It feels like I’ve cooked dinner 395 times this month.

That’s a line from a “quarantine diary” entry. And it highlights the do