Amazon.com Inc. (Nasdaq: AMZN) is an essential part of my life.

There’s an average of 1.3 Amazon Prime boxes a day at my doorstep.

My wife and I watch old movies on Prime streaming video.

And Alexa is always there to queue up the perfect Disney song to calm a frustrated toddler.

I remember using Amazon for the first time in 2002. This was a few years after it started selling items other than books.

I needed a bag of tennis balls for my loyal mutt. They arrived at my apartment in just a few days, saving me a trip to the nearest sporting goods store.

I thought Amazon was really on to something back then.

But when I looked at the company, it wasn’t making any money. Nor was it even expected to make any money for a few years.

It was shortly after the dot-com bubble had burst. The stock had dropped 90% from its high.

The bottom wasn’t easy to spot. The price would double or triple in a few months’ time, only to fall 50% in the next pullback.

So, I thought I would have a better chance to buy it sometime in the future when it was less volatile.

Boy, was I wrong. Amazon has increased 600-fold from its post-dot-com lows.

But I learned an invaluable lesson from this.

And there’s one specific sector I’m following that reminds me of Amazon back then.

The Hype Cycle

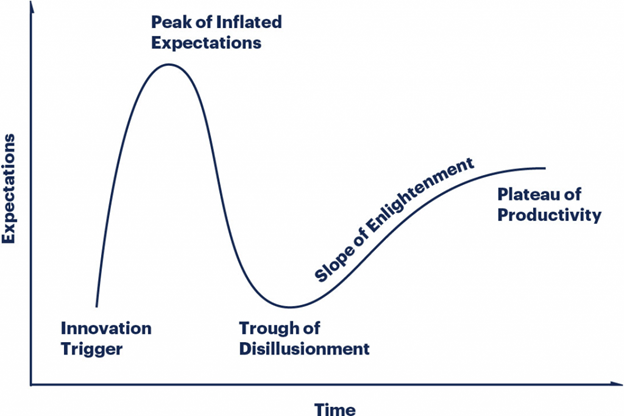

Every new technology follows the same “hype cycle.”

When a new innovation arrives, investors hype it up to inflated heights.

We saw this with dot-com in 2000, bitcoin in 2017 and electric vehicle stocks in 2021.

But then expectations sour, and the hype pendulum swings downward. Investors become disillusioned with this new technology.

At some point, investors start to realize that the technology isn’t going away.

Adoption rates start to increase, slowly at first.

It soon becomes an indispensable part of our daily lives.

Where the Biggest Gains Can Be Found

When I look around the market for investments, I’m always searching for the one that holds immense promise, but investors have cooled on its prospects.

That’s where the biggest gains can be found.

Right now, decentralized finance (DeFi) is in the trough of disillusionment.

This is the peer-to-peer financial services infrastructure that’s being built on top of crypto networks.

Last year, DeFi expectations were overly inflated. You couldn’t hear enough about how DeFi was about to replace the entire $100 trillion financial system.

The value of crypto in the DeFi space grew 100X, from under $1 billion to over $100 billion.

The prices of DeFi tokens that allowed for trading, lending and other financial activities surged.

It even graced the cover of Fortune in an issue titled “Crypto vs. Wall Street.”

Investors have since become disillusioned with DeFi’s future.

They’re concerned about the legacy banks forcing heavy-handed regulation from Congress and the SEC.

They’re fearful about a spate of recent hacks, which amounted to $1.3 billion lost in 2021.

They’re worried that DeFi will never go mainstream, reserved only for the techno literate among us.

Amazon faced similar concerns 20 years ago.

Investors worried about credit card theft, lost packages and a company that was far from making any money.

In hindsight, that was the time to buy.

Invest in the Amazons of the DeFi Space

If you look at DeFi, you can see what I call the “Next Gen Effect” at work.

What this means is that 2.0 is always bigger and better than 1.0.

We’ve had our current banking system for thousands of years. That’s 1.0.

And DeFi is 2.0. As a transformational technology, it holds the key to a better, more efficient way of doing business.

It will disrupt the $100 trillion financial system, similarly to how Amazon impacted the brick-and-mortar retailers.

DeFi is the 2.0 version of banking: It’s an innovative technology that holds the key to a better, more efficient way of doing business.

Crypto protocols like Aave, Uniswap and Balancer remove multiple middlemen out of financial transactions and allow for instant settlement.

Banking as we know it is about to change. And there’s one crypto in particular that’s set to disrupt the game in a major way.

Click here for all the details.

DeFi will be a vital part of our lives. And I’m confident that we won’t have to wait 20 years to get there.

Regards,

Editor, Strategic Fortunes

Morning Movers

From open till noon Eastern time.

Sunlight Financial Holdings Inc. (NYSE: SUNL) operates a platform used to provide secured and unsecured loans for homeowners to purchase and install residential solar energy systems, and other home improvements. The stock is up 26% after the company announced a $50 million share buyback program.

Yellow Corp. (Nasdaq: YELL) provides various trucking and logistics services in North America. The stock jumped 22% this morning on the news that several company insiders including the CEO, CFO and COO are buying up more shares of the company.

Eve Holding Inc. (NYSE: EVEX) designs and produces electric vertical take-off and landing (eVTOL) vehicles for urban air mobility solutions. The stock is up 20%, continuing a pattern of volatile trading since it went public via a SPAC deal last week.

Vuzix Corp. (Nasdaq: VUZI) designs and sells augmented reality (AR) wearable display and computing devices. The stock rose 19% with investors expecting good news after the company scheduled a conference call for tomorrow to announce a “new major corporate development.”

Forge Global Holdings Inc. (NYSE: FRGE) enables private company shareholders to trade private company shares with accredited investors. The stock is up 19% on a rebound after it slumped Monday when it refused to reaffirm its 2022 outlook given recent uncertain market conditions.

Stronghold Digital Mining Inc. (Nasdaq: SDIG) is a crypto asset mining company that focuses on mining Bitcoin. It is up 18% after it reported first-quarter results showing a surge in crypto mining revenue.

Janus International Group Inc. (NYSE: JBI) manufacturers and provides turn-key self-storage, commercial and industrial building solutions, and smart locks and automation tools. The stock climbed 18% after the company beat estimates for the first quarter and raised its outlook for 2022.

Q2 Holdings Inc. (NYSE: QTWO) provides cloud-based digital banking solutions to regional and community financial institutions. The stock is up 18% on reports that the company is fielding takeover interest from several unnamed private equity buyers.

Microvast Holdings Inc. (Nasdaq: MVST) designs, develops and manufactures battery systems for electric vehicles and energy storage systems. The stock rose 17% after the company exceeded its forecasts for the first quarter and set itself up for strong revenue growth for the rest of the year.

Paramount Global (Nasdaq: PARA), the global media and entertainment company, is up 14% today. The move came after Warren Buffett’s Berkshire Hathaway revealed that it purchased about 68.9 million shares of the company in the first quarter.