Story Highlights

- Central banks bought a record amount of gold this year.

- Now, another precious metal must rise by 35% to get back to its average price.

- Here’s an easy way to turn that gain into 105% without using options.

According to the World Gold Council, central banks bought a record $15.7 billion of gold in the first half of 2019. And that trend continues today.

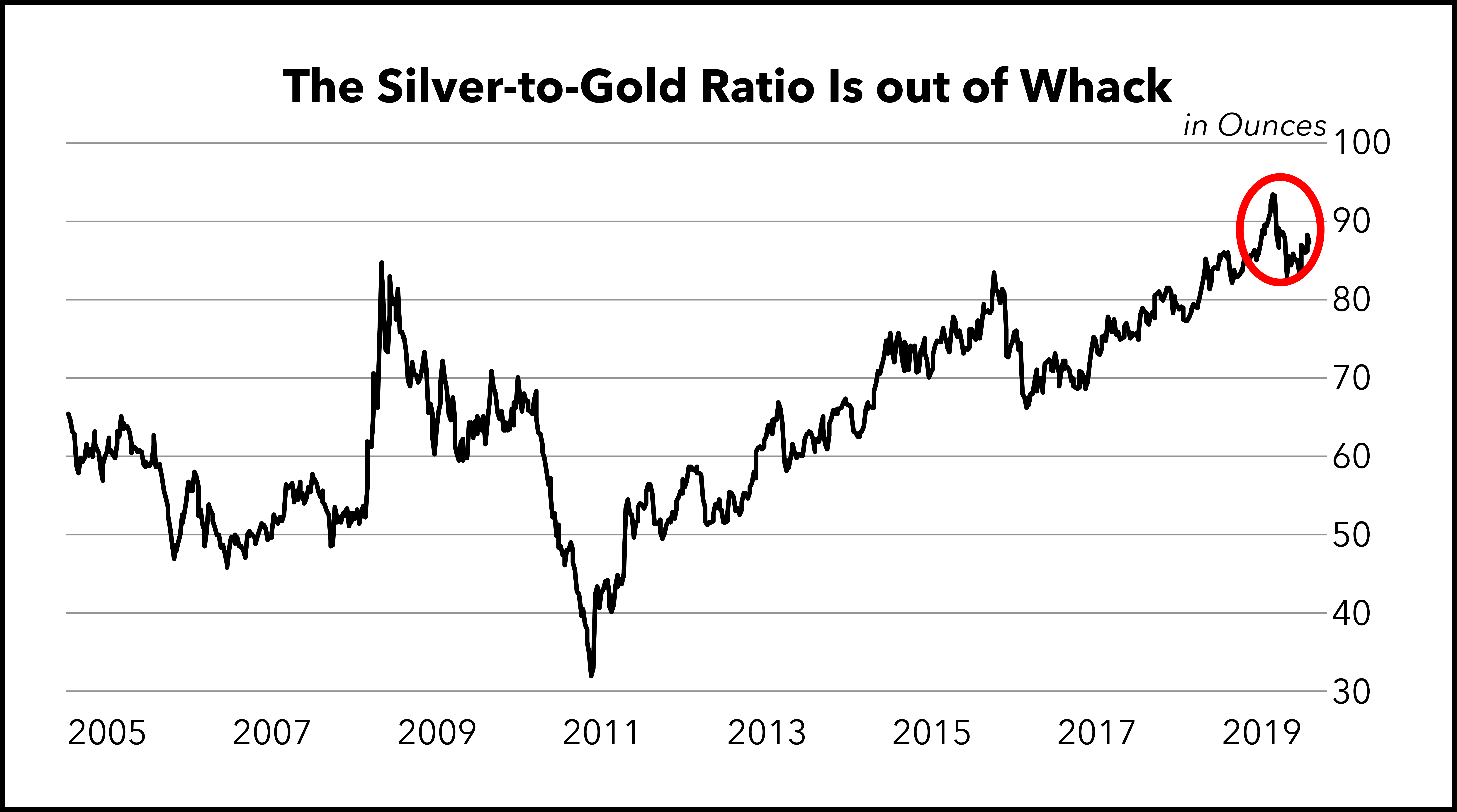

That buying spree led to the biggest imbalance between gold and silver that I’ve seen in my career.

