Grab your coffee…

While this may not be the best topic to break out at your upcoming family BBQ or church coffee hour, I promise it’s going to give you something to think about — and a possible strategy to add a little juice to your portfolio.

I was attending our quarterly Banyan Hill brainstorming session earlier this month, and a colleague and I started discussing the difference between “positive skew” and “negative skew” strategies.

They each offer very different return profiles that, in simple terms, look like this:

- Negative skew: lots of small winners, a few large losses.

- Positive skew: lots of small losses, a few large winners.

They are mirror images of each other.

One is not objectively “better” than the other. You can put $10,000 into a negative-skew strategy and another $10,000 in a positive-skew strategy and end up with $15,000 from both because the skewness of each strategy doesn’t speak to its return over time.

Instead, skewness speaks to the “path” of those returns, and thus the experience an investor has while investing in a strategy.

Positive- and Negative-Skew Strategies

For instance, a buy-and-hold strategy of the broad stock market (i.e., S&P 500) is a negative-skew strategy.

It fits the “lots of small winners, a few large losses” return profile because most days, weeks, months and years … the stock market edges higher (aka small wins) — but occasionally, stock prices fall sharply lower in a short time, handing investors outsized losses.

Since so many investors are already invested in negative-skew strategies, adding a positive-skew strategy to the mix is a nice complement, since they tend to be lowly or negatively correlated. That dampens overall volatility at the portfolio level without sacrificing returns.

That said, it requires discipline and a cool head to follow many positive-skew strategies. Research from the Nobel prize-winning behavioral psychologist Daniel Kahneman suggests this is the case because we humans downplay “large, impactful” events in our minds (whether negative or positive) when recounting history.

Negative-skew strategies, like buy and hold, lead investors to minimize or downplay the large and impactful, but short-lived, losing periods they’ve suffered in the past.

They see the continual drip of “small winners” at face value, and well worth the occasional agony of bear markets and crashes, which are eventually given diminished importance.

We see that playing out now as almost two-thirds of U.S. adults age 65 and older continue to hold equity in stocks, despite the brutal bear market we just went through. That’s up from around half before the 2008 financial crisis, according to The Wall Street Journal.

On the other hand, the large winners of positive-skew strategies come along only occasionally. And according to Kahneman, we also eventually downplay the importance of those large winners in our minds, and instead disproportionately remember and feel the pain of the long-lasting periods of losses that a positive-skew strategy tends to endure.

All told, most mortals have a tougher time sticking to a positive-skew strategy, such as diversified trend-following commodity trading advisors, than they do sticking to a negative-skew strategy, like buy and hold the stock market.

Everyone is different, but for me, it just takes an understanding of the strategy I’m trading to stick with it … and prudent position-sizing, too, of course.

And that’s where I come in with the newest feature of my premium service Max Profit Alert — the live trade room.

Rinse and Repeat

If you’ve been reading The Banyan Edge, or following my work at my Money & Markets home base, you’ve likely heard of my Wednesday Windfalls strategy.

This positive-skew strategy is based on calendar patterns. These are regular, exploitable patterns that tend to repeat themselves each week. Here’s a quick breakdown:

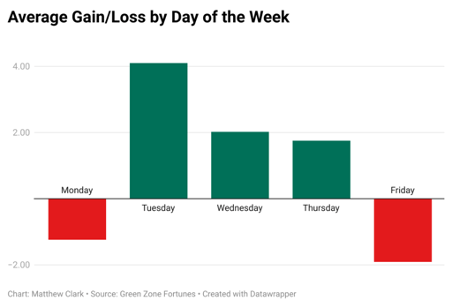

- Mondays and Fridays tend to be weaker and historically show losses on average.

- Tuesdays, Wednesday and Thursdays are positive on average.

- The greatest returns happen on Tuesdays.

Why is this the case? We can only hypothesize.

Perhaps traders take profits on Fridays to avoid having exposure over the weekend. Maybe, fresh off the weekend, investors make portfolio changes on Mondays and then reallocate on Tuesdays.

There isn’t a definitive answer. But the pattern is very real, and this pattern is at the core of my Wednesday Windfalls trading strategy.

It’s a simple, two-day approach to trading. You’re in on Monday afternoon at 2 p.m. Eastern time … and out again 48 hours later on Wednesday. And we follow this same pattern each and every week.

If you’re looking for a way to complement your typical negative-skew buy-and-hold way of stock investing, my Wednesday Windfalls strategy is a perfect fit.

And that’s where my brand-new Trade Room comes in.

Every Monday that markets are open, from 10:30 a.m. to 11:30 a.m. Eastern time, my chief research analyst, Matt Clark, and I join hundreds of investors like you to have an open discussion about Wednesday Windfalls trades.

We walk through potential signals for that week, review past trades, give insights into the broader strategy and answer any questions our incredible subscribers have.

Think of it as an opportunity to learn more about trading, and a preview of the week’s action before I send my Wednesday Windfalls recommendations later on Monday at 2 p.m. Eastern time.

We’re still in the early stages, but I’ve been truly impressed by the knowledge everyone is bringing to the table. It’s a community that offers plentiful opportunities to learn and develop your investing toolkit.

If that sounds like something you want to partake in, I encourage you to click here for more information. The trade room is just one aspect of my Max Profit Alert premium service, but it may be the most important hour of my week.

See you tomorrow morning!

To good profits,

Adam O’Dell

Adam O’Dell

Chief Investment Strategist, Money & Markets