Gold is your insurance during a wavering stock market.

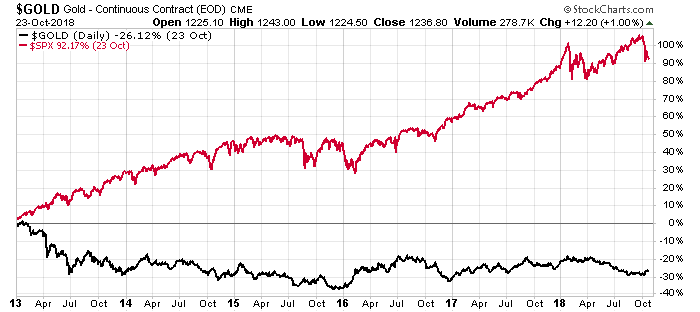

Looking back over the last six years, we see an interesting correlation. U.S. stocks went up (over 90%) and the price of gold fell (-26%).

You can see what I mean from the chart below.

The price of gold moved opposite the value of the S&P 500 Index. That wasn’t good for gold owners at the time. But as most of us who own gold understand, it was doing its job.

You see, I own gold for insurance against volatile times.

Gold is a widely accepted store of value. It doesn’t corrode or rust. It’s beautiful. And it has held its value since the first nugget was plucked from a stream bed millennia ago.

We still desire it. But as you saw, it fell in price for the last six years.

That’s actually good for us right now.

The Time for Gold Insurance Is Back

As gold goes down when the market goes up, the opposite is also true.

In 2008, at the start of the financial crisis, the S&P 500 fell nearly 40% that year alone. The price of gold rose 5%.

That’s why we own gold, as insurance against these times of trouble.

From January 2008 to December 2011, the S&P 500 fell nearly 15%. But the price of gold rose over 86%.

So, investors who held gold during that period didn’t take as large of a hit as investors who were 100% in the stock market.

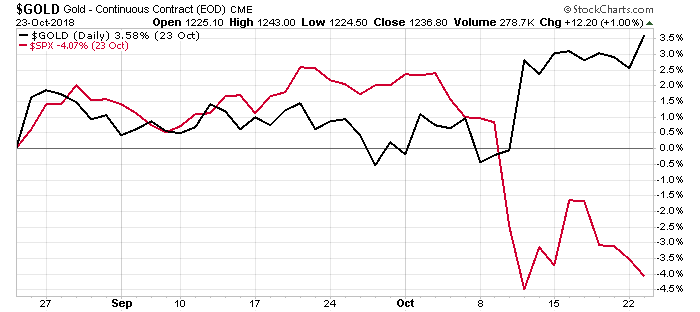

The time for gold insurance is back. As you can see in the chart below:

Over the past two months, the performance of the S&P 500 and gold flipped. The S&P 500 fell 4%, while the gold price rose nearly 4%.

That’s a warning sign. The first shot of the coming war…

We need to take precautions … and that means buying gold.

Not gold miners … gold.

Buying Gold Is Easy

The good news is gold is easy to buy, and it’s relatively cheap.

At its peak in 2011, the price of gold hit $1,900 per ounce. However, today it trades for $1,230 per ounce.

While the price is up slightly, it’s still early. We can buy plenty of insurance without paying a huge premium.

There are several ways to buy gold: gold coins, gold jewelry and on the stock market.

We’re going to focus on buying gold in market to hold in our portfolio. For a short-term insurance policy, this kind of gold works fine.

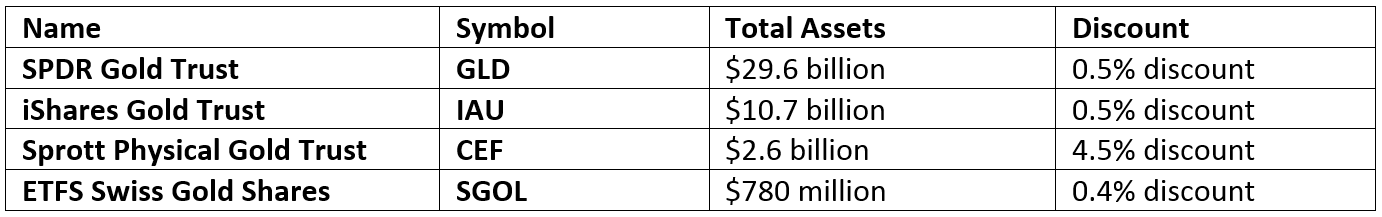

The good news is we can buy gold at a discount to the spot price. That means we pay less than the current price of gold.

Here’s the list:

Adding gold to your portfolio is as easy as buying a stock. These funds are large, liquid and cheaper than buying physical gold.

And if you don’t own any gold yet, this is the way to ensure that your wealth doesn’t follow the market down during the next big fall.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist