2017 saw the price of most metals go up.

Those associated with electric-vehicle (EV) batteries fetched a premium.

Lithium was up 20%.

Nickel gained 30%.

And cobalt soared roughly 125%.

The year of stable growth made investors even more optimistic. 2018 was supposed to be the breakout year for EVs and their metals.

In the famous words of legendary investor Warren Buffett, it is wise to be “fearful when others are greedy, and greedy when others are fearful.”

This year punished investors who got too greedy. But next year will reward those with patience.

Charging the EV Revolution

While EVs still have shortfalls like range and charging time, the interest in this space is quickly closing the gap.

Major automakers are pouring millions into making EVs from fear of missing out.

BMW and Porsche created a fast charger that can recharge 80% of capacity in 15 minutes. That’s twice as fast as Tesla’s superchargers.

With every automaker developing an EV, we’ll see costs fall while function improves. This will create a snowballing effect for demand of these new-age cars and trucks.

Lithium and cobalt grabbed speculators’ attention the last couple years, but other metals will spark the next bull market in battery metals.

Nickel and silver are irreplaceable in EVs. Nickel’s demand will continue to grow as automakers try to engineer out cobalt.

Silver is already used in car electrical systems. EVs will demand even more silver.

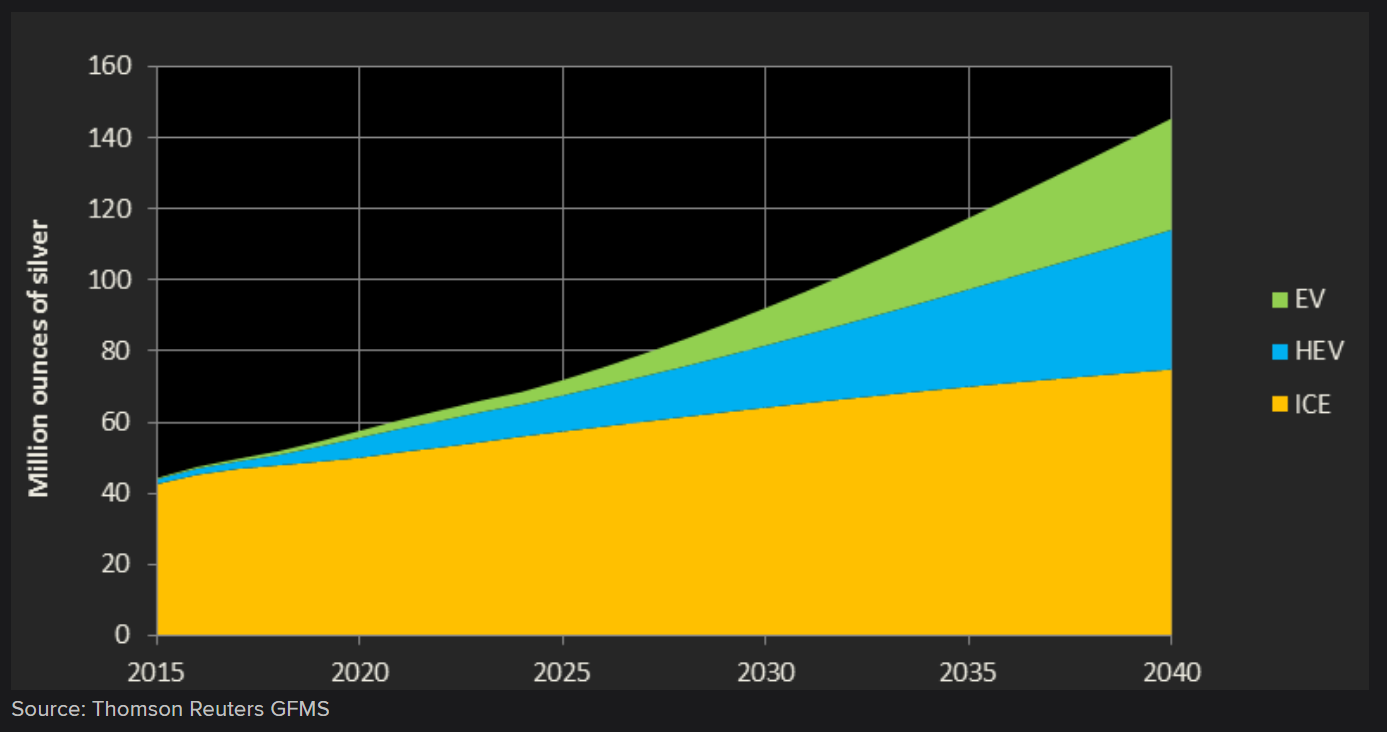

The demand for silver from the auto industry is forecasted to triple by 2040. That represents 15% of the predicted supply.

The chart below shows the forecasted demand for EVs, hybrid-electric vehicles (HEVs) and internal combustion engines (ICEs).

A New Contender

Battery-powered EVs were the foregone winners to power the next century of cars. But this year saw the resurgence of fuel cells in a new niche.

Hydrogen-powered fuel cells have some advantages over batteries. While they deliver great torque like batteries, refueling is rapid and the range is comparable to gas or diesel.

This makes fuel cells perfect for trucks and heavy-duty transporters.

Nikola Motor Company, a maker of hydrogen fuel cell semitrucks, secured a deal with Anheuser-Busch to supply 800 trucks to its fleet. It will take just 28 fueling stations to power this beer maker’s national distribution needs.

Platinum will be the metal to play this trend in the move toward fuel cells. According to research from Reuters, 2% of cars and trucks switching to fuel cells represents a 20% increase in demand for platinum.

A Year Ahead

The first half of 2019 is shaping up to be a volatile period. Fears of declining growth are causing sell-offs across sectors. Concern over auto demand is included in that.

Once the market works through these fears, it will be looking for the next growth story.

At Real Wealth Strategist we are keeping a close eye on developments in EVs and fuel cells. The bear markets in platinum and silver will give way to a sharp bull run.

Good investing,

Anthony Planas

Internal Analyst, Banyan Hill Publishing