We’ve been living through some amazing times.

We’ve been in an era of easy money for more than a decade now. Unprecedented.

But the future is more in doubt than ever.

It makes sense to save something for our future. For the next phase.

So, it may surprise you to learn that these gold and silver exchanged-traded funds (ETFs) I’m going to share with you saw triple-digit returns over the past two years alone.

And they’re not done.

But first…

Gold Is on the Rise

The price of gold is rising.

And there’s an important chart to watch.

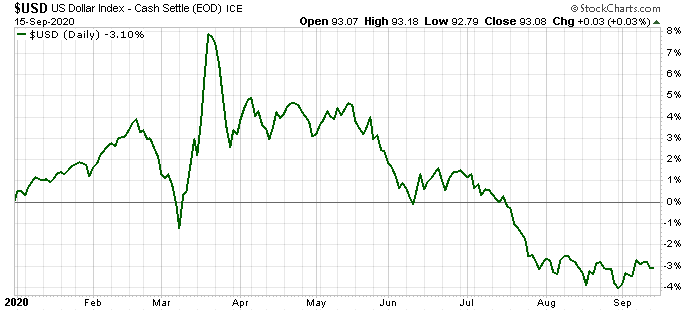

It’s the U.S. dollar index. It shows the value of the dollar, priced against six other currencies. Such as the euro and the Japanese yen:

(Source: Bloomberg)

When the index is rising, the dollar is gaining value versus its peers. But when it’s falling — like it is now — it’s depreciating.

When the dollar falls, items priced in it tend to rise. For example, the market prices gold and silver in dollars.

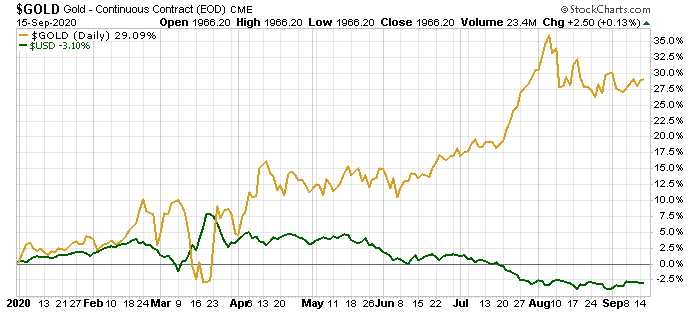

Take a look at the price of gold versus the U.S. dollar:

The dollar doesn’t move as much as stocks. That’s why the moves aren’t proportional.

But you can see the direction of the two assets is the opposite.

This move lower in the dollar is the largest we’ve seen in a few years.

And it could continue.

You see, Federal Reserve Chairman Jerome Powell has made it clear that he and his team aren’t going to support the dollar by raising interest rates.

In early June and again in late July, he said: “We’re not even thinking about thinking about raising rates.”

If Powell says he is raising rates, I assure you the dollar will rise. But he says that isn’t likely to happen for years.

So, What Should You Do?

Don’t make investing any harder that it has to be.

The price of gold and silver is rising.

Owning the companies that pull these metals out of the ground is a good idea.

Over the past two years, six ETFs that own gold and silver miners have more thand doubled.

Take a look:

| Fund | Ticker | Price | Total Return | Market Cap |

| iShares MSCI Global Gold Miners ETF | RING | $35.70 | 160% | $582 million |

| Sprott Gold Miners ETF | SGDM | $36.83 | 143% | $308 million |

| VanEck Vectors Gold Miners ETF | GDX | $42.79 | 141% | $18.5 billion |

| U.S. Global GO Gold & Precious Metal Miners ETF | GOAU | $24.47 | 136% | $127 million |

| iShares MSCI Global Silver and Metals Miners ETF | SLVP | $17.27 | 123% | $250 million |

| Global X Silver Miners ETF | SIL | $48.54 | 112% | $1.1 billion |

(Source: Bloomberg; as of 9/15/20)

The first four names on the list focus on gold producers and royalty companies, and the last two on silver.

Either way, the government is pushing up the price of the metals they produce. That’s good for these ETFs.

And the performance isn’t a fluke. Five of these names have been around for five years. (GOAU began trading in 2017.)

Over that five-year stretch, they have seen total returns between 175% and 262%.

So as long as the dollar is weak and precious metals are in demand, it makes sense to have some exposure to names such as these.

I get it. You may not be used to the government helping you. But in this case, it is.

Good investing,

Editor, Profit Line