I’ve watched the prices of gold and silver orbit one another for nearly 15 years now. And rarely do they get this far out of balance. It took serious bank involvement to get there.

Central banks, the big national banks around the world, are worried. And when they are worried, they buy gold. That’s what pushed the gold price up from around $1,200 per ounce in late 2018 to over $1,525 per ounce in August 2019.

That’s an increase of 27%. Central banks helped to drive the largest 12-month increase in gold prices since 2011.

Now, one metal needs to rise 35% just to get back to its average price. That’s a huge move — one that we could turn into an easy 105% when it happens. Because it will happen, likely in early 2020.

Let me show you why…

Do you own any metal, (not miners)?

— Matt Badiali (@MattBadialiGuru) December 26, 2019

How We Measure Gold and Silver’s Relationship

The relationship between the gold price and the silver price is one of the first relationships I studied when I began working in finance.

It’s important because these metals are a safe haven for many skilled investors.

Gold and silver move together like the earth and the moon. Both hold value in their own right.

Gold is scarcer and more desirable than silver, so it costs more.

We use the gold-to-silver ratio to measure that relationship.

In other words, we measure how many ounces of silver it takes to buy an ounce of gold.

In July, I told you that the ratio was at a 30-year extreme. It took 92.6 ounces of silver to buy an ounce of gold.

We had to go all the way back to 1993 to find a time when the ratio was more out of whack. That’s why I told you to buy silver in July.

By September 2019, the trades in silver gained 56% in just over two months. But I knew bigger gains were ahead.

I was right. The trade on VelocityShares 3x Long Silver exchange-traded note (Nasdaq: USLV) skyrocketed from $63 to $132 by early September — a fantastic 110% gain!

The iShares Silver Trust exchange-traded fund (NYSE: SLV) trade returned 29% over the same period.

Those were great trades.

After that, shares of both eased lower. But the gold-to-silver ratio didn’t. That creates another great opportunity today!

Silver Price Needs to Rise 35% — Here’s Why

As you can see from the chart below, the ratio is at an extreme:

Data From Bloomberg.

Since 2005, the average is 65 ounces of silver to 1 ounce of gold. Right now, the value is 87-to-1.

That’s way, way out of balance.

In order to get back to 65-to-1, one of two things must happen.

- The silver price must go up 35%, to $23 per ounce.

- The gold price must fall 26%, back to $1,090 per ounce.

I don’t think we’ll see gold fall this year. It would take a big seller, and we know central banks are still buying. So there won’t be enough selling to offset that much demand.

Instead, I think 2020 will be the year of a massive silver rally.

If you haven’t already bought the iShares Silver Trust ETF (NYSE: SLV), which tracks the price of silver, now is the time to consider adding it to your portfolio.

Or, for a bigger payoff, look at the VelocityShares 3x Long Silver ETN (Nasdaq: USLV). This leveraged fund would return about 105% on a 35% rally in the price of silver! The risk-reward on this trade looks excellent.

If you’re looking to buy the best silver stocks, in my Real Wealth Strategist newsletter, we’ve held two great silver miners in our model portfolio since March. My readers’ open gains on those positions are 70% and 19% at last glance.

And I’m researching new silver companies to add in 2020, so we can profit when the metal’s price rises 35%!

To learn more, check out this special presentation today.

Good investing,

Editor, Real Wealth Strategist

P.S. For daily commentary, pictures and ideas — not to mention my brand-new weekly Twitter polls! — follow me @MattBadialiGuru on Twitter and Instagram.