Editorial Director’s Note: This holiday week, we’re looking back on the past year and sending you some of the best content we published in the past 12 months. We hope you enjoy this special series. We’ll be back the week of Monday, December 30, with brand-new research from all of our experts … as well as an exciting announcement for Sovereign Investor Daily. — Jessica Cohn

The “Dogs of the Dow” is an investment strategy.

Michael B. O’Higgins coined the idea in his 1991 book, Beating the Dow. (O’Higgins co-authored the title with John Downes.)

He recommends buying the 10 highest-dividend-paying stocks in the Dow Jones Industrial Average each year. The Dow includes 30 blue-chip industrial stocks.

Another version of the idea is to buy the five (of the 10) stocks with the lowest stock price.

The American Association of Individual Investors (AAII) tests many investment methods. This includes both versions of the Dogs of the Dow.

From 2003 to November 30, 2018 (the last date presented), AAII shows the 10-stock Dogs thesis returned 4% per year. The five-stock version returned 3.6% per year.

The system rebalances each month. And these numbers do not include dividends.

That is an OK performance. But you could do better investing in the S&P 500 Index.

In the spirit of the Dogs, I want to present another idea to you. You won’t find this in any textbooks (so far as I know) because I developed it.

It is another way to find some beaten-down stocks as you head into the new year…

A Revised Version of the Dogs Strategy

For this idea, I wanted to choose from a broader group of stocks. Instead of looking at 30 Dow stocks, I looked at the S&P 500.

Not all stocks in the S&P 500 pay dividends, so I screened for the worst-performing stocks of 2018.

This is like the Dogs of the Dow, which seeks the highest-dividend-yielders.

Dividend yield equals dividend divided by price. As such, the Dogs strategy often highlights the stocks whose price has fallen the most.

Then I assessed the quality of their financial performance. To do this, I looked at their revenue growth, free-cash-flow growth and debt levels.

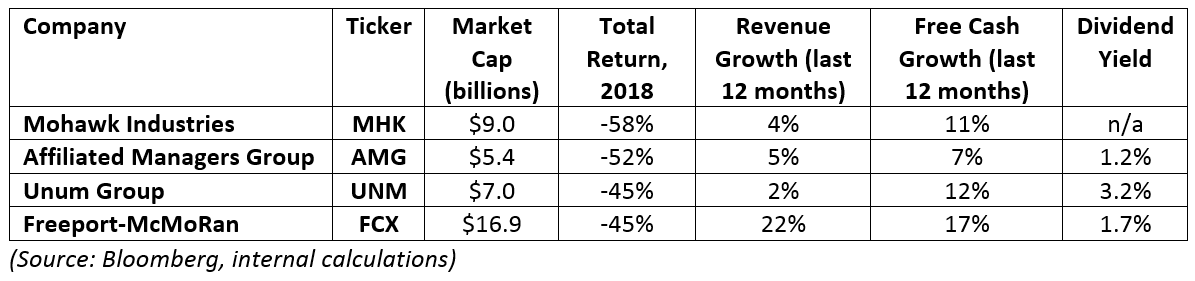

The below list of stocks is a good place to start a speculative 2019 stock wish list:

You will note that not all the stocks pay a dividend. For this screen, I was looking for stocks that are down and might perk back up. I was less worried about the dividend.

I didn’t highlight the debt levels in the above table. Each of the above names can manage their debt, though.

These stocks are from various industries:

- Mohawk Industries Inc. (NYSE: MHK) makes flooring.

- Affiliated Managers Group Inc. (NYSE: AMG) is an asset manager.

- Unum Group (NYSE: UNM) is in insurance.

- Freeport-McMoRan Inc. (NYSE: FCX) is a copper and gold producer.

I mentioned this above, but it bears repeating: You should note that these names are down a lot over the last year.

That should raise your antenna. These ideas are more speculative than they are core investment ideas.

However, the main idea of this search is this: If these companies can continue growing sales and generating cash, their shares will move higher.

If they return to recent valuations, they should gain at least 25%.

Good investing,

Brian Christopher

Editor, Profit Line