Earnings season is upon us again. And like last quarter, this quarter is expected to see high growth.

Of course, the No. 1 number that most people look at for growth is earnings per share (EPS). Investors will base a lot of assumptions, including what the stock price should be, off of that one number.

But something that I think is a lot more important is revenue growth.

For one thing, revenue growth can’t be manipulated. The initial amount of money you make from sales is a set number.

On the other hand, EPS is calculated after subtracting a lot of different expenses, and can easily be manipulated by bending accounting standards.

The EPS numbers we usually see in the headlines don’t even follow the overarching U.S. accounting standards. So, EPS isn’t reliable on its own.

Another reason why sales is a more reliable number is because it’s the rawest form of growth available. If people stop buying as many products, it’s clear the business isn’t doing as well, and maybe its stock isn’t worth buying.

But if EPS grows, it could be due to dozens of reasons.

It could be that sales are down, but EPS went up because the company got a one-time tax break. If anything, that should be negative. However, people could see the earnings growth and buy the stock without looking at anything else.

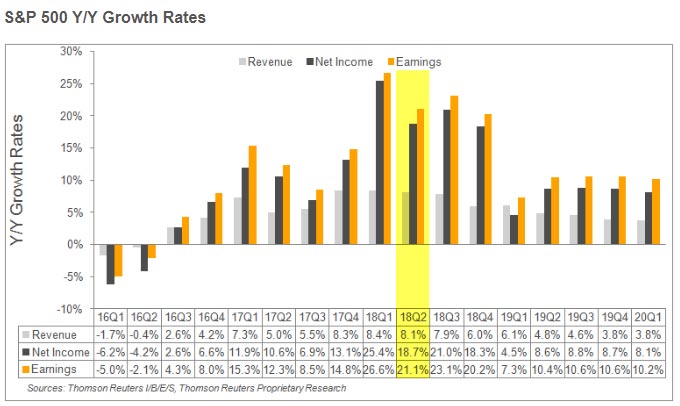

So, with that in mind, the chart below shows that this is predicted to be the third straight quarter of 8% sales growth for the S&P 500 Index as a whole.

That’s extremely high. And as of last Friday, the average sales growth reported so far was 8.8%. That’s the highest rate since the third quarter of 2011.

Of those companies that have reported, 85% have reported higher-than-expected sales growth.

Of course, this is just the beginning of earnings season, so we could see that change. But so far, it’s been strong.

The Best Sectors to Invest in This Earnings Season

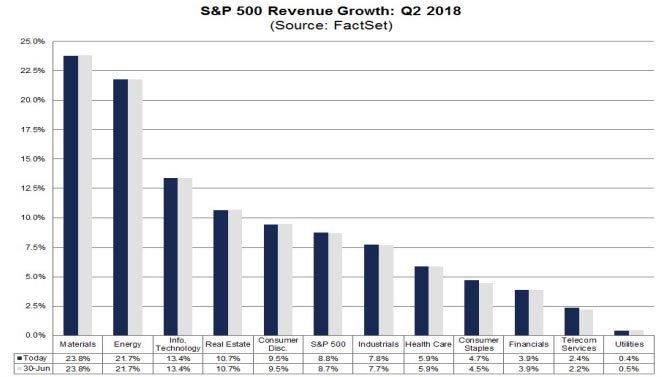

Here’s a look at which sectors are expected to report the highest sales growth this quarter:

Materials, such as metals and agricultural companies, are expected to do the best, and energy (mainly oil companies) is right behind.

That makes sense since commodities like metal and oil are in high demand due to a strong global economy.

To invest in these sectors as a whole, I recommend the Materials Select Sector SPDR ETF (NYSE: XLB) and the Energy Select Sector SPDR ETF (NYSE: XLE), both of which hold the biggest, most established companies in each sector.

Regards,

Ian Dyer

Editor, Rapid Profit Trader