Investor Insights:

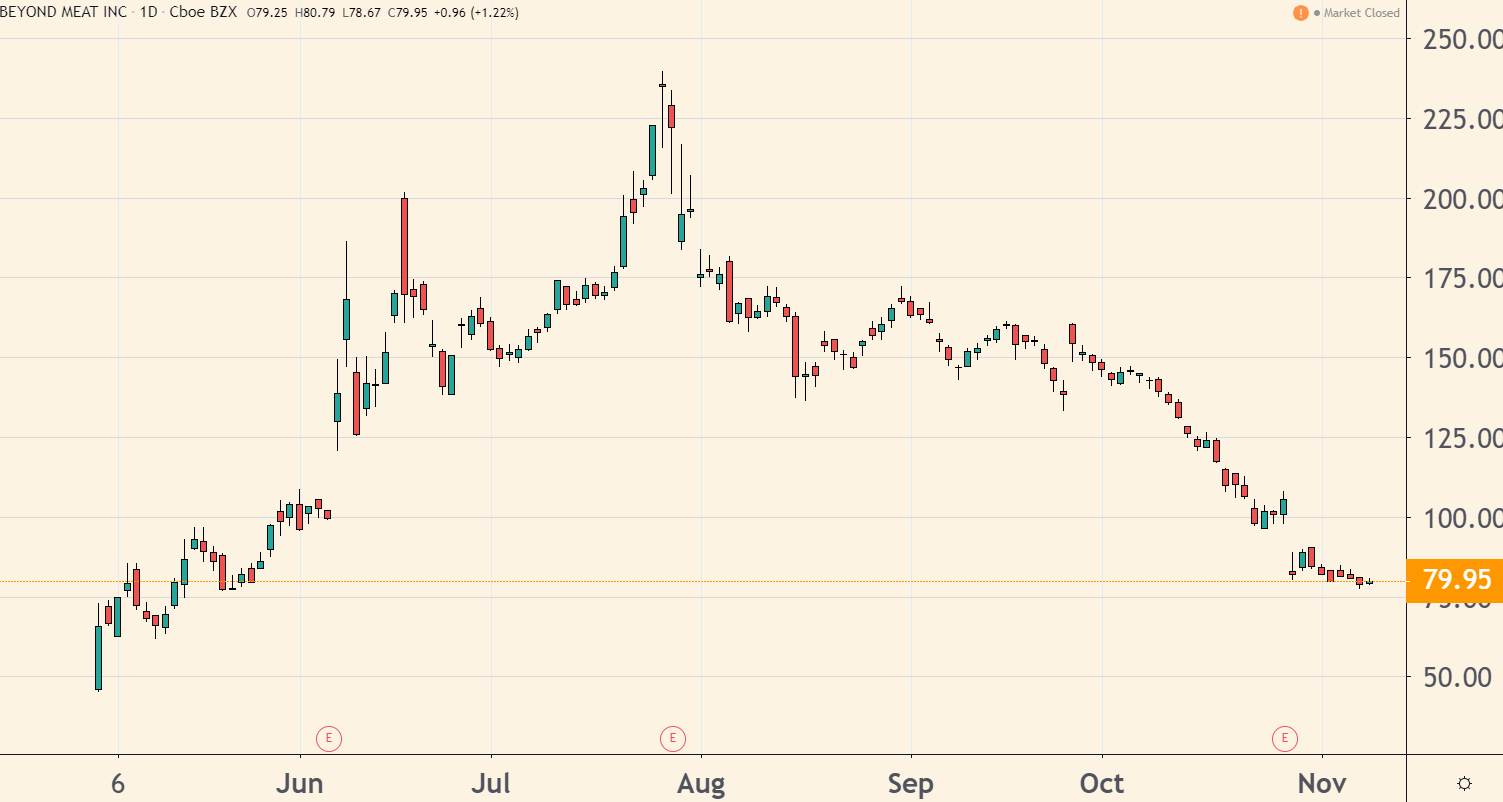

- Since I wrote about Beyond Meat in August, the stock is down 54%.

- The company’s latest earnings report saw it beat Wall Street’s forecasts by $0.02.

- Analysts now expect Beyond Meat’s profits to grow 130% over the next three years.

Well, don’t say I didn’t tell you so.

Back in August, with the stock trading at $175, I sounded the warning about Beyond Meat Inc.’s (Nasdaq: BYND) growing competition and cash-burning ways.

“That’s where disruptive companies … are at a disadvantage,” I wrote. “They grow fast, but consume lots of investors’ cash in the process.”

I added: “Shareholders can be plenty patient — for a time. But not forever.”

Since then, the stock is down 54%.

But if you like the stock, all is not lost.

Beyond Meat Is on a Promising Track

As I tell my Total Wealth Insider readers all the time, it’s great to identify a groundbreaking company with a fast-selling product.

But it’s not enough. You want to buy the stock at the right price too.

In that department, Beyond Meat may still have a ways to go. But it’s a lot closer to being right than wrong compared to three months ago.

With three quarters’ worth of numbers under its belt, and Wall Street’s forecasts for 2020, Beyond Meat is actually on a promising track.

It’s showing real progress in turning into a company with profits, instead of losses, for its shareholders:

The latest report, which came out October 28, saw the company beat Wall Street’s forecasts by $0.02.

Adding up the quarterly projections for 2020, analysts think the company could post profits of $0.31 a share next year.

If we divide the current stock price by next year’s profits, we come up with a forward price-to-earnings (P/E) ratio of 258.

To some, that’s an astronomical price to pay for any stock. After all, the average P/E ratio for the S&P 500 Index right now is only 15.77.

Then again, Wall Street analysts expect Beyond Meat’s earnings per share to more than double to $0.77 in 2021, and nearly double again to $1.23 a share in 2022.

To put all that in perspective: The company’s profits are set to grow 130% on average over the next three years.

A Highly Buyable Entry Point

That doesn’t mean the stock is out of the woodshed in the next few months. Three things are keeping it down temporarily:

- Short sellers are betting heavily against it. They’ve borrowed nearly 10% of Beyond Meat’s public float on the assumption the stock will head lower still.

- The lockup period for Beyond Meat’s early investors expired on October 29. They’re now free to sell their shares and realize millions of dollars in profits.

- Public investors — having been burned on other hyped initial public offerings such as Uber and Lyft — have turned sour on “unicorns” such as Beyond Meat.

Given those challenges, my best guess is that we could see the stock drop to $45 (the stock’s price on its first day of trading) between now and the first days of the new year.

If we do see that price or lower, it would be a highly buyable entry point — made even more buyable by several positive developments on the horizon.

While Beyond Meat is already on Burger King’s grills, a deal with McDonald’s would carry a lot more weight with investors. The fast-food chain is doing trials of a Beyond Meat burger in Canada.

Beyond Meat’s executives have also indicated they want to expand into China before the end of next year.

Confirmation of either development would have analysts updating their profit projections — and investors changing their tune about taking a bite of the stock.

Of course, I’ll keep you updated on the latest. So stay tuned.

Best of good buys,

Editor, Total Wealth Insider

P.S. A new technology I call the Hypernet is 1,600 times faster than your home internet and 22 times faster than 5G. It’s the key to all future technologies — unlocking a potential $48 trillion gold mine. And one company stands at the forefront of it all. My new special presentation gives you all you need to know — including how this opportunity could hand you 10 times your money. To watch it, click here now.