You’ve got questions on oil. So we’re diving in today.

To bring you up to speed on fossil fuel and why I’m bullish, let me take a step back … here’s a little background on how we got here…

In the 2020 presidential debate, President Biden was asked if he’d close down the oil industry.

His response? “I would transition from the oil industry. Yes.”

He even told New Hampshire voters on September 16, 2019: “We’re going to end fossil fuels.”

In his first days in office, President Biden wasted no time declaring war on oil…

- January 20, 2021: President Biden signed an executive order killing the Keystone Pipeline.

- January 27, 2021: The Department of the Interior stopped natural gas leases on federal lands.

- April 22, 2021: The Climate Finance Plan starts promoting capital away from high-carbon investments.

A chain of events was set in motion as soon as Biden put his hand on the bible and became the 46th president.

One year after sitting in the Oval Office, gas prices jumped by 41%.

The rise in price should’ve surprised no one.

When COVID was under control, the world woke up and needed fossil fuel.

However, production was in the dog house.

Oil executives and the bankers that lent them money were seen as the enemy of the climate.

When banks stopped lending, and oil companies stopped drilling, supply dried up.

In February of this year, the White House did an about-face: We needed fossil fuel now!

But it takes time for oil production to start up after being dormant for so long.

And during this time, crude oil prices fell to as low as $67 per barrel.

Huh? It made no sense at all.

I said Mr. Market is missing it … oil prices should be going higher, not lower!

And recommended taking positions in oil and gas companies over the past year.

Now, the law of supply and demand has finally caught up with reality.

Crude oil just closed out its seventh consecutive week of gains, up 24%.

But folks this is just the beginning. Fossil fuel has just started a multiyear bull market. This is a huge opportunity for investors.

So today, before oil rises any higher, I’m going to answer all your questions and share one of the biggest opportunities I see.

Question #1: Emerging Markets

Q: Andrew from California asks: All I read is China, China, China. What is happening with China’s economy and how will it impact oil?

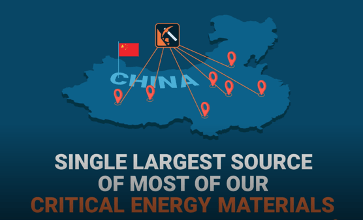

A: China has the world’s second-largest economy … and it’s the single largest source of our most mission-critical energy materials.

The big story you’re not reading about is this: China is just beginning to come back online after years of lockdowns.

As a result, China and other emerging market countries accounted for 90% of all new demand for oil last year.

As these countries continue to grow and prosper, their demand for vehicles and more energy-intensive products will grow as well.

China’s economy still hasn’t kicked into high gear, but it’s only a matter of time before it does.

And when that happens, prices will rise even higher.

Question #2: Going Green?

Q: Betty from Ohio asks: Oil was supposed to be going the way of the dodo bird… How’d we get to $83 a barrel?

A: Electricity isn’t made by magic. It’s produced by fossil fuel. The manufacturing of EVs is not fossil-free. It takes huge amounts of oil and gas to make one EV car and battery.

97% of the cars on the road are still gas-powered.

Heavy-duty vehicles, ships and airplanes all still rely on oil for their fuel.

And these types of transportation are in higher demand than ever before. It all points to higher oil prices.

In an unscripted moment during his State of the Union Address, President Biden backpedaled on his war on oil.

He admitted that we’re still going to need oil and gas “for at least another decade … and beyond that.”

The Energy Information Administration agreed that petroleum will be our largest energy source by the year 2050.

Despite the government’s green energy mandates, there’s simply no way America will be carbon-free by 2050.

I dug into this further on my podcast with a special guest Diana Furchtgott-Roth.

She served in the White House under U.S. Presidents Ronald Reagan, George H.W. Bush and George W. Bush.

She shed some light on the difference between green energy pipe dreams and real-world pipeline facts.

What I learned knocked my socks off. I highly suggest you listen to it:

(Or you can read the transcript here.)

Question #3: Making Money in an Oil Bull Market

Q: A lot of you just wanted to know one thing: How do I make money now that oil is heading into a bull market?

A: We’re in the early innings.

And I’m not the only one that thinks so.

While Washington spent 2022 hawking its green energy agenda, Warren Buffett has been buying Occidental Petroleum and now owns close to 25% of the company.

Multiyear bull markets are not new, they’ve happened before.

On October 20, 1973, OPEC announced an embargo on oil to the U.S. — kicking off a multiyear bull market.

Oil prices surged from $3.50 to $40 per barrel before it was over. That’s a gain of over 1,000%.

It happened again in 1998.

That’s when China’s economy kicked into overdrive, and oil saw another 1,000%+ gain as prices rocketed from $12 to $140 per barrel.

Now, for the third time in 50 years, oil investors stand to make huge returns.

Higher oil prices are INEVITABLE. And one company is doing everything right…

☑️ It has hundreds of millions of barrels in oil reserves.

☑️ Millions of acres of land it can drill on.

☑️ Hundreds of millions of dollars in free cash flow.

☑️ And zero bank debt.

This is the kind of company that can quickly double in an oil bull market.

I’ll share the full story and details about my #1 oil and gas recommendation with you. Just click here now.

Regards,

Founder, Alpha Investor

Warren Buffett’s $700 Million Bet

I try to keep my independence when investing. Meaning, when I feel strongly about an investment, I go against the herd.

But every now and then, I do find it valuable to look over the shoulders of some of the all-time greats … like a certain gentleman from Omaha.

Now, I don’t recommend copying Buffett’s moves verbatim (or those of any other investor for that matter).

Buffett’s objectives as the head of a major multinational conglomerate might be very different from yours or mine. But it’s nice to look for common themes in his investments to see if they might make sense for my investing strategy.

So let’s take a look at Mr. Buffett’s latest portfolio moves. As an institutional portfolio manager, Buffett is required to disclose his stockholdings every quarter…

Buffett’s Bet on Homebuilding

Looks like the Oracle of Omaha is betting big on housing.

He dumped $700 million into the shares of DR Horton (NYSE: DHI), one of America’s largest homebuilders, and smaller amounts into a handful of other homebuilders.

Now, $700 million isn’t a lot when compared to the $177 billion he owns in Apple. But it shows commitment, and perhaps more importantly, it’s a new sector he wasn’t previously invested in.

It’s not hard to see Buffett’s investment rationale here. America needs new homes, and it needs them now.

Buffett’s bet is simple: Regardless of high interest rates, Americans will continue to aggressively buy homes.

Interestingly, Buffett also bumped his position in credit card issuer CapitalOne, by a full 25%.

I’ll admit that one surprised me. I’ve been concerned for a while now about the health of the U.S. consumer, as national credit card debt has soared above $1 trillion for the first time. A large swath of Americans will also be back on the hook for student loans starting next month.

However, it seems that Buffett believes any weakness in consumer spending will be short-lived.

Should We Follow Buffett?

Here’s what I take away from Buffett’s latest moves…

First off, I’m not suggesting you immediately run out and invest in homebuilders. That sector tends to be wildly volatile, and there’s a learning curve to investing in it.

But Buffett’s willingness to invest in this sector suggests that any general weakness in the economy will quickly run its course … and that opportunities still abound.

Now, if you want to take a few tips from our “resident Buffett,” Charles Mizrahi, today he makes a strong case for the oil and gas market.

As he noted, Buffett has a 25% share in Occidental Petroleum. Oil prices have also been on the rise this month, which Charles himself predicted months ago.

So if you want to get in on this rising oil bull market, Charles is recommending his #1 oil stock pick.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge