Last week, we talked about the three things you have to get right when trading options.

The direction of the stock to trade, how high/low it’s expected to move and how quickly it will play out.

But even after you have all of those answers, there are still variables that will impact your return.

I’m talking about things like the option price, strike and the exact expiration you choose.

Today, we are going to talk about the difference a strike price can make on your returns — and your risk.

Then I’ll let you know which strike price is my favorite one to trade…

Understanding Strike Categories

When you go to pick a strike, there are dozens, if not hundreds, of different prices to choose from at each expiration.

Options traders boil them down to three easy-to-remember categories:

- In-the-Money: These are options with strike prices that have intrinsic value, the value if the option was exercised today. For a call option, an in-the-money strike is a price that is below where the stock is currently trading. For a put option, an in-the-money strike is a price that is above where the stock is currently trading. For example, if the stock is trading at $20, an $18 strike price is in-the-money for a call option because a call is betting the stock would go up, and it’s up by $2 from the call’s strike. So if you sold it, you’d have cash put back into your brokerage account.

- Out-of-the-Money: These are options with strike prices that have no intrinsic value, or would be worth nothing it they were exercised today. For a call option, an out-of-the-money strike is a price that is above where the stock is currently trading. For a put option, an out-of-the-money strike is a price that is below where the stock is currently trading. So taking our call example from above, if the stock is trading at $20 and the call has a strike of $22, it’s out of the money. The call option will only make money if the stock goes up and would need to be above $22 when it expires to have any value left in the option.

- At-the-Money: This is what you would think, a strike price that is equal to the price where the stock is currently trading. It doesn’t matter if it is a call option or a put option. It’s simply the strike that is equal to the current price of the stock. That’s it. With a stock that is trading at $20, the $20 strike price is considered at-the-money.

In-the-money and out-of-the-money strike prices each carry different risks compared with their rewards.

In general, the more in-the-money you go, the more conservative your trade will be. For example, if you paid $2 for a $20 call option, if the stock hits $24 it would help you double your money ($24 minus $20 equals $4). But if you bought the $15 call option for $8, you would need the stock to hit $31 to double your money ($31 minus $15 equals $16). So if you open an in-the-money option trade, the returns could be smaller, but your losses could be smaller too.

Out-of-the-money is considered more aggressive. You need the stock to move more to see gains. And your risk of taking a loss on the trade goes up. But you have the potential for bigger gains depending on how big the stock’s move is.

There are some positives with both … and some downsides.

That’s why I like to keep it super simple. When I’m buying an option, call or put, I stick to the at-the-money strike price.

Here’s why…

Keep It Simple

It’s the best bang for your buck.

For me, it really is that simple.

You’ll pay more per contract for an at-the-money option than an out-of-the-money one, but it will give you the best chance to profit without needing an excessive move in the stock.

Go too far out-of-the-money and you risk having a loss on a trade that could have been a winner.

Go too far-in-the-money and you could cut your gains right out from under you if the stock doesn’t move a significant amount.

The at-the-money strike is closest to where the stock is trading, so it’s the one I pick every single time when I’m buying a call or put option.

After all, I base my trades on where the stock is trading at today. Why not base my options on the same price?

Next week, I want to use the wild ride we are seeing in GameStop (NYSE: GME) to talk about implied volatility with options. Trust me, after we take a look, it will all make sense. GameStop is the perfect example of what I’m talking about … just on an extreme scale.

Before I sign off, I wanted to share my latest edition of Bank It or Tank It with you. This time, it is on electric vehicle maker NIO (NYSE: NIO). Remember, these are not official recommendations. I’m providing my insights on the stock from a mile-high view.

Bank It or Tank It: NIO Limited Stock

NIO has had its ups and downs over the years, but its latest price movements are simply mind-blowing.

I’ll break down everything you need to know, from the fundamentals and sentiment to what the price chart is telling us to expect over the next 12 months.

You can watch my new video here:

This Stock Could Be China’s Ticket Into the EV Market

Summary:

- After some ups and downs, NIO Limited may be China’s ticket to becoming a true competitor in the electric vehicle market.

- This company has found a way to build on the same trends as its major American counterpart plus one ignored technology.

- Take a look at the fundamentals, sentiment and technicals to find out if you should “Bank” or “Tank” NIO.

