Many U.S. oil companies are on the brink of disaster. Four months of losses will do that to you. And global producers are taking advantage.

The latest round of bankruptcies just hit the U.S. oil patch. California Resources Corp. (NYSE: CRC) is the first of what could be many more. It declared bankruptcy on July 15. According to Bloomberg, Denbury Resources Inc. (NYSE: DNR) and offshore driller Noble Corporation Plc. (NYSE: NE) missed this month’s debt payments. That’s not a good sign.

We have discussed bankruptcies in the past. Few (if any) U.S. oil companies can make a profit with oil prices below $45 per barrel. That’s a problem this year.

You see, the benchmark oil price — West Texas Intermediate — hasn’t been above $45 per barrel since the first week of March. And many Texas oil producers are selling at their lowest prices since the 1990s. At one point in April, it was cheaper to buy a barrel of oil in Canada than a can of beer.

We call that a “bust” in the oil industry. And this was an epic bust.

All the usual things happened. Companies laid off thousands of workers. They shut down satellite offices. But most importantly … they stopped drilling.

In the age of shale, oil wells are only good for about 18 months. That’s because the shale rock must be forced open with high-pressure water and propped open with sand. Over time, the natural pressure of the rock squeezes the wells shut again.

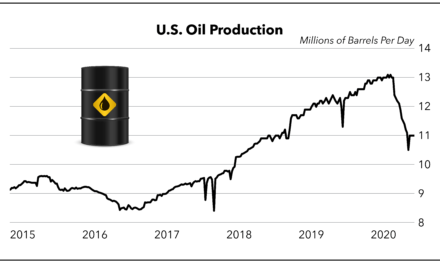

So, when the companies stopped drilling, U.S. oil production didn’t plateau … it crashed. You can see what I mean in the chart below:

U.S. oil production peaked in March 2020 at more than 13 million barrels per day. From that point, oil production fell more than 2.6 million barrels per day in four months. That’s the most precipitous fall in oil production in U.S. history.

The Industry Won’t Recover Soon

Normally, cutting a couple million barrels per day of oil production would cause prices to soar. But Saudi Arabia and their peers stepped in to make sure that didn’t happen.

Saudi Arabia, Russia and the other Organization of the Petroleum Exporting Countries (OPEC) members — basically the largest oil-producing countries outside North America — increased production to take advantage of the U.S. collapse. Adding barrels to the global supply means oil prices won’t recover much above its current price.

See, these countries can make money at $45 a barrel. But few North American companies can. Our oil production went from 5 million a day in 2008 to 13 million a day in 2020 as the shale oil production exploded. That extra oil stole market share from OPEC and Russia.

OPEC needs these shale barrels to go away in order to regain their supremacy and control prices. North American oil became a real thorn in their side.

You may remember that OPEC and Russia cut their production quite a bit in recent years to stabilize prices. But now, they don’t need to. They can increase production and actually make money. At the same time, they can cap prices well below the break-even price of most shale companies.

Capping the price around $40 per barrel will keep pressure on U.S. producers and lead to more bankruptcies here at home.

Speculators in the oil space must be cautious. Debt is more important than ever right now. The vulnerable companies have high-interest payments and loans coming due in the next year or two. Chaparral Energy Inc. (NYSE: CHAP) is an example. Management just asked for an extension on its July payment.

These are the stocks to avoid right now.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist