Stop me if you’ve heard this story before: The Federal Reserve raises interest rates, and the U.S. dollar falls.

It’s counterintuitive. But it happened in December 2015 and December 2016.

And it will happen again.

When it does, the value of commodities priced in dollars will jump. Especially gold.

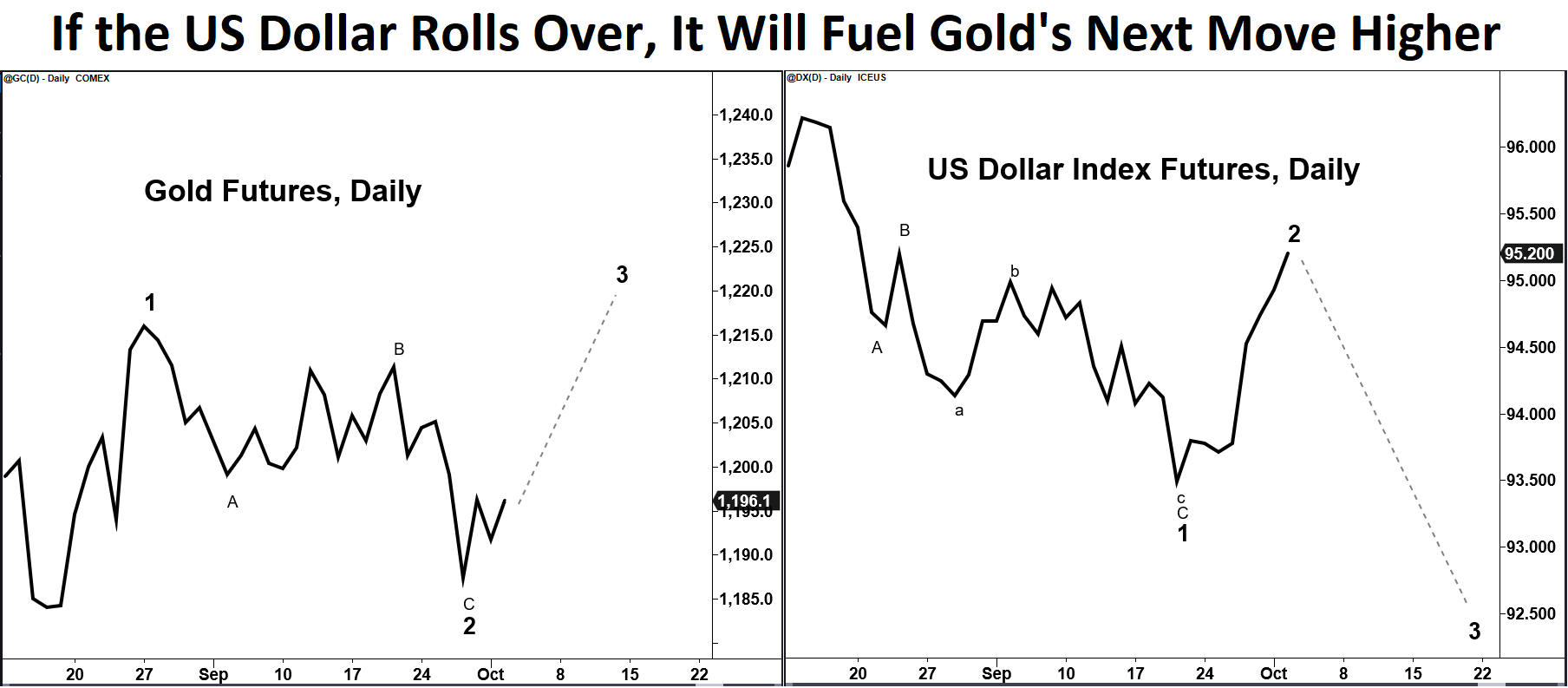

Prices are warning of a possible sentiment shift that will hit the dollar and fuel gold’s next rally.

Gold made a new low in the middle of August. The U.S. dollar made a new high.

Price patterns unfolded in textbook fashion after that…

Gold and the dollar are each carving out three-wave patterns.

In wave one of an uptrend, optimism becomes euphoria.

In wave two, euphoria turns to doubt.

In wave three, doubt turns back into optimism, and then to euphoria again.

That’s noteworthy. Patterns unfold this way because they reflect the basic emotional responses of traders.

Prices rise and fall on these base emotions.

The chart patterns above suggest gold will rise and the dollar will fall in October.

They might even signal the start of a larger trend. A change in how investors feel about interest rates is possible.

Why I’m Bullish on Gold

You see, rising interest rates attract capital. Capital inflows create demand for the underlying currency and drive up its value.

Yet the opposite happened after the Fed’s December 2015 and December 2016 rate hikes.

Each time, global markets cried out: “Don’t take away our capital. We need dollars!” The Fed listened and postponed future rate hikes.

And each time rate expectations flipped, the dollar lost support. Gold climbed 26% and 17%, respectively.

Today’s concerns are the same. China and emerging economies are having a rough go of it, and markets are starting to worry.

The U.S. economy is strong, but the Fed knows its interest-rate policy affects the whole world. If it drives U.S. interest rates too high, it increases pressure on the rest of the world.

The Fed doesn’t want that. So, it doesn’t want a stronger dollar either.

I’m bullish on gold and gold-mining stocks right now. Consider increasing your exposure to gold if you haven’t already.

Good investing,

John Ross

Internal Analyst, Banyan Hill Publishing