In my latest edition of Bank It or Tank It today, I’m excited to be talking about NIO Limited (NIO), basically the Chinese version of Tesla (TSLA).

NIO — The Fundamentals

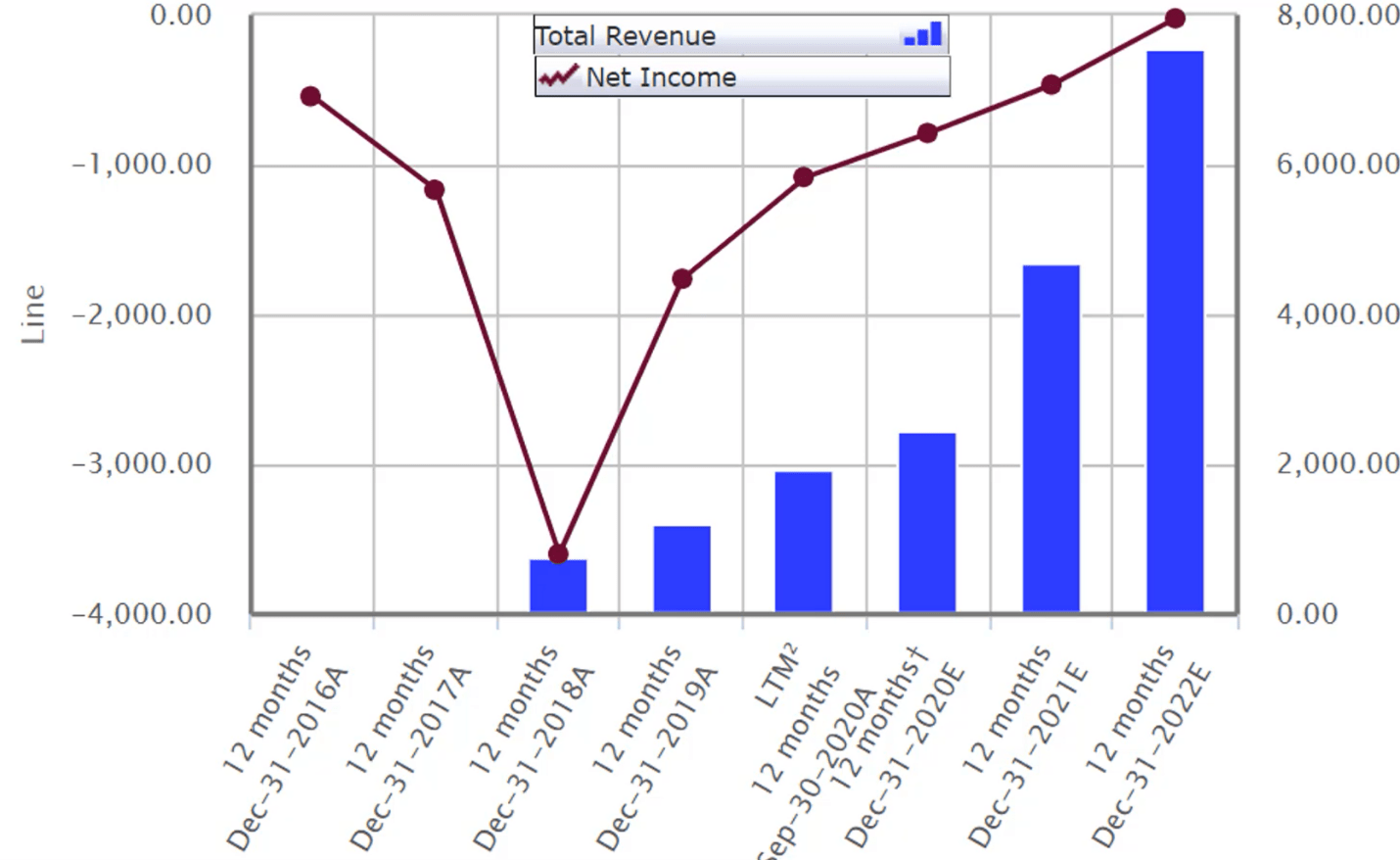

Let’s get started by breaking down the fundamentals. We’re going to look at a chart of the key stats. Starting with a look at total revenues and net income…

Source: S&P Capital IQ

The total revenues are the blue bars on the chart (the key on the right-hand side); and net income is the line graph on the chart (key on the left-hand side).

