Earlier this year, I introduced you to my weekly options trading strategy, Wednesday Windfalls, in a way you probably never expected from a financial newsletter writer…

I compared it first to a supercharged muscle car, capable of neck-snapping power but also nerve-wracking handling. It was inspired by an ad I saw for a ‘92 Chevy Monte Carlo … shortly after my wife and I moved to a small prefab home on just eight inches of elevation and 30 feet from the coastline in the Florida Keys.

That setting was, to us, equal parts extremely rewarding and occasionally terrifying … which I later saw as another analogy to my high-stakes Wednesday Windfalls strategy.

The rush of the rewards this strategy brings is palpable, with some weeks giving you the potential to multiply your money several times over in a mere 48 hours.

The nerve-wrecking part, too, is ever present — since we’re buying short-dated options on a two-day hold period, all it takes is one bad day to knock us off course.

Though overall, our research on the strategy — back tests from 2003 onward and real-world trading — prove this high-stakes strategy has a positive expected edge over the long-run, and thus anyone who shows up every Monday can expect great things over time.

And recently, we’ve been on a real hot streak — returning 19%, 103%, 9%, 23% and 136% through five consecutive trading weeks in June and July.

But I’m not here to give you the same old pitch for Wednesday Windfalls. If you know what it is, you know well enough by now if it’s right for you.

Instead, I want to tell you about a recent change we made to Wednesday Windfalls that takes it to a level I’m immensely proud of … and cannot wait to continue iterating on.

This change turns Wednesday Windfalls into something I’m confident we all inherently crave: a community.

And I’d like to invite you to that community today.

Taking Wednesday Windfalls Live

Over the last week, my team and I made two major, positive changes to Wednesday Windfalls.

For one, anyone that was subscribed to Wednesday Windfalls was given access to my longer-term options trading strategy, Max Profit Alert. The latter essentially took on Wednesday Windfalls as an additional strategy.

We found that the strategies complemented each other well, as a constant stream of short-term Wednesday Windfall trades could supplement the big-picture Max Profit Alert trades we hold for 2-3 months.

Safe to say, if you’re someone who likes to trade options, you’re right at home in the new-and-improved Max Profit Alert.

To be clear, that change extends to any newcomers, too. If you’re joining one membership, you’re now joining them both. (My latest research presentation shows you how to access both research services — details here.)

This decision fed directly into the next big change: We took Wednesday Windfalls live.

Every Monday morning, from 10:30 to 11:30 a.m. ET, I join my chief analyst Matt Clark along with hundreds of subscribers in an exclusive trade room environment. There we discuss our strategies and open positions in Max Profit Alert, explore candidates for the week’s Wednesday Windfalls trades, and most importantly, stoke conversation in our community.

My hope was that this effort would not just “give a man a fish,” but “teach a man to fish” as we shared details about our trading systems that have never been put out to the public before.

And it delivers: Our system is rich with information to help a discerning trader make their own way, while also sharing their ideas with others in the community.

I also hoped it would show each member of our community just how big we are… How we’re all striving toward the same goal of beating the market and having fun doing it.

About 200 people turned out to the first stream. The messages I saw were incredible. And I mean all of them — the countless notes of thanks, the intelligent questions about what we do and why, and the feedback on things we can improve.

But this is just the beginning…

Under One Roof

Look, I’m not here to shove triple-digit numbers in your face, or extoll the endless virtues of a single method of investing. That’s just not my style and never really has been.

My mantra has always been to simply provide the best research possible, using methods I fully believe in, and trust that my work will fall into the right hands. Hearing from my subscribers in this past Monday’s first live Wednesday Windfalls session made it clear I’m on the right track.

As I said, the core of Wednesday Windfalls is everything it always has been. I recommend three uncorrelated call options trades, which seek to benefit from what has historically been the best 48-hour period of the week for stocks: Monday afternoon to Wednesday afternoon.

Likewise, Max Profit Alert is still a data-driven system that targets stocks set to lead their sectors higher (for bullish trades) … or drag them lower (for bearish trades) … with the perfect options trade to pull 100% profits or bigger in any situation.

But now, these two incredible options strategies are together “under one roof,” so to speak.

And also under that roof are hundreds of like-minded traders coming together to learn and share their ideas and experiences.

That should sound appealing to anyone looking to make the most of this market, no matter what it does next.

If it does to you, check out this recent research presentation I put together which details the Max Profit Alert strategy.

And if you decide to join, me and the rest of our community will see you in the trade room Monday morning.

To good profits,

Adam O’Dell

Adam O’Dell

Chief Investment Strategist, Money & Markets

Fed Funds Rate Now at a 22-Year High

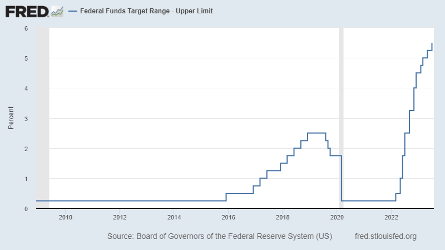

Was it the pause that refreshes? That might be debatable. But after taking a month off, the Federal Reserve did indeed resume raising short-term interest rates.

As of yesterday, the targeted Fed Funds rate is now 5.5%, its highest level in 22 years.

As for what comes next, Chairman Powell wouldn’t definitively commit one way or the other. But he left the door open to additional rate hikes.

In his own words:

“I would say it’s certainly possible that we will raise funds again at the September meeting if the data warranted. And I would also say it’s possible that we would choose to hold steady and we’re going to be making careful assessments, as I said, meeting by meeting.”

“Meeting by meeting,” he says.

I’d love to think that the most powerful people in the world of finance have more of a gameplan that simply winging it, and seeing how they feel at the next meeting.

But at the same time, I get it. The results from monetary policy come on a lag. The Fed won’t know for sure whether they’ve pushed us into recession until potentially months after the fact.

But for the moment, it seems that the economy is humming along just fine. Estimates for second quarter GDP growth came in higher than expected, and the economy grew at a 2.4% clip, adjusted for inflation.

A couple points really jumped off the page. To start, despite all anecdotal evidence suggesting consumers are pulling back, consumer spending actually grew 1.6% last quarter.

Both imports and exports were also down. This is a little worrisome, as this is often a significant sign of economic weakness. But, as we’ve been reporting for the better part of a year now, we’re in an era of deglobalization. So we shouldn’t expect a lot of robust growth in imports and exports.

Perhaps the most interesting point in the GDP release was the impact of fixed investment. Non-residential investment grew by a whopping 7.7%. And digging deeper, investment in equipment was up 10.8%.

It’s always a mistake to read too deeply into a single news release, as the data can be messy. But don’t be surprised to see equipment investment playing an outsized role in GDP growth in the years ahead.

As we’ve been writing for months, the only real solution to the labor shortage and the resulting inflation is massive investment in AI and other automation technology.

We’re already seeing it. This is the present, not the distant future we’re talking about … and we’re just getting started.

You can actually leverage AI in your own investing strategy. Our friends at TradeSmith have developed a new AI software called “An-E.” It can actually predict the next 30 days of market moves — and the most likely outcome of a stock’s momentum.

An-E can even choose your next winning stock investment.

Want to learn more about An-E, or find out how you can try it out for yourself? Go here for all the details.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge