Recession warnings are everywhere you turn.

Investor uncertainty and fear are at extreme levels.

We could undergo a major economic slowdown next year. Or a bear market.

Barring a global financial crisis, it’s time to look outside the U.S.

The Fed Controls the Dollar

The U.S. dollar fuels the global financial system. It’s vital to global trade, cross-border loans and investment.

And the dollar is weighing on emerging-market stocks.

A stronger dollar attracts global investors to dollar-based assets. When this happens, emerging market stocks lose their appeal.

This brings me to the Federal Reserve.

Fed policymakers may not respond to stock market weakness, but they will respond to economic weakness.

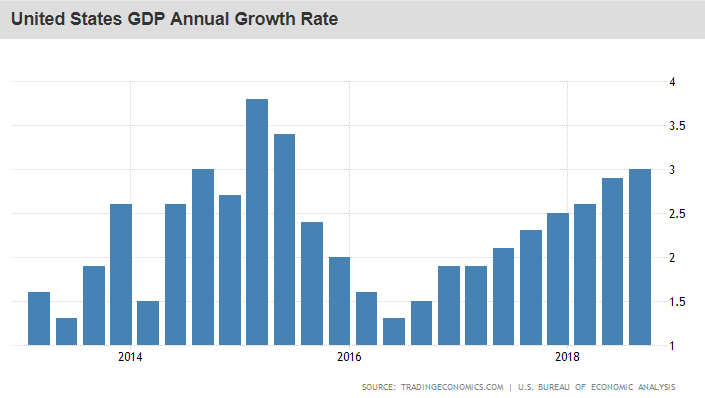

In the second quarter of 2016, U.S. gross domestic product (GDP) growth dropped to 1.3%.

The Fed withheld rate hikes for an entire year until the economy firmed up.

A Welcome Backdrop for Emerging Markets

We are further along in the cycle today. But the Fed is approaching a similar crossroads.

If investors expect the Fed to stop raising rates because growth is slowing, the markets will react. And the dollar will drop.

In that environment, I’d take aim at emerging markets.

Their performance in the fourth quarter hasn’t been as bad as the S&P 500. When the SPDR S&P 500 ETF (NYSE: SPY) lost 19% in the fourth quarter, the iShares MSCI Emerging Markets ETF (NYSE: EEM) only shed 11%.

Growth is likely to slow down in the U.S.

U.S. stocks may struggle to shake off those expectations.

At the same time, the slowdown in emerging-market economies is already priced in to emerging-market stocks. Year to date, EEM lost 22% in 2018.

In other words, emerging-market stocks should offer better value than U.S. stocks in the new year.

Good investing,

John Ross

Senior Analyst, Banyan Hill Publishing