One of Chartered Market Technician Chad Shoop’s loyal subscribers reached out to tell him:

Holy cow, look at this! I’m up $12,740 in thirty days with an initial investment of $50,000!

Guys you have to show this to people so they can see how the Profit Stacks work!

I’m a 44-year-old FedEx driver, a hay-cattle farmer and a father of nine kids still at home.

If I’m not the busiest member of the Profit Stacking program then I’m surely in the top 10!

And I’m getting results like this!

— Matt T.

When our team shared this email, I realized that Matt is right!

We need to show you so you can see how Chad’s “Profit Stacks” work.

Chad’s goal was to create a strategy to help you build a seven-figure nest egg in the months and years ahead. One so powerful, simple and effective even first-time traders can use it to grab massive gains and avoid unnecessary risks.

Chad has been running this strategy live with his subscribers since 2017.

Last year was fantastic. If the performance from 2019 continues, you could turn a $10,000 stake into just over $1 million in only 13 years.

Now, this is key: You can get started with as little as $500 a month. Chad has uncovered a way to harness the power of cycles.

The Power of Cycles

If you’ve paid attention to how volatile the market has been — up, down, back up, further down — in recent weeks, you might be wondering whether historical cycles can work at a time like this.

I asked Chad that same question.

This was his answer:

Historically, cycles have always played a part in the stock market. And after major sell-offs, they become even more prominent for the rebound. They allow us to pick up quick double-digit gains in a matter of weeks. It is an uncertain market right now, but trusting a proven system built around the cyclical nature of the stock market gives us great predictability.

You see, Chad has determined which sectors are cyclical year after year.

We can benefit from the volatility.

Sectors are just groups of related companies — for instance, pharmaceuticals.

Chad has targeted short, seasonal cycles that you can profit from year in and year out.

For example, electricity and heating-oil consumption take off in the winter.

And when sales spike, the stock prices do too.

The Exact Calendar Dates

Chad figured out the precise calendar date that the most cyclical sectors tend to rise in price and the exact date that they usually fall or stall out.

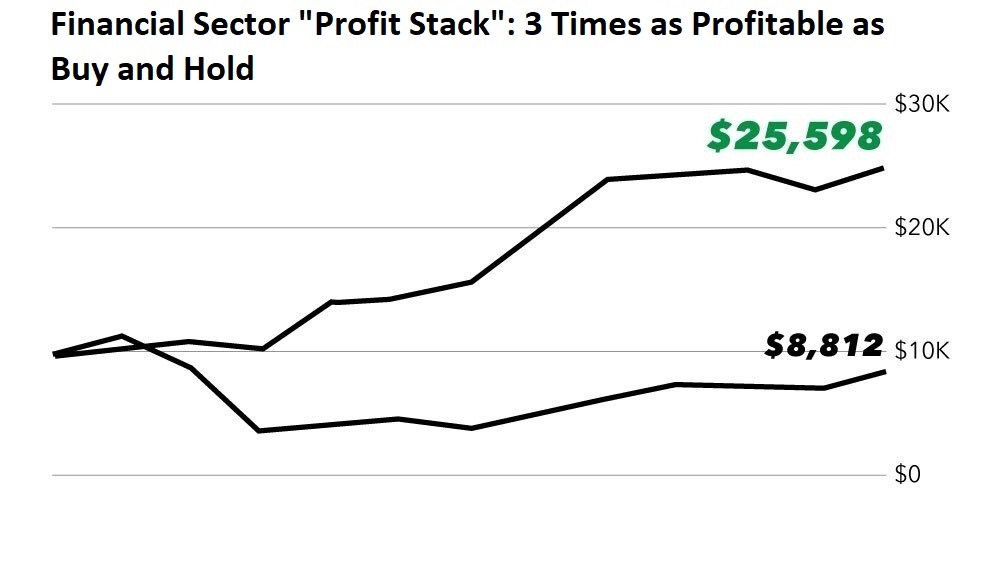

Take a look at how much more you could have made by buying and selling the financial sector during its most profitable months, instead of buying and holding, over the past 10 years.

This is with an initial $10,000 stake:

So, if you bought and held the financial sector for the last decade, you lost money — your $10,000 is worth just $8,812.

But by investing only during the profitable cycle, over and over, you could have turned that small investment into $25,598!

That’s almost triple your money by following the seasonal cycle.

And that’s just the first step to Chad’s “Profit Stacking” strategy: He calls it “stacking potential.”

Next, Reinvest in Another Cycle

The financial “Profit Stack” I discussed above lasts for about six months, from September to March.

And that’s the beauty of Chad’s strategy: You can reinvest your money in another cycle.

Don’t hold a stock for an entire year when it does nothing for six months.

Instead, take your winnings and put them into another reliable cycle!

In addition to stacking potential, you need what Chad refers to as “stacking compatibility.”

That just means finding investments whose seasons line up. That will allow you to roll your capital right into the next reliable cycle.

According to Chad’s “Profit Stacks” Calendar, the financial cycle I described above is part of a stack that includes two other sectors: natural gas and financial inverse.

The profitable season for natural gas is from April to June. So, you’d sell your financial position in March, before the lull begins. Then you’d invest in the natural gas position Chad’s system recommends.

The financial inverse season runs from July to September — so, again, you’d roll that same capital into one position.

Then start over again with the financial stock Chad’s system selects!

That way, you’re fully invested year round and maximizing your profits.

Chad and his team pored over thousands of hours of market data to identify every sector with “stackability.”

So far, they’ve found 15.

And Chad tipped me off to one investment he thinks could be a buy next week.

Here’s what he said:

I’m looking at a position in gold. The prime season for gold doesn’t officially begin until July 20, but with the price per ounce of gold consolidating here, it gives us an opportunity to add a bullish position ahead of a breakout.

My system is telling me we’ll get a buy signal as early as Monday, June 22.

So, for all the details about Chad’s “Profit Stacks” — the same system that Matt T. wrote in and told Chad everyone needs to know about — watch the video below.

Don’t miss the chance to open your first “Profit Stack” with his brand-new gold trade!

Finally, we have more great content to share with you.

Check out Our 3 YouTube Videos!

Chad Shoop’s new Bank It or Tank It video on the tech stock Micron:

Alpha Investor Report Editor Charles Mizrahi’s eight-minute video, “4 Retail Stocks to Buy as Businesses Reopen.”

Apex Profit Alert Editor John Ross’ new 12-minute Reading Tea Leaves video, “Short vs. Long Term: Livent Corp. — Plus, Golden Snails!”

I’ll be back next Saturday to tell you more about how “Profit Stacks” allow you play the historical down months in some sectors — like the financial inverse play I mentioned. Stay tuned!

Good investing,

Senior Managing Editor, Winning Investor Daily