An Increasing Lack of Sense and Sensibility

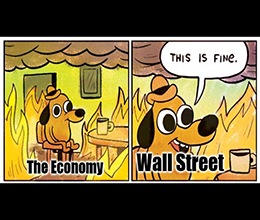

There’s an increasing sense that the recovery from the virus related shutdown is going to be more drawn out, more uneven than maybe the market was looking for.

That, dear reader, is your Quote of the Week … but it might as well be the Quote of the Year.

To say that Mr. Delwiche has a flair for understatement would be, well, an understatement. An “increasing sense”? That’s what we call a near-4% intraday reversal these days?

Seriously, what gave it away?

Was it Federal Reserve Chairman Jerome Powell’s recovery warning? Or maybe White House trade adviser Peter Navarro’s admission that the Trump administration was preparing for a second wave of coronavirus infections, even if it didn’t fully expect one?

Nah, you know it wasn’t any common sense like that.

What set the market off yesterday was California’s return to lockdown. The state, which accounts for about 15% of the U.S. economy, extended closures for bars and indoor dining, as well as several other restrictions.

That’s what set off Wall Street’s “increasing sense” indicator and sent the market plummeting.

Now, where else would you have heard that lockdowns and extended closures would be a thing again?

That’s right! Great Stuff!

I don’t like to say: “I told you so,” but … I told you so.

Back on June 17, we warned you that “there will most likely be a second economic lockdown. … I’m not talking about an official federal lockdown. I’m talking state, local and personal decisions.”

California’s return to lockdown is just the tip of the iceberg here. Texas, Florida and Arizona are on tap to follow suit. Even if the governors of those states don’t reintroduce lockdown rules, people there may do it anyway.

That’s a whole lot of economic hurt that Wall Street can’t ignore forever.

Luckily for your portfolio, Jerome Powell is still walking on water with unlimited stimulus. But that stimulus can only create so much of a floor for stocks. What happens when that stimulus finally catches up with the market? I’m talking inflation — i.e., consumer prices rising faster than expected.

The bottom line is that you need to prepare … now.

We don’t know how long Wall Street or the Fed can maintain the “increasing sense” charade. We do know, however, that until the pandemic is resolved … skyrocketing market volatility is the new normal.

We need to stay cunning — to attack volatility head-on before it attacks us. And we’ve got just the hard-hitting, profit-hunting way to do that.

It’s a new strategy called “Flow Trading” that lets you laugh in the face of volatility … and stack the odds in your favor! Flow Trading uses a fatal flaw in the market to your advantage, potentially doubling your money every 60 days.

Earnings season — and the economic fallout of more lockdowns — will blow this market flaw wide open. Because of how much interest we’ve had in Flow Trading, we’re fast approaching the limit of how many folks can join in.

Click here ASAP to learn about Flow Trading … before your chance to get with the Flow is no more.

The Good: Speak of the Devil

Someone at Great Stuff headquarters must’ve left the Tesla Inc. (Nasdaq: TSLA) pot o’news set to “simmer” last night.

Every time we mention Tesla lately, it’s only a matter of hours before the pot boils over! Whether Elon takes to Twitter after hours or the “unverified source” rumor mill starts spinning … nary a day goes by without Tesla news.

Today’s catch-up: TSLA, joining the broader market to take a breather from yesterday’s barnstorming, ran up again premarket today. Analyst price targets keep rising too — this time, it’s a Piper Sandler boost from $939 to $2,322.

The TSLA tribe roared back: “Not enough! Not enough!” Then, all were satiated on the news that company officials met in Chongqing, China, to talk about “accelerating projects.” That’s it. Very exciting, is it not?

In what could otherwise come out of the Dilbert-worthy Corporate B.S. Generator: “Reuters also reports unidentified sources cited by the China Securities Journal stating that cooperation could refer to sales and maintenance centers rather than factories.”

Now, to balance out the fancy-free rallying … this is all hype. I’m as bullish as always on the charge that Elon and company lead, but even the most gung-ho of Tesla fanboys should take a step away from this electrified ether frolic.

