I continue to hear concerns about a bubble in the stock market, but I don’t see the surest sign of a bubble. All I see is a market reaching peak velocity that is set up to deliver additional gains.

This doesn’t mean I’m not concerned about a bubble. I’m always watching for bubbles, but from research I’ve learned that price action alone isn’t enough to define a bubble.

Let’s look at some classic bubbles so we know what we should be watching for…

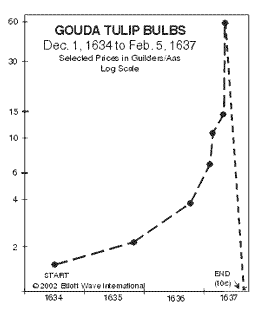

Tulip Mania

In the early 1600s, if CNBC had been covering financial markets, its attention would have been focused on Holland, where the big story was that tulips had gone from a beautiful flower valued by collectors to the most actively traded commodity of its time.

In the early 1600s, if CNBC had been covering financial markets, its attention would have been focused on Holland, where the big story was that tulips had gone from a beautiful flower valued by collectors to the most actively traded commodity of its time.

Because tulips bloom for just a few weeks every year, traders invented tulips futures contracts to buy and sell. The contracts made it possible to trade a bulb without having to dig it up and deliver it to a new owner. As prices rose, the contracts allowed traders to divide ownership interest of a bulb.

You could, for a time, trade a contract for one-tenth of a bulb. Imagine Mad Money host Jim Cramer shouting: “I’d be a buyer of Prinses Irene at this level, but I am out of Gouda tulip bulbs and you should be, too!”

As you may know, tulips are simply beautiful flowers with little economic value. This means tulips traded under the “greater fool” theory, with each buyer needing an even greater fool to enter the market as a buyer to justify the high prices. Not wanting to miss out on the profits available from flipping tulips, individual speculators entered the market. Eventually, the market collapsed because Holland is a relatively small region, and it ran out of fools.

Tulip mania was actually one of the few bubbles in history that impacted society. It involved far more than just a sharp price rise and an equally sharp price drop — it included the creation of new trading products and led to significant changes for the society that created and tolerated the trading.

The Risks in “Risk-Free”

It’s the introduction of new trading products that fuels a bubble and causes damage to a society.

Traders invented tulip futures in the 1600s. More recently, traders invented collateralized debt obligations (CDOs) to slice and dice mortgages. These products served no economic purpose but allowed banks to claim that their mortgages were risk-free. Every CDO they created could earn a AAA rating for safety based on mathematical assumptions, so there was an incentive to create more CDOs.

Because these mortgages carried no risk, underwriting standards were lowered and homes were eventually valued under the “greater fool” theory. Not wanting to miss out on the profits available from flipping homes, individual speculators entered the market. Even though the United States is a large country, the market eventually ran out of fools and housing prices crashed, dragging mortgage derivatives down with them.

The fiction of risk-free mortgages ended in 2007, and the Great Recession that followed changed the world.

Of course, there are other examples throughout history of fools rushing into markets.

Prior to CDOs in 2007, we saw shares of worthless Internet stocks used as a currency for major deals in 1999, and in 1987 portfolio insurance guaranteed large investors that they would never again suffer a major loss. In hindsight, we know these were bad ideas.

Individuals borrowed money in 1929 to put just 10% down on investment trusts because stocks had reached a “permanently high plateau,” according to a leading economist. Again, in hindsight, we know this was a bad idea.

The list of new trading instruments goes on and on, and the theme is clear: New products in the financial markets are the first step in bubbles that end in crashes.

Right now there isn’t anything new, as the Securities and Exchange Commission’s recent decision not to allow a bitcoin exchange-traded fund demonstrates. That means we aren’t in a classic bubble. We also know there is more than $2.6 trillion in money market funds. I expect much of this money to move into stocks on any pullback, and that is bullish.

Major stock market averages are at new highs and continue to move higher. Now is not the time to look for a crash. Now is the time to plan on buying stocks that can participate in the up-moves.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader