Last week, I spent some time with my family back in North Carolina.

Even though I have only been away for four years now, it really does feel like a completely different town when I go back, and it’s not just the unfamiliar faces around our small town. My body is also telling me this isn’t home anymore.

I lived there for 26 years and never, ever, had allergies.

But now when I visit, all of a sudden I have severe sneezing and irritation.

It’s miserable.

Springtime is a season of the year I used to love.

It meant I could finally wear shorts again and get back into sports, fishing, camping and such.

But here I am a few years later, and this same season has a completely different context for me: allergies.

It’s all just part of change, and my body is adapting to the Florida climate, I guess.

But when your portfolio is going through an adjustment like this, the last thing you want to hear from your financial adviser is that it’s “just a period of adapting to the new environment.”

This isn’t a phrase you have heard too much yet, but give it another year or so.

With all the changes in the market in the past few months, the coming shift is inevitable … and you don’t want to be on the wrong side of it.

Out With the Old, In With the New

I have helped create many trading systems, some of which have been extremely profitable. Others have been not so profitable — trust me, you never hear about those — but that’s just part of the research and due diligence that goes into developing a strategy.

I have also reviewed systems across the industry over the years, and one thing tends to be pretty common: Most track records and backtests go back to about 2009 — after the stock market bottomed from the Great Recession.

Some go back a few years further, but the bulk of the data that is being used to base strategies on falls under a certain economic environment.

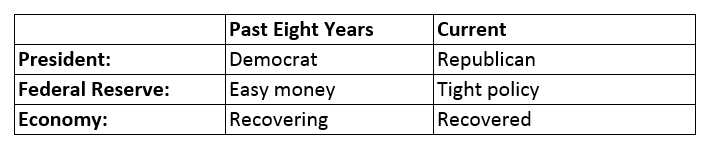

Take a look:

There is a stark contrast in each category between the past eight years or so and what we have today.

And prior to the past eight years, things were a bit different when it came to which strategies worked or didn’t work.

So you are likely going to hear the following phrase somewhat often: “Your portfolio is adapting to the current environment.”

What that phrase essentially means is your financial adviser was late in adapting your portfolio.

Improvise, Adapt and Overcome

All the way back during the Great Depression, the economic collapse was often called a “price-to-earnings ratio adjustment.” That was a common explanation for why investors’ portfolios crashed more than 50%.

Today’s economic changes could be referred to as an “adaptation adjustment” for all I care. Even though the adjustment’s impact may not be severe for everyone, it will surely cause isolated damage for many investors.

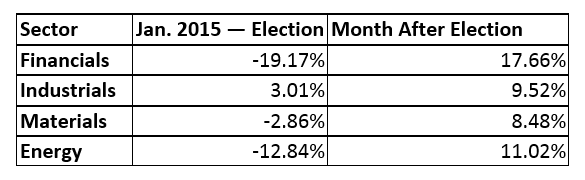

After the election, we have seen a very selective rally. The bulk of gains came from the financials, industrials, materials and energy sectors — again, a major contrast from the past several years. Take a look:

From 2015 up to the election, the financials sector was down nearly 20%, energy was down 13%, and materials and industrials were basically flat. But just a month after the election, financials jumped 17%, energy popped 11%, and materials and industrials came to life with nearly a 10% rise in each.

So we are already seeing the shift to an adaptive environment. And some of the shorter-term strategies may not work out as well as planned because of this shift.

The robust strategies should still thrive, and ones that are adaptive can generate great returns as well.

For example, in my Automatic Profits Alert service, which is designed to follow seasonal patterns, I use an indicator to help us time entering and exiting a trade.

By using a simple indicator to show us better entry points, it takes some of the pressure off the seasonal trends to be 100% on the money every time.

Therefore, this strategy has a built-in adaptation tool, and many strategies do.

But going blindly into the current environment, or placing your funds with your stockbroker and leaving them alone — which worked out great over the last eight years — may not find the same luck in the coming years.

We will know more after another year or so with the changing market environment.

But the bottom line is that your portfolio will likely not be as strong as it was during the previous eight years without some changes being made.

So the takeaway today is to stay diligent with your portfolio and don’t sleep on it. Making changes is fine.

Plus, keep tuning into Winning Investor Daily to stay current with the latest market trends.

I’ll have more next week about possible changes to make.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert