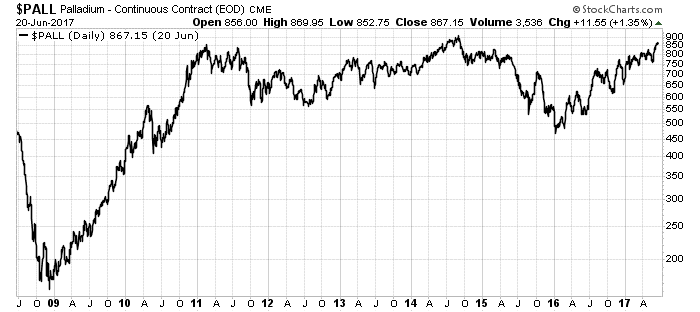

Palladium is probably the stealthiest bull market in the world. Its performance since 2009 beats every other metal out there…

Since January 2009, it outperformed gold by 300%. It outperformed silver by 300%. It outperformed platinum by over 350%.

Palladium is like the ugly younger sibling of platinum. Most of the world’s palladium comes from nickel mines in Russia and platinum mines in South Africa.

Back in 2009, it was cheap. Palladium peaked in the 2008 bull market around $600 per ounce before crashing back down.

In the bull market from 2009 to 2011, palladium’s rising price hid in the shadow of metals like gold and silver. However, what made palladium’s run so impressive is that in 2011, when the other metal prices collapsed, it did not.

A Metal in the Shadows

You can see what I mean from the price chart below:

While palladium’s performance over the last 10 years is impressive, it’s the bull market since January 2016 that is truly outstanding. Unlike its more glamourous peers, the price of palladium continues to climb straight up. According to the Financial Times, palladium outperformed every member of the Bloomberg Commodity Index in 2017.

The reason is simple: cars.

You see, palladium is the key component in catalytic converters, those bulky things on your tailpipe. As the exhaust moves through a palladium wool, it makes pollutants react to form less harmful compounds.

That makes palladium a key player in reducing air pollution … something China is fighting with today.

Just Can’t Get Enough

Demand for palladium is soaring. According to the Financial Times, supplies at New York Mercantile Exchange warehouses are down 40% this year to their lowest level since 2003.

According to the Thomson Reuters research firm, palladium prices will exceed platinum for the first time since 2001 sometime this year. That’s notable because in 2007, an ounce of platinum cost $1,000 more than palladium.

Palladium’s strong rise has less to do with supply than demand for the last five years. Carmakers can’t get enough. China and the U.S. are producing more and more cars.

That’s a big part of the problem with palladium. The supplies are not around. There isn’t a giant pile of the stuff waiting for higher prices (like with oil).

The major mines are in Russia and South Africa. The African mines in particular are old, deep and running out of ore. That means it’s harder and more expensive to get it out.

How to Play Palladium

Rather than buy a supplier of the metal, such as the big Russian company Norilsk Nickel or the South African company Anglo American Platinum, we should just invest in the metal itself. One simple way to do that is through the Sprott Physical Platinum and Palladium Trust (NYSE Arca: SPPP).

This publicly traded vehicle actually holds the physical metal. It lists the serial numbers of the bars on its website. (How cool is that?) Even better for us, we can buy the trust at a discount to the value of the metal it owns.

The current value of the trust’s platinum and palladium is roughly $8.30 per share. However, the trust units are trading at $8.22 per share. That’s crazy. If you want to buy a palladium coin today, you will pay spot plus commission. That means a markup from the dealer of anywhere from 1% to 10%.

However, we can buy shares of specific bars of palladium and platinum for less than the actual price by buying shares of SPPP. That’s a great way to take advantage of the bull market in palladium.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist