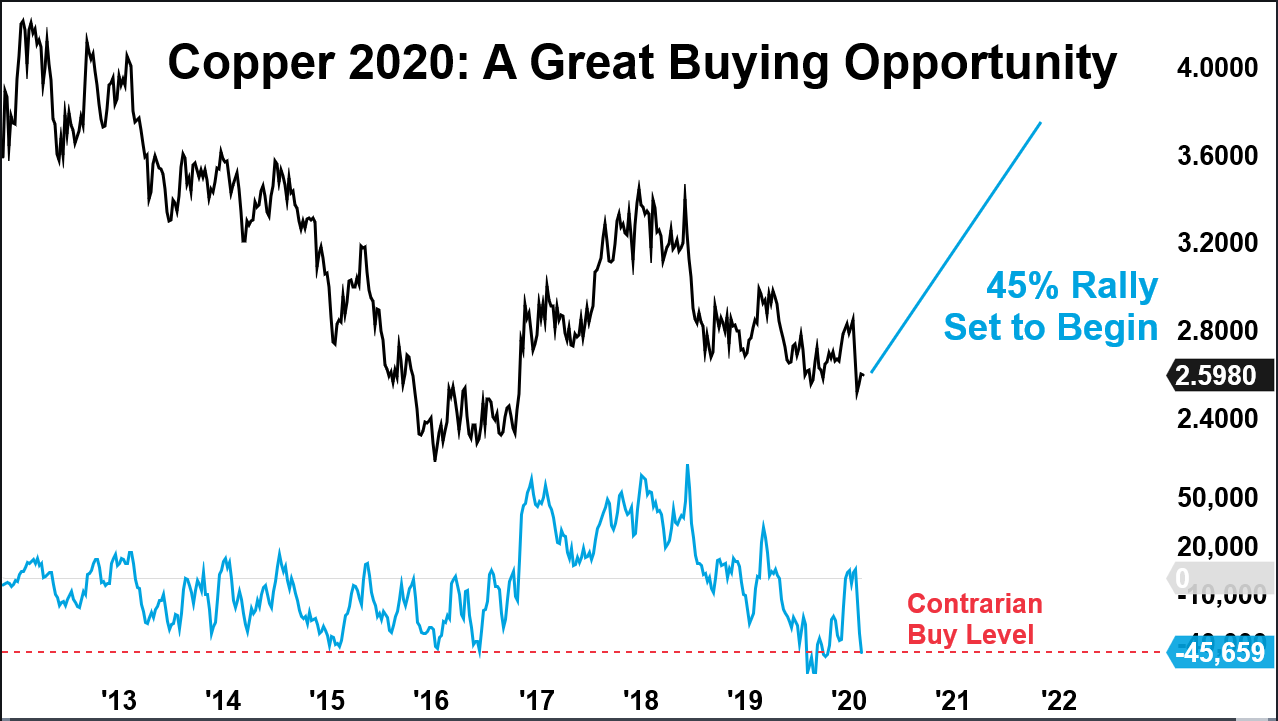

The chart below holds the secret to the imminent surge:

Today, I’ll share with you one easy way to ride this trend to a potential 93% gain.

The black line is the price of copper.

And the blue line represents large speculators, or money managers betting on the copper price.

When Wall Street is all-in on one side of a bet, we see a sharp reversal. That’s happening right now.

Wall Street is piling on its bet against copper. That’s a contrarian signal to buy copper.

The last five times speculators were this bearish on copper, it rallied between 5% and 15% over the coming weeks.

That could happen any day now.

I expect it to happen that way again because of how everyone became bearish on copper.

Coronavirus Hits World’s Biggest Copper Consumer

China consumes more than half the world’s copper.

Based on recent estimates, the coronavirus in China has killed more than 1,800 people. It’s infected more than 72,000 others.

It’s a sobering situation. My prayers go out to those suffering from sickness and the loss of loved ones.

As a result, the Chinese economy is slowing as people avoid public spaces. That means less demand for electronics and copper.

The government is making efforts to stimulate China’s economy.

It will take time still to recover from the worst of the virus. But global investors are likely to shake off their fears sooner than that.

Because of the sell-off in copper, we have an opportunity to position for profits now.

I see copper prices rallying 46%. But we can pocket twice that — without options.

An ETF That Lets You Capitalize on Copper Producers

There’s a simple way to double the performance of copper with an exchange-traded fund (ETF).

I’m talking about the Global X Copper Miners ETF (NYSE: COPX).

COPX tracks an index of copper stocks, including Freeport-McMoRan Inc. (NYSE: FCX) and Southern Copper Corp. (NYSE: SCCO).

If history is any guide, short-term traders could make 20% with COPX by June … and longer-term investors could see a 93% gain in the next 18 months.

That’s a long time horizon for some. But if you’d like to see how my system can be applied to individual natural resource stocks for shorter-term trades, take a look at how Matt Badiali and I use them to find profit opportunities when stocks are rising — and falling!

Good investing,

Editor, Apex Profit Alert