Tesla Vs. GM: It’s Not What You Think

How much wood would Cathie Wood chuck if Cathie Wood could chuck wood?

Personally, I’d much prefer Wood chucking wood rather than the shade she tried to throw at General Motors (NYSE: GM) on Friday.

Last week, a slew of automakers reported their quarterly deliveries. All the big names were there, including Tesla (Nasdaq: TSLA) and General Motors … the two players in today’s tale of troubling talking head economics.

First up, General Motors said it delivered 446,997 vehicles in the U.S. in the third quarter, down 32% from the same quarter last year.

GM blamed semiconductor supply chain constraints for the decline … a move we all expected.

Meanwhile, Tesla said it delivered 241,300 electric vehicles (EVs) during the third quarter, up about 73% year over year.

The company only mentioned semiconductor supply chain issues in passing, noting that it had to close some operations at its Shanghai assembly plant during the quarter due to the chip shortage.

Clearly, a 73% increase in deliveries looks better than a 32% decline, and investors reacted accordingly … even though General Motors delivered 46% more vehicles than Tesla during the quarter. Analysts came out in defense of Tesla, even though it didn’t really need defending.

Piper Sandler Senior Research Analyst Alexander Potter said:

Auto Forecast Solutions Vice President Sam Fiorani also piled on the bullish accolades, noting:

But the best “hot take” on the comparison came from Cathie Wood, founder, CEO and CIO of ARK Invest:

It feels like it’s time for another Econ 101 lesson for Cathie here. GM sold 46% more vehicles than Tesla last quarter. Fewer semiconductors per vehicle or not, that’s a fact.

If GM only had to produce 241,300 vehicles to see a 73% increase in deliveries, there would have been no mention of semiconductor shortages from the company.

It’s a simple matter of scale, Cathie. Someday, Tesla might actually deliver as many vehicles in a quarter as GM … but to get there, Tesla needs a much more robust supply chain than it already has. It needs a GM-sized supply chain.

So, what’s the investing takeaway?

Tesla can beat forecasts and grow deliveries 73% year over year because it’s still a relatively small company in the automaker market.

And for those of you yelling: “Tesla isn’t small! Its market cap is blah blah blah…” I’d like to remind you that GM’s decline in production was almost as big as Tesla’s production.

In other words, GM’s drop was basically Tesla’s entire quarterly production. Chew on that for a bit…

Big companies grow slower than small companies. It’s basic Econ 101. However, when big companies like GM finally put all their weight behind a business plan, they have so many more resources to bring to bear. If it’s serious, GM will one day overtake Tesla in EV sales — it’s just a no-brainer.

But that doesn’t mean GM’s stock price will grow by the same leaps and bounds. It’s a steady grower, not a shower like Tesla. Both stocks will make you money in the long run, but Tesla might just grow a bit more simply because it has room to grow … while GM will basically be replacing existing combustion-engine customers.

And that, Cathie Wood, is the real takeaway from last week’s vehicle delivery numbers.

Sigh… Tesla this, Tesla that. I wish there was more happening in the EV market than just “Everybody vs. Tesla.” What else ya got, Great Stuff?

There’s no getting around Tesla, but get this:

A former Tesla employee released a brand-new innovation promising to make every EV out there instantly obsolete. Some call this man “Employee No. 7.” Even the “Godfather of the EV Revolution.”

He created the first working Tesla battery. Now he’s about to change everything again.

Click here for the full story.

The Good: Merck Goes Berserk

Move over vaccine makers, there’s a new sheriff in town. On Friday, pharmaceutical giant Merck (NYSE: MRK) and its partner Ridgeback Biotherapeutics announced that their experimental COVID-19 pill could lessen the severity of people’s symptoms who’ve contracted the coronavirus.

The oral drug, called molnupiravir, cut the number of hospitalizations and deaths by 50% in the most high-risk COVID-19 patients so long as it was taken within five days of symptom onset.

Merck now plans to seek emergency-use authorization for molnupiravir and could get the pill approved as early as year’s end. If the FDA bites, molnupiravir will be the first easy-to-use, at-home treatment for COVID-19.