Just one thing you’ll notice is net income. It’s not even expected to be in positive territory until 2022. And you see the dip that it took in 2018.

This is a company that, even earlier in 2020, has been on the verge of bankruptcy. China’s government had to bail the company out.

NIO has been supported by the government. You can say Tesla has to some extent, too, because of some of the rebates and credits for the company that it was able to take advantage of. But NIO and China are a totally different breed than a company in America.

China’s electric vehicle (EV) market is in NIO. So, that’s what has really saved the company and bought its stock this year and early last year. And China is going to continue to lift the stock as it continues to develop its policy around a company like NIO, versus Tesla that’s trying to break into that country with a growth model.

And there’s no way that NIO is not going to be competitive in that. China’s now going to have a brand and a dog in the fight in this electric vehicle market, and NIO is its ticket right now.

You can see in the revenues the big jump up to 2021 and 2022. This is all based on expectations of more demand for electric vehicles and more adoption in China.

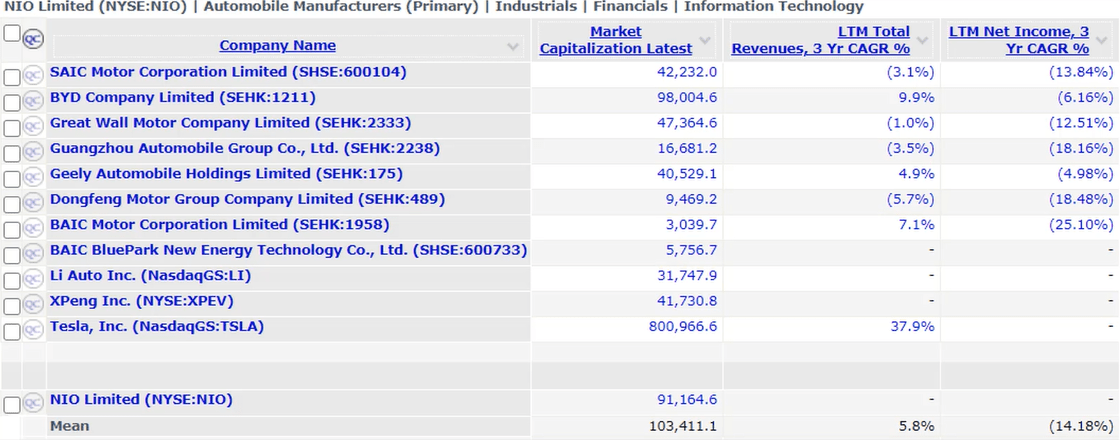

Speaking of Tesla, let’s pull up some quick comparisons. Take a look at NIO and how it stacks up against the competition…

Source: S&P Capital IQ

Source: S&P Capital IQ

A lot of these companies are foreign, many based in China and elsewhere in the world. I added Tesla.

It didn’t come up as a comparable company, likely because of its market cap. You can see Tesla at around $800 billion, which is massive. It’s one of the top five largest publicly traded companies that exists and one of the most valuable stocks out there.

We refer a lot to Tesla. But you can see NIO, at just $91 billion, is nowhere near the same level of valuation as Tesla.

Let’s level out that perspective when we talk about Tesla and NIO. The run-ups that they’ve seen, the demand and the euphoria around these companies are driven by two different ideas. With NIO being heavily supported by the China Party, and Tesla making it on its own and having a cult-like following that just loves the company, loves everything it does and loves the CEO, Elon Musk.

He’s like a modern-day Iron Man, and people are in love with this guy. NIO doesn’t have that man out front in that way. At least not to the American consumer. But it has found a way to continue to build on the same types of trends that Tesla is riding.

One interesting thing it’s doing differently is battery swap technology. We’ve seen Tesla introduce this before, but the company said there was no real demand in it from American consumers or in other places. Tesla even built a station in China, but NIO’s going all in on this.

And this is what’s interesting because China’s government is going to help dictate this policy. Yes, Tesla has more charging stations throughout China than NIO.

