Hello Loyal Reader,

Last week we talked about using delta to decide which option to buy.

Delta tells us how “fast” an option will move relative to the underlying stock.

This week, I want to continue the conversation — but this time, we’re talking about “delta per dollar.”

Basically, this lets us see how much bang we’re getting for our option-buying buck.

A position with higher delta per dollar will be more volatile than a position with lower delta per dollar. This means profits and losses will accumulate faster.

So, higher delta per dollar might be better for a day trade, while lower delta per dollar could work well for a longer-term swing trade.

Let’s dive right in:

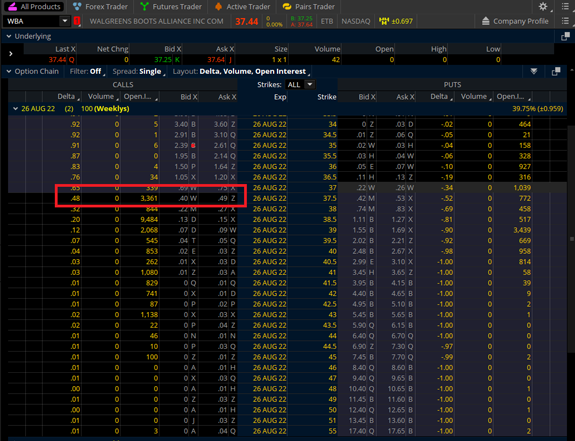

Take a look at the WBA August 26 $37.50 call option above.

To determine how much delta we’re getting per dollar of capital committed, we first look at the delta and mid-price of the option.

In this case, it’s a .48 delta for $0.45 per contract.

The closest to a dollar we can get is two contracts, for a total of $0.90 and a .96 delta.

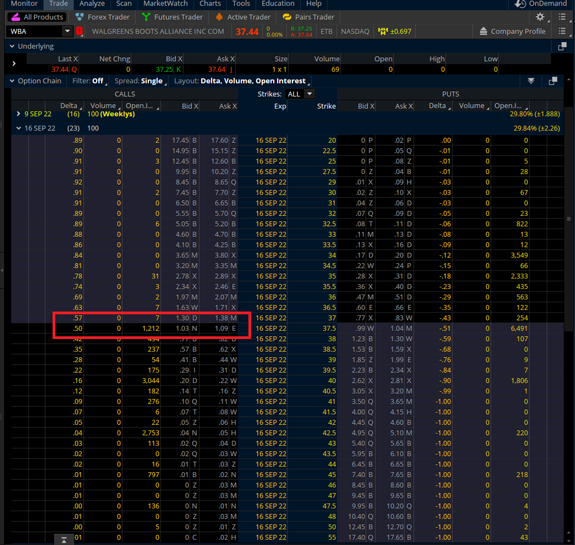

Let’s compare that to another WBA option, this time expiring in a few weeks.

This particular option has 23 days to expiry and gives us a .50 delta for a mid-price of $1.06.

This has a delta per dollar ratio just under .50/1.06.

So, for about the same price, we can get two of the two-day options or one of the 23-day options.

The key concept here is that, with the 23-day option, we COULD allocate twice as much capital to get the same level of delta as the two-day option.

Putting all of this together, the higher delta per dollar of the two-day option tells us it is going to be twice as volatile as the 23-day contract.

One of the critical skills a trader needs is the ability to anticipate how a trade will behave. With some practice, this simple “delta per dollar” ratio will go a long way towards helping us achieve that.

I suggest you practice this mindset in a paper trading account until you get used to it, in order to see how it will play out during live market hours.

Until next time,

Bryan Klindworth

Senior Analyst, Kings Corner