Not only is this a huge win in our fight against the virus … but molnupiravir could appeal to people who’ve avoided vaccination because of the perceived risks associated with all these COVID shots. Those who don’t want the ol’ stick in the arm might be more inclined to take a prescription pill, which should cut down on overall infection rates.

Investors immediately pounced on the good news and pushed Merck shares higher in premarket trading. Meanwhile, both Pfizer and Moderna shares plummeted on what Jeffries analyst Michael Yee calls a “perceived headwind”:

Basically, molnupiravir’s approval could pose a risk to vaccine stocks if everyone jumps on the prescription pill bandwagon. MRNA and PFE investors beware.

What do you think, Great Ones? Are you livin’ on reds, vitamin C and molnupiravir? Or are you still avoiding Big Pharma altogether? Let us know at GreatStuffToday@BanyanHill.com.

Editor’s Note: The Biggest Tech Trend Of 2022 That Nobody’s Talking About

Right now, hardly anyone knows about this trend. But in just a few short years, “Digitarium” will become as common as the internet…

While most Main Street Americans have no idea how big this tech will be, 916 of the Fortune 1000 companies are going “all-in.” Click here to learn why.

The Bad: Whistling “Fix Me”

By now y’all are probably familiar with The Wall Street Journal’s “The Facebook Files,” which exposed thousands of leaked Facebook (Nasdaq: FB) documents detailing the platform’s nefarious business practices and its blatant disregard for users’ wellbeing.

If you haven’t kept up on the latest scandal, you can read more about it right here. Seriously, it’s worth checking out.

Over the weekend, Facebook’s nameless and faceless whistleblower finally came forward. Frances Haugen, a former product manager on Facebook’s civic misinformation team, revealed herself as the source behind the leaked documents in Sunday night’s “60 Minutes” episode.

According to Haugen, she became “increasingly alarmed by the choices the company makes prioritizing [its] own profits over public safety,” including the use of Facebook’s own algorithm to promote misinformation:

Here we get to the crux of Facebook’s problem: The social media mammoth is in it for the money — not your personal security when using its platforms. Same as it ever was.

So, what comes next?

For starters, FB investors should brace themselves for upcoming hearings on the eight accusations that Haugen has hurled against Facebook (Instagram’s negative impact on teenage girls being one of them).

I personally don’t see this amounting to much, if any, impact on Facebook stock. In fact, while FB fell more than 5% today, it’s much more likely that the global outage of Facebook properties — Facebook, Instagram, WhatsApp and Oculus VR — is responsible for the drop than any whistleblower action.

Honestly, I wish that weren’t so. But nothing happened after Cambridge Analytica. Nothing happened after two U.S. elections. Nothing will likely happen now. That said, I’m still not investing in Facebook. It makes me feel dirty for some reason.

The Ugly: Oil Be Seeing You

It’s a bad day for Texas-based oil producer Amplify Energy (NYSE: AMPY) … like, really bad. The company lost almost half its stock market value this morning following a major oil spill off the coast of California.

An estimated 126,000 gallons of thick Texas Tea made its way into the Pacific Ocean before Amplify was able to shut down its production and pipeline operations.

As you can imagine, an oil spill of this magnitude is sure to be devastating to local wildlife … as well as to consumers who rely on Amplify’s pipeline to put gas in their cars, heat their homes and so on.

I hate to say “I told you so” to all the oil enthusiasts out there … but this is just one of the many reasons I support alternative energy solutions over their “cruder” counterparts. I mean, when was the last time a faulty wind turbine caused this kind of mass environmental damage? Hmm?

As for Amplify investors, this is just the latest disaster in a long line of problems that have come to plague the company, including its recent brush with bankruptcy. But the pain is far from over for AMPY stock. In response to the spill, Roth Capital has already suspended its price target on the oil operator:

Ouch. That’s sure to leave a smudgy oil stain on investors’ portfolios.

Great Ones, guess what’s back? Back again?