But as NIO wants to expand and finds the model it wants to take, then it’s going to open up for the Chinese government to support the company and its growth. That way, the company can be the No. 1 selling brand, likely in China, and then continue to expand over the world.

With the battery swap technology, you can change out the battery in five minutes. What’s interesting is that NIO is basically selling its cars without batteries.

The company has a line of cars. And all of them, for one, take the same type of battery pack. So, it’s able to take the price and basically knock $10,000 off of it, if you do the battery swap program. I’m sure there are fees introduced into this, which would end up having a cost. But if it’s able to knock $10,000 off a $50,000 car that everybody else has to pay for, that’s a huge difference if you’re able to use battery swap. At the end of the day, you physically don’t own a battery.

That makes for a pretty interesting setup for how NIO is going to take a different path and still compete with Tesla and continue to grow.

Now, for the total revenues and net income growth…

A lot of these car companies are newer. You don’t see the Fords, GMs, etc., listed here. Only either foreign companies or smaller cap, newer companies that are trying to grow.

You see Tesla’s revenue growth, at 37.9%. And that’s just because it’s starting to ramp up on revenue. NIO’s just getting into that phase. The company doesn’t even have a three-year compound average annual growth rate (CAGR) yet, but it’ll have that in the coming years.

Income is negative for these companies. But I just wanted to show you that they’re still young and still learning. These companies are definitely growth stocks, and they’re just getting started. We’re going to see a lot of potential start to play out in the coming years. As in, which ones are the big winners and losers as we move forward.

Investor Sentiment

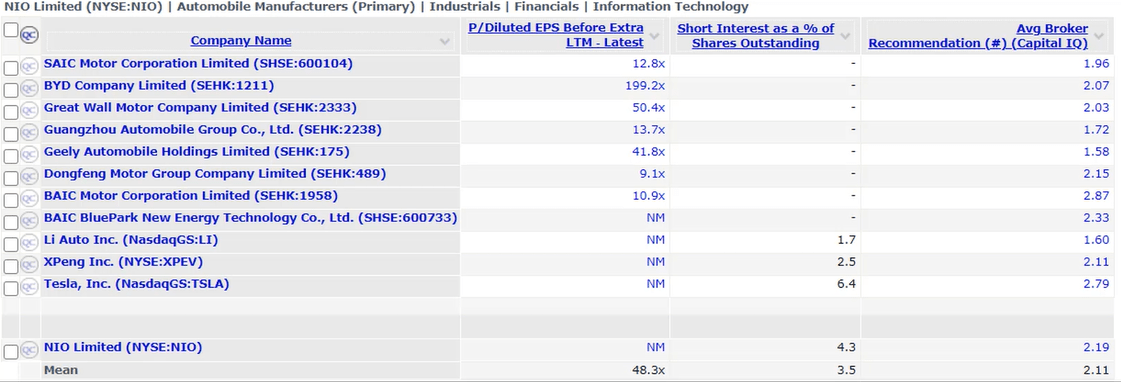

Next is sentiment readings. Basically, we want to look at the price-to-earnings ratio…

Source: S&P Capital IQ

Source: S&P Capital IQ

It’s not going to help us too much, but you see that the mean in the industry for the companies that do have price-to-earnings is 48.3 times earnings. That’s a pretty hefty price tag. Around 22 is the average for the S&P 500.

But, again, these are growth stocks. If Tesla had a price-to-earnings ratio, it would be in the hundreds easily, if not high, near 1,000 times earnings. The company doesn’t even really have earnings for a full year in order to have this price-to-earnings multiple yet. But when it does, and once it has stable earnings coming in (and some consistency), you’ll be able to get a better idea on that. For now, for the most part, you’re paying for growth.

And the short interest, which gives us an idea if investors are willing to bid on these stocks going lower, is not too high. Tesla’s 6.4% is nothing crazy, especially with the run-up that we’ve seen. This is not out of hand. NIO is at 4.3%. Well within reason and nothing to be alarmed about.

And the average broker recommendation, according to S&P Capital IQ, is 2.19 for NIO. That’s an Outperform rating. For Tesla, it’s 2.79. That’s basically a Hold. (3 is a Hold, 1 is a strong Buy.)

