I have talked about my new service, Earnings Drift Alert, a few times recently, and that’s because I’m excited to finally share it with you.

I want you to understand the strategy so that you can see the potential it has if you utilize it in your portfolio.

So today, I want to walk you through an actual trade from May so that you can see step-by-step what goes into an Earnings Drift trade alert.

Before I walk you through it, let me clear up a few things about an earnings drift.

Learning to Drift

For starters, it is just that — a drift.

It occurs after earnings are announced, not before. We are not gambling our wealth on an earnings announcement, which can be manipulated to the extremes by corporations.

Instead, we are placing our money on proven drift patterns that have occurred for a certain stock.

That is point No. 2 — this is specific to certain stocks. There is no one-size-fits-all strategy. And I’m not just saying that to say it. I have done the research.

I have reviewed every earnings instance for S&P 500 and Nasdaq 100 stocks since 2006. And I can say without a doubt that it’s not a one-size-fits-all approach that you can take — it’s company specific.

Third, we are exiting prior to the next earnings announcement. That’s because earnings announcements are the company’s opportunity to set the record straight, good or bad, about how its operations are doing. And this occurs four times a year, every quarter.

We want to be out of a position ahead of that next announcement, and price movement is largely tied to investors’ reactions to a company’s previous earnings report.

Now that I’ve got that out of the way, let’s look at a recent trade.

Accelerated Profits

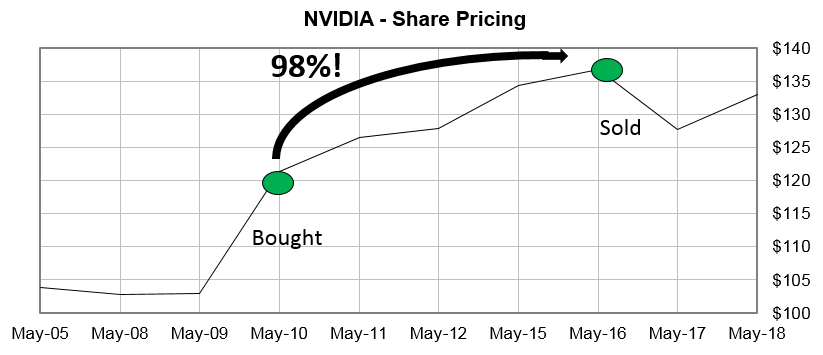

This was on May 10 of this year. Nvidia Corp. (Nasdaq: NVDA) reported earnings that easily topped analysts’ expectations, and investors liked what they saw. We know they liked it because the stock jumped over 10% on the news.

This triggered a new trade for us.

That’s because Nvidia had a similar occurrence around an earnings announcement 10 times during the 10 years of research. And in each of those 10 times, the stock was in positive territory and had been up as much as 30% over the duration of its drift.

So I knew this was an extremely consistent drift with promising returns, and I recommended the trade.

We use what I refer to as a “profit accelerator” that allows us to risk less while profiting more — a win-win for us as investors. The profit accelerator is stock options, and don’t worry — I give you all the details on how to use them and what to expect.

I walked readers through exactly how to place the trade — giving them the specific option that would hand them the best returns for the risk — how long we planned to hold the position, what price to pay for the option and even how we planned on exiting the position — all that was right there in a brief alert.

In this trade, I was able to let them know the very next day that we locked in a 50% gain already — a remarkable return for any trading strategy.

Less than a week later, we were handed a 147% gain on the second half of the trade. Overall, it handed us a quick 98% gain.

Here’s how that money-making trade looks on a chart:

To be fair, not all drifts look the same. As I mentioned, these drifts are specific to a company, and each time can look different. For example, on Friday I explained a unique drift, one that didn’t begin immediately, but from the research I conducted, I knew it had a two-week delay — and it paid off big time.

To be fair, not all drifts look the same. As I mentioned, these drifts are specific to a company, and each time can look different. For example, on Friday I explained a unique drift, one that didn’t begin immediately, but from the research I conducted, I knew it had a two-week delay — and it paid off big time.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert