Tesla lovers have a lot to be happy about. Shares surged 36% last week. That marked the top of a 400% rally since June!

Tesla bulls expect a perpetual uptrend.

Even major news outlets such as Barron’s and Forbes are jumping on the bandwagon with huge price targets. That’s because there are rumors about Google buying out Tesla:

- “Could Tesla Be Worth $8,000 a Share to Google? Now We Are Getting Silly.”

- “How Google Could Acquire Tesla For $1,500 Per Share On Its Way To $2 Trillion Stock.”

I’m going to stay out of the Tesla mania for now. I have my sights set on an easier way to make money off the rumor mill.

And that’s by betting against one of Wall Street’s favorite stocks: Google’s parent company, Alphabet Inc. (Nasdaq: GOOGL).

Investors banking on a deal between Tesla and Google have the wrong idea.

One reliable indicator tells me Google is overpriced.

The Over/Under on Google

The Over/Under on Google

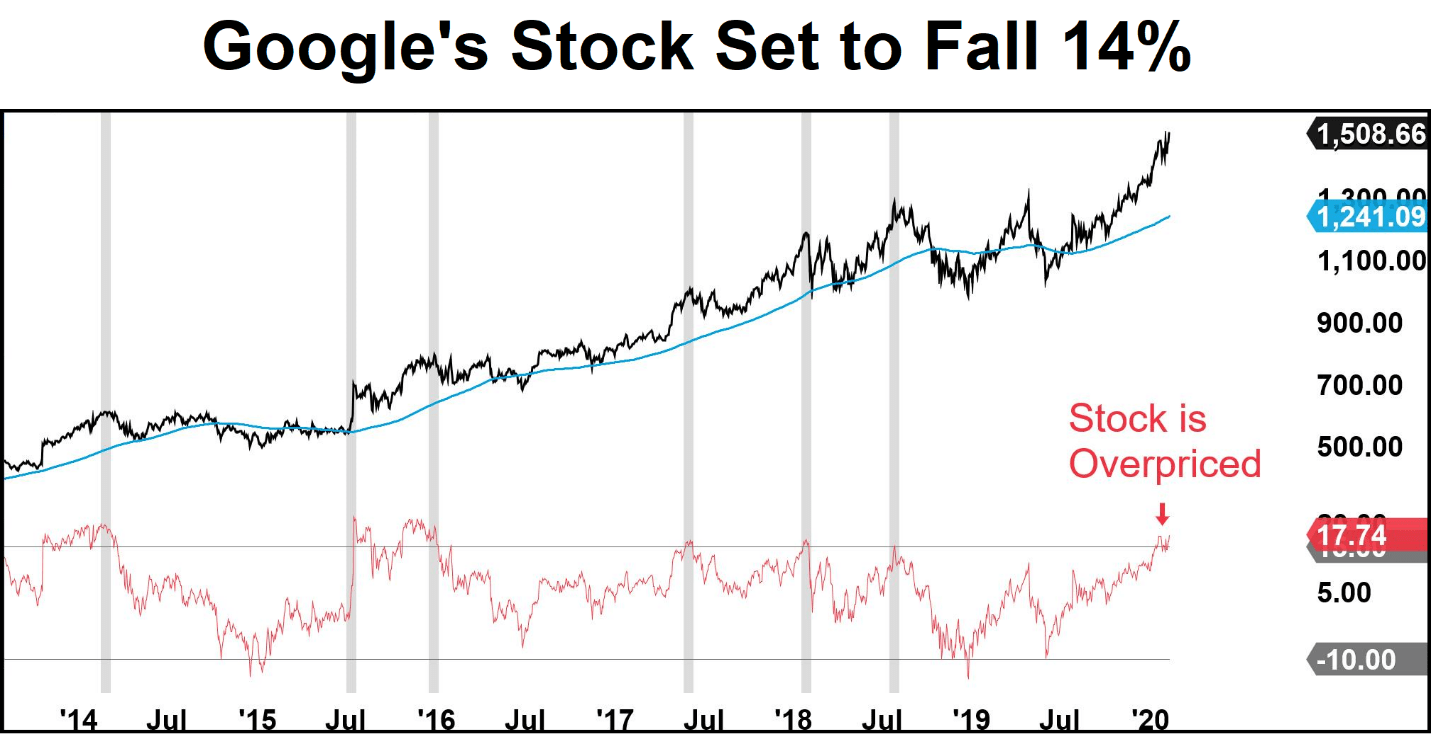

The black line is Google’s stock price.

The blue line is its 200-day moving average (MA), the average of the stock’s price over the most recent 200 days.

Investors use the 200-day moving average to determine trend strength.

The over/under (O/U) is the red line, and it shows the percentage the stock price is trading above or below its 200-day MA.

When the O/U is high, the stock’s potential return over the coming weeks is low.

When the O/U is low, the stock’s potential return over the coming weeks is high.

The O/U for Google is high right now.

The last six times Google traded this far above its 200-day moving average, it went on to fall an average of 14%.

Rumors about Google buying up Tesla will lead investors into Google’s stock at the wrong time.

The stock is overpriced in the near term. The reward is not worth the risk.

But you can use the O/U indicator to avoid making a bad buy.

Or, even better, profit from Google’s decline. Let me show you how.

How to Profit on Google’s Mispricing

I see shares falling 14% by May.

I don’t recommend you short the stock. I’m seeing a short-term drop.

The best way to profit off that is by buying put options on Google.

A put option gains value when the underlying stock drops.

A near-the-money April put on Google will cost about $5,000.

And since options provide leverage, you’d have the chance to turn that $5,000 into $10,000 or more … in two months!

The risk of loss in an option is limited to the amount paid to purchase the option — in this case, $5,000.

Options are not for everyone.

But if you’re looking for a way to make big, fast gains, don’t be intimidated by options.

The lingo is a bit different from stocks, but making trades is just as simple.

For nearly 15 years, I’ve been showing readers how to use options to find opportunities to profit from mispriced stocks.

Last week, Brian wrote in to share his winning trade:

Hey John and team,

Just sold my second half of KL for $2.90 after already closing first half for 70% gain.

A $1,080 investment for 18 contracts at $0.60 for a $2,430 profit.

THANKS!!!

God bless you all.

Brian B.

If you’d like to learn more about what I do, click here to watch the presentation my team and I put together.

Good investing,

Editor, Apex Profit Alert