When you look at NIO, though, it doesn’t standing out too much. Just a nice, solid Outperform rating. That means that investors are willing to buy it. But as we get to the pressure, you’ll see that it’s been on a massive run-up on its own outside of what we’ve seen from Tesla.

A Look at the Technicals

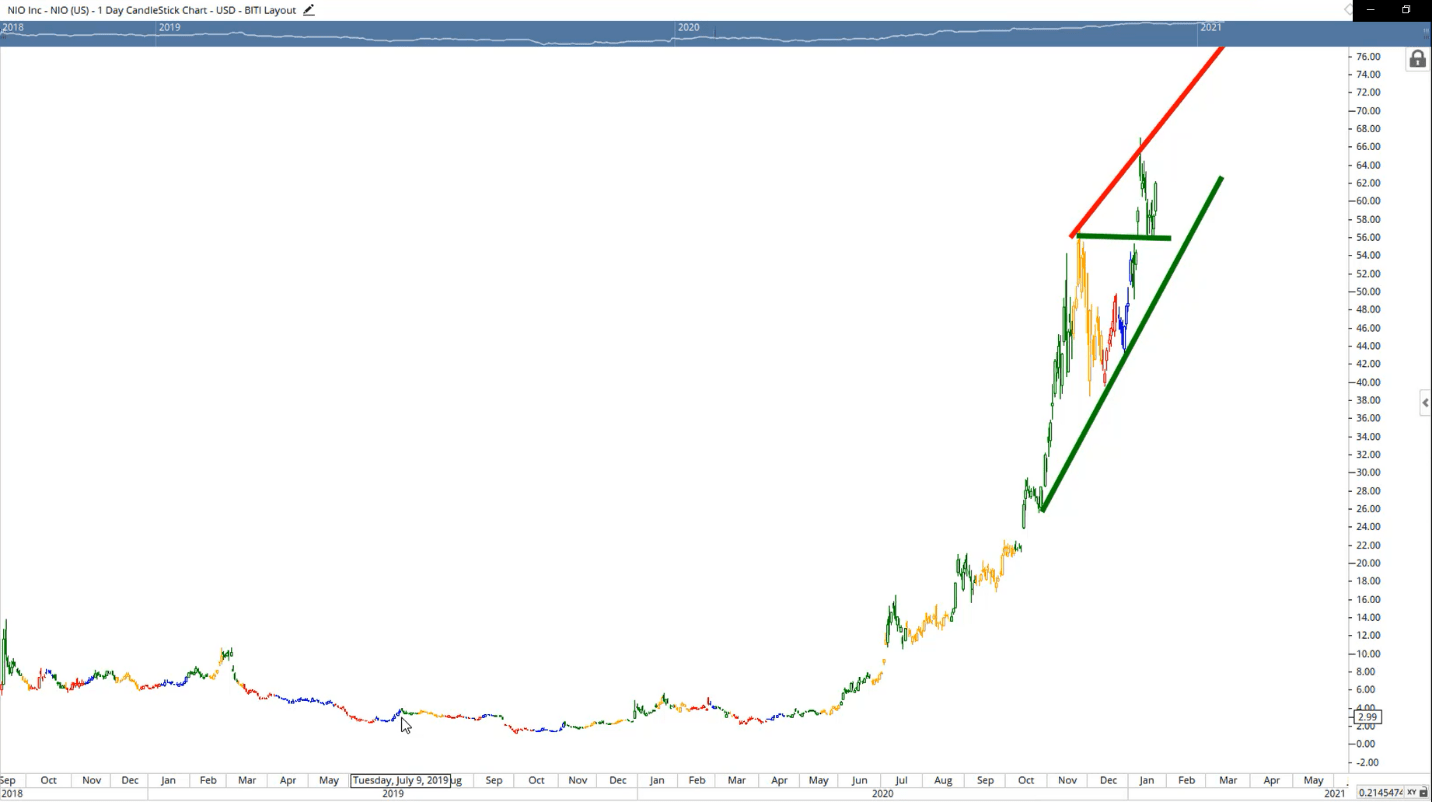

Let’s pull that price chart up. This is what we go over for the technicals. We just want to look at a few key trends. Now, this is just a historic chart for NIO…

Source: Optuma.com

It IPO-ed back in 2018 to not much fanfare.

