It has been a rough month.

We had the worst start for December since the Great Depression.

And stocks continued lower after the latest Federal Reserve meeting.

It had the possibility to send stocks soaring into the end of the year. But despite lowering expectations for rate hikes in the future, the Fed was unable to lift the stock market.

That bearish sentiment could change as we head into what’s been known as the Santa Claus rally.

While some have considered the Santa Claus rally to occur throughout the entire month of December, volatile years like this have shifted that focus to simply the six trading days after Christmas being the bulk of the rally.

This year, that will be December 26 through January 3, since the market is closed New Year’s Day.

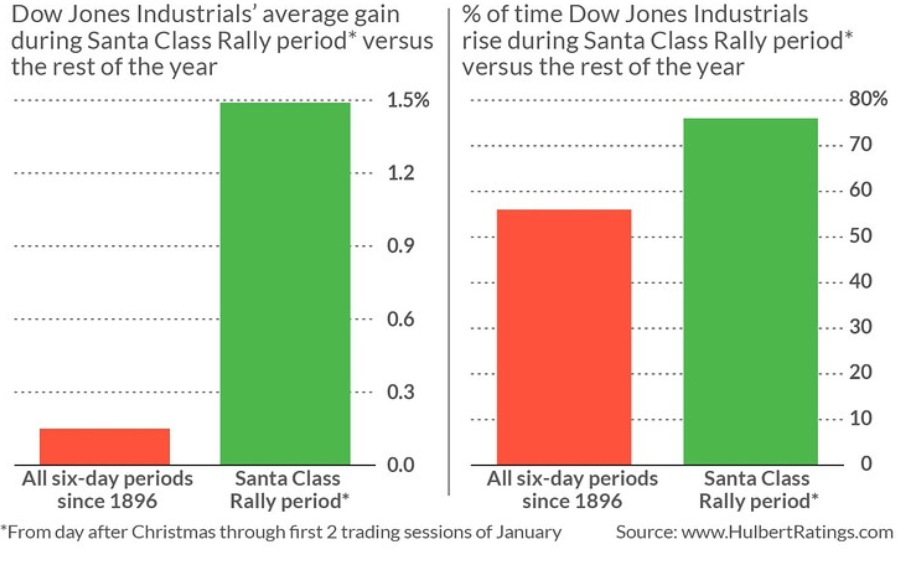

Tracking the Dow Jones Industrial Average since 1896, when the index was first created, it has increased 76% of the time over these six days.

Take a look:

This gives us a clear picture of what to expect this Christmas.

You can see in the first chart that the Santa Claus rally sees a significant six-day rally compared to similar time periods throughout the year.

And the second chart highlights the consistency this rally has seen. That helps explain why it’s a phenomenon tracked heavily in the markets.

We can’t simply ignore a historical trend with 76% accuracy that sees gains 10 times a normal six-day period.

It’s one we want to pay attention to.

After an extremely volatile month, look for Santa to bring investors a gift, and somewhat salvage what has been a turbulent year.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert