Investor Insights:

- In the spirit of the “Dogs of the Dow,” I want to present an idea to you.

- As we head into the new year, I found some beaten-down stocks to invest in.

- If they return to recent valuations, they should gain at least 30%.

The “Dogs of the Dow” is an investment strategy.

Michael B. O’Higgins coined the idea in his 1991 book, Beating the Dow. (O’Higgins co-authored the title with John Downes.)

He recommends buying the 10 highest-dividend-paying stocks in the Dow Jones Industrial Average each year. The Dow includes 30 blue-chip industrial stocks.

Another version of the idea is to buy the five (of the 10) stocks with the lowest stock price.

The American Association of Individual Investors (AAII) tests many investment methods. This includes both versions of the Dogs of the Dow.

Over the past decade (through November 2019), AAII shows the 10-stock Dogs thesis returned 10.7% per year. The five-stock version returned 12% per year.

The system rebalances each month. And these numbers don’t include dividends.

That’s decent performance. But you could do better by investing in the S&P 500 Index.

In the spirit of the Dogs, I want to present another idea to you. You won’t find this in any textbooks (as far as I know) because I developed it.

It’s another way to find some beaten-down stocks as we head into the new year…

A Revised Version of the Dogs Strategy

For this idea, I wanted to choose from a broader group of stocks. Instead of looking at 30 Dow stocks, I looked at the S&P 500.

Not all stocks in the S&P 500 pay dividends, so I screened for the worst-performing stocks of 2019.

This is like the Dogs of the Dow, which seeks the highest dividend yielders.

Dividend yield equals dividend divided by stock price. As such, the Dogs strategy often highlights the stocks whose prices have fallen the most.

Then I assessed the quality of their financial performance. To do this, I looked at their revenue growth, free cash flow growth and debt levels.

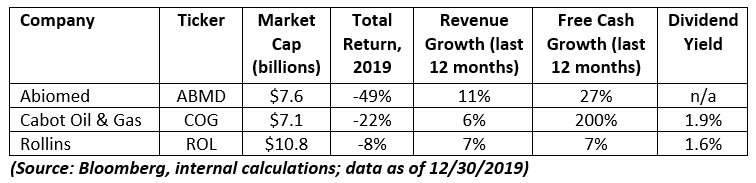

The below list of stocks is a good place to start a speculative 2020 stock wish list:

You’ll note that not all the stocks pay a dividend. For this screen, I was looking for stocks that are down and might perk back up. I was less worried about the dividend.

I didn’t highlight the debt levels in the above table. Each of the above names can manage its debt, though.

These stocks are from various industries:

- Abiomed Inc. (Nasdaq: ABMD) makes medical devices for hearts.

- Cabot Oil & Gas Corp. (NYSE: COG) produces energy, especially gas. And unlike its peers, it does so profitably.

- Rollins Inc. (NYSE: ROL) controls pests.

I mentioned this above, but it bears repeating: You should note that these names are down over the last year. A year when the broader market rose.

That should raise your antenna. These stocks are more speculative than they are core investment ideas.

However, the main idea of this search is this: If these companies can continue growing sales and generating cash, their shares will move higher.

If these beaten-down stocks return to recent valuations, they should gain at least 30%.

Good investing,

Editor, Profit Line

P.S. In my colleague Jeff Yastine’s new video presentation, he shows you how a one-page form will allow you to make the same gains as an exclusive group of the world’s top investors. Knowing how to use this form could open the doors to a $1,024,000 windfall. Go here to see all the details.