We saw an initial pop, but since then, shares have drifted lower and ultimately ended up needing the Chinese government to bail it out.

And you see the massive price rise. We just wonder if it can hang onto it.

We talked a lot about Tesla. And that’s because the electric vehicle market has really surged higher out of this pandemic. And it’s mind-blowing when you think about it, when we look at where it was trending before the pandemic.

This stock was just around $5 a share, trading at almost nothing. You see it crash during the pandemic, down as low as $2 and some change. Then, all of a sudden, it breaks out, seeing this get back up to $14 to $15 a share. That was an insane move higher that you were looking to fade the rally.

Now, that’s up into the $60s. It’s just an incredible run. It truly is, and it continues to amaze me. And I know that the fear of missing out on this rally is really eating at a lot of people who were not in on these trades. You wonder if you’ll ever be able to trade the electric vehicle play again.

But just keep in mind that during the dotcom bubble, there was a lot of the same fear of missing out as well. This is similar to that. We’re seeing companies run wild, run way past what any sort of realistic fundamental evaluations would justify for the stock. And that’s true for NIO.

This is a stock that was going to bring up bankruptcy not long ago. To see it turn around and shoot up like it did is truly mind-blowing.

When we look at the price chart, I don’t like to get caught up in all the fundamentals, because, at the end of the day, the fundamentals didn’t draw up this rally. If we’re going to talk about fundamentals during this whole rally, they’re not going to add up. They’re not going to make sense and it’s fully valued or overvalued throughout this whole period. We can’t talk about fundamentals at the top.

We have to continue to look at the price. And what we saw was that a nice ascending triangle pattern formed. It broke out of that, created a resistance trend to the upside, came back and tested it. And that’s what’s interesting to see on this price chart, it tested the previous resistance (the horizontal line). That was great to see, actually. And then it bounced higher off of that last week.

Right now, I have a price target on the stock over the next several months up near $80 a share. And that’s because we take the height of this pattern, which is about 30 bucks a share and goes up to $56, but started around $26. We take those 30 bucks, you add it to the point of the breakout, which is $56. That’s almost $86 a share that you could see trend higher in the wedge formation.

We say that, but anything can change, especially these days. What you want to watch is the key red resistance line at the top. That’s to let you know that we’re trending along at the same pace. Once you break out of that, it’s an even more euphoric rise. And it’s going to come crashing down at some point.

But we look at the green support line, and that is the main one we want to see it hold. As long as NIO can hold that, we want to keep this on our Bank It list and watch this stock head higher and make a run up to around $86 a share.

But if it breaks below that, then look out, because when you see massive rallies like this, this stock could fall back down to, say, the teens. That’s a 70% drop for the stock to get back to the teens. And it was trading there just a few months ago.

It’s not unrealistic to see these big, massive runs and to see a massive drop like that because I mentioned the dotcom bubble earlier. The runs that we saw then were absolutely incredible. Everybody just wanted to have a dotcom in their name, and shares were running up.

After that, though, the stocks that didn’t go bankrupt (which, a lot of them did) — not saying NIO or these others are going to go bankrupt — it took them years, even decades to come back to those pre-peak levels.

This is not the same thing. This is a legitimate company that’s selling vehicles and has the support of the Chinese government. This stock is on our Bank It list for now. If you’re looking at a stock like NIO or even Tesla and thinking that now’s the time to get it in for the long term, that’s not how I would want to play this.

If you are looking at these stocks, even if you want to have exposure long term, you have to think short term now, just trading the stock until it gets to a level that you’d say, “All right, I’m ready to dump my chips in and hold this for the long term.” I just don’t think we’re there yet.

For now, we want to continue to watch our key levels and play these stocks as they’re trading stocks. Because that’s what the market’s handling them as, judging by the massive rallies that we’ve seen.

And that’s just how you’re going to be able to keep your shirt on. In case they see these massive 50% to 70% drops in a short time period, you’ll be able to trade then. And as it pulls back, you can start to average into this trade for the long term, because you want to bet on NIO and Tesla going higher in the years to come.

That’s all for today.

If you have any questions or comments, you can reach me and my team at WeeklyOptionsCorner@BanyanHill.com.

Regards,

Editor, Quick Hit Profits