Oh, I know this one! Earnings season’s back … tell a friend?

Not quite yet, sorry. Much like CCR, earnings season is always comin’ up around the bend, but you have a few more weeks to wait before the real meat of the market pitter patter resumes. And by that time, everyone will be preoccupied with a different kind of monster … the McRib.

Some of you love ‘em, some of you hate that you love them, and some of you just plain hate McRibs, which are coming back to McDonald’s come November. I don’t have a paltry pork patty in this fight … but what if the McRib’s fabled return could bear meaning for your portfolio?

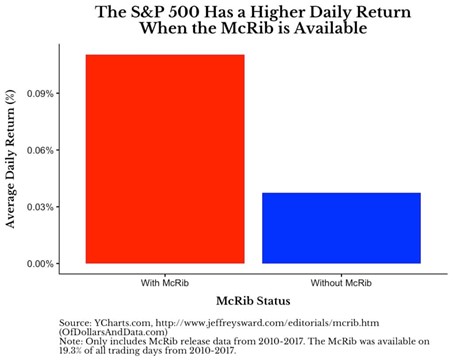

Nick Maggiulli, COO for Ritholz Wealth Management, investigated “The McRib Effect” on his blog Of Dollars And Data.

The effect is not so much a trading indicator so much as a funky correlation, kinda like the lower abdominal pain that correlates to any of my previous McRib forays. (Sorry, McRib lovers, it’s just … I like ribs. Not that abomination on a biscuit.)

While Maggiulli’s exact figures are slightly outdated, his findings and the McRib’s prospective return make for an appetizing McChart of the Week:

There you have it: The S&P 500 returns 0.07% higher on days when the McRib is available, annualizing out to about 19% each year. Check out the math right here. So, what do you do with this newfound knowledge?

Well, frankly … nothing. Maybe go get a McRib once they’re out, if you’re so inclined?

If you’re going to make investing decisions based on the limited availability of a McDonald’s exclusive, go for it. But be prepared for the consequences, even if the consequences are “no consequences.” Otherwise … you could slip deeper down the rib-bit hole.

My semi-cynical opinion (for some time now) has been that McDonald’s pulls out the McRib card whenever things get a bit too apocalyptic in the social zeitgeist.

I mean, for some, the McRib makes for a nice barbecue-y balm on a Monday’s bad news. Massive oil spills on the California coast? Sounds like a McRib fix. Did you just find out Facebook was a toxic hive of scum and villainy? You’re a bit late there … but you look like you need a McRib.

If you want to believe the McRib is a social pacifier for the Maccas-munching masses … I won’t stop you.

The point of the McRib Effect is to separate the correlation and causation behind market data using a funny food-based example.

It’s to show that causation is extremely dang difficult to pin down — especially in a financial market with millions of individual factors, dynamics and potential causes behind everything.

And when we try to explain a stock movement or even a broader sell-off on one particular lone-acting factor … it’s often like concluding markets rise because of the McRib.

So, really … what do we do now? Is everything meaningless and unpredictable in this entropy-filled existence?

No, you’re fine, stop it. Just don’t get caught up in placing causation with 100% determination. It’s the stock market … ‘tis a complicated (but silly) place, after all.

What we’ll do now is call it a day. Make more predictions and drop some hot takes later. Maybe buy some stocks tomorrow. Depends what color socks I pull out of the dryer in the morning…

Oh … and write to us in the inbox. Share with us what you think about the McRib. Also, feel free to sound off on why it’s a pale imitation of any real rib sandwich … or share your affinity for fast food. We like hearing from both sides of the barbecue aisle.

GreatStuffToday@BanyanHill.com. Write to us sometime! In the meantime, here’s where else you can find us:

- Get Stuff: Subscribe to Great Stuff right here!

- Our Socials: Facebook, Twitter and Instagram.

- Where We Live: GreatStuffToday.com.

- Our Inbox: GreatStuffToday@BanyanHill.com.

Until next time, stay Great!

Joseph Hargett

Editor, Great Stuff