Tesla is overvalued … but so is the entire market. Any hint at good news is all it takes to send them both higher, regardless of valuation.

But does it matter?

Nope.

And did it ever matter?

Nah.

From here, the TSLA crescendo will grow, pulled by those sweet dreams of S&P 500 inclusion potential, a blow-your-shorts amount of short squeezing, bullish analyst calls (above), bullish yet vague and unverified hype out of China (also above), a great snatch-up by index funds forced to add TSLA exposure…

Oh man, there goes that TSLA pot a-simmering again.

Editor’s Note: Chasing Tesla is like chasing your tail right now. One company is set to tear through the electric market in the most lucrative story of 2020. Click here for the details!

The Bad: Delta Blues

Looking to flag a ride? Better head down to the crossroads and forget about the muddy waters surrounding Delta Air Lines Inc. (NYSE: DAL).

Delta is in trouble, and it shows. The company reported a second-quarter loss of $9.01 per share as revenue collapsed 91% to $1.2 billion. Passenger revenue plunged 94% from a year earlier, and flight capacity imploded 84%.

In a call with investors, CEO Ed Bastian said that Delta’s second quarter “illustrates the truly staggering impact of the COVID-19 pandemic on our business.” He added that it will take “more than two years before we see sustainable recovery.”

How’s that for an “increasing sense”?

Delta said it had adequate liquidity to ride out the pandemic for the time being. (And even if it doesn’t, Powell has Delta covered.)

However, you can bet layoffs and a scaled-back fleet are coming later this year once CARES Act employment restrictions are lifted in September.

The Ugly: Wells Has Far to Go

We’re rounding the day out with a mini “Good, Bad and Ugly” within a “Good, Bad and Ugly.” It’s sort of a Shakespearean Hamlet “play within a play” thing, except instead of something rotten in Denmark, it’s the financial sector.

If you’ve read your headline news today, you know that JPMorgan Chase & Co. (NYSE: JPM) killed it with its second-quarter earnings report. That’s the good.

Meanwhile, Citigroup Inc. (NYSE: C) tried to follow suit, beating both earnings and revenue expectations. But investors dinged Citi over exposure to international credit markets during the pandemic. That’s the bad.

But Wells Fargo & Co.’s (NYSE: WFC) quarterly report? It’s just plain ugly. Wells reported a quarterly loss of $0.66 per share, missing both earnings and revenue estimates for the quarter.

That’s not all. Wells also slashed its dividend from $0.51 per share to just $0.10.

“Our view of the length and severity of the economic downturn has deteriorated considerably from the assumptions used last quarter, which drove the $8.4 billion addition to our credit loss reserve in the second quarter,” said Wells Fargo CEO Charlie Scharf.

Wells is clearly Scharf-ing the bed this year. WFC is down more than 50% this year, compared to a 23% loss for the Financial Select Sector SPDR Fund (NYSE: XLF).

Great Stuff hasn’t recommended any financial stocks this year, and we have no plans to.

A 50% loss for WFC and a 23% decline for the entire sector even with unlimited stimulus from the Federal Reserve? Count us out.

Great Stuff: Feed the Beast

We call on you, the Great Ones out there worldwide, yet again for our weekly email roundup. In just two days, my team and I will dive into the murky depths of our inboxes to dredge out your best, most offbeat and most alluring emails.

We’d love to feature your email in this week’s Reader Feedback!

But we can’t chitchat if you don’t write in to GreatStuffToday@BanyanHill.com…

So let’s get the conversation started:

- Is Tesla due for a big pullback from these lofty heights?

- What earnings reports are you looking forward to this season?

- What stocks have you invested in lately? Any stocks you’re curious about?

- What’s the lockdown situation like in your local area — personal or enforced?

- Got any great music recs? We need something new worth blasting around here.

Hit us up at GreatStuffToday@BanyanHill.com anytime you get the itch to rant, ramble and rave. We’ll be here, trust me.

If yelling into the virtual void just isn’t your thing, keep tabs on us with social media: Facebook, Instagram and Twitter.

Until next time, stay Great!

Joseph Hargett

Editor, Great Stuff