Latest Insights on ETSY

Robinhoodwinked!

Robinhoodwinked! August 31, 2021 Great Stuff

Robinhood’s August Burns Red And I think the brokerage’s merry men would rather wake up when September ends… Robinhood (Nasdaq: ) has had an insane, narrative-driven month: Fresh off its IPO, Robinhood saw the Cathie-Wood-driven “meme stock rally that’s not a meme stock rally.” But that ARK-fueled summer had come and passed, and Robinhood knows […] Crypto Curmudgeons, Affirm Confirms & Support in Short Supply

Crypto Curmudgeons, Affirm Confirms & Support in Short Supply August 30, 2021 Great Stuff

Old Man Yells At New Market Come gather ‘round people wherever you roam, and admit that the waters around you have grown… The times they are a-changin’, Great Ones. And like Dylan sang: You better start swimmin’, or you’ll sink like a stone. OK, I actually have a point that ties all this nonsense into […] Lordstown Motors: Epic Comeback Or Falling To Pieces?

Lordstown Motors: Epic Comeback Or Falling To Pieces? August 28, 2021 Great Stuff

What’s The Deal With Lordstown Motors? Question for you Great Ones: Can changing a company’s CEO really change a company’s stars? Can one man make things epic? (OK, that was two questions.) Electric vehicle (EV) maker Lordstown Motors (Nasdaq: ) and its investors certainly hope so. And if Daniel A. Ninivaggi’s history is anything to […] The SEC Won’t Let Me Be, Shopify Stupefies & Intel’s Government Pension

The SEC Won’t Let Me Be, Shopify Stupefies & Intel’s Government Pension August 24, 2021 Great Stuff

What A Tangled Web We Weave… Great Ones, today we’re talking about billionaire investor Mark Cuban and his spat with the SEC. But first … did y’all see the new Spider-Man: No Way Home teaser trailer? Spoiler alert! I’ve watched this trailer way too many times, which directly shows (or hints at) the following appearances: […] Analysts Agape, Space Bezos, Cemented Deals & RIDE Like The Wind

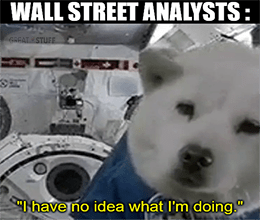

Analysts Agape, Space Bezos, Cemented Deals & RIDE Like The Wind June 7, 2021 Great Stuff

Wall Street Analysts: ¯\_(ツ)_/¯ Great Ones, if you’ve kept up to date with your Great Stuff, you know that I’ve taken quite a few digs at the analyst community this earnings season. In fact, I’m pretty sure you can read any Great Stuff article from the past two weeks and find something like: “C’mon, analysts. […]