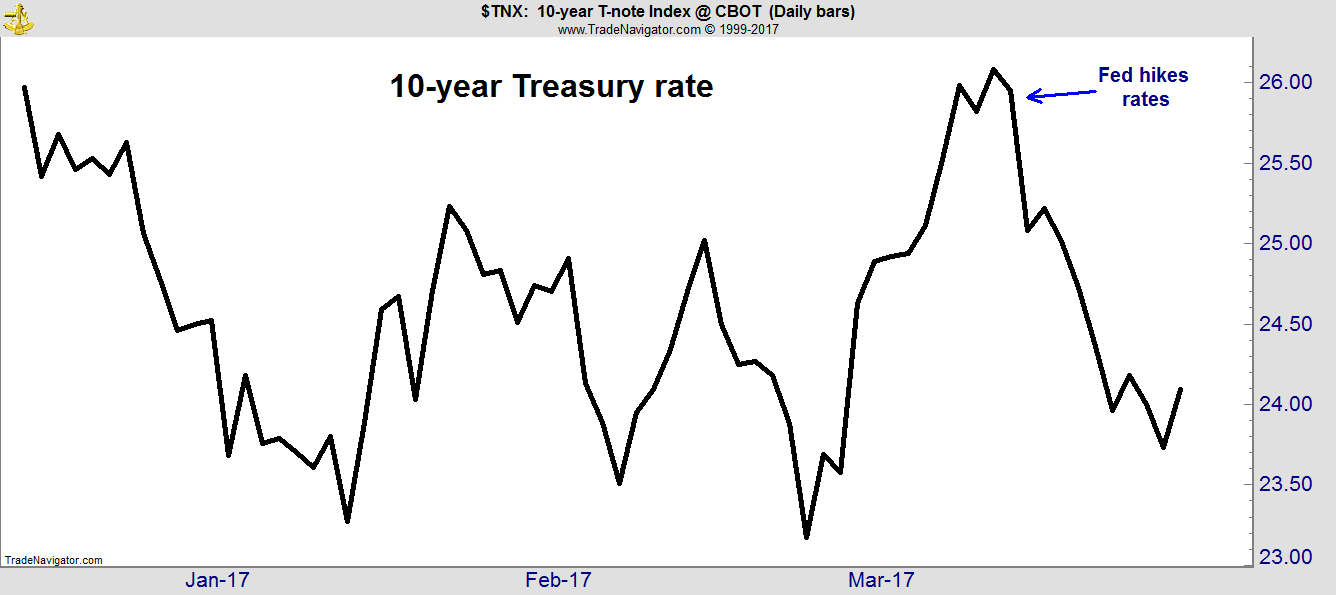

It was just two weeks ago that the Federal Reserve raised interest rates for the second time in three months. After the hike, Fed Vice Chairman Stanley Fischer said the official forecast for two more rate hikes this year “seems about right.”

“That’s my forecast as well,” Fischer said in an interview with CNBC earlier this week. Two hikes

would leave short-term rates at about 1.5%, less than 1% below the current rate on the 10-year Treasury note. This yield has fallen from 2.6% before the Fed’s action down to 2.4% this week.

Traders seem to disagree with the Fed about the need for higher interest rates and are pushing Treasury rates down as they try to ensure the return of their capital instead of seeking a return on their capital. This flight-to-safety trade has been a theme around the world, with the yield on the German 10-year bund falling below 0.4% this week.

While the Fed is using interest rates as a policy tool and raising rates in response to improved economic news, traders seem to be worried about the political situation around the world. Their concerns are well-founded.

In the U.S., traders watched an attempt to repeal and replace Obamacare collapse last week. In Europe, the United Kingdom officially kicked off negotiations to begin the two-year-long Brexit process. Within two years, the process for leaving the European Union will be worked out, and there are questions about how many countries will follow Great Britain.

An election in France this spring could push France to the negotiating table. The Netherlands is also a live possibility despite the headlines in the U.S. media telling us that voters rejected the idea. The reality in the Netherlands is that the nationalist faction gained seats in the Parliament even though they fell short of the prime ministry … for now.

A banking crisis in Italy appears imminent, and the crisis in Greece is never-ending.

In Asia, North Korea continues testing the components of an intercontinental ballistic missile. China is expanding its military operations in the region, and Japan is debating expanding its defensive military capabilities to include a pre-emptive attack.

With uncertainty growing in the world, traders are ignoring the risk of no returns. As long as interest rates remain low, stocks should continue to benefit from the “TINA” market. As any institutional investment manager knows, There Is No Alternative to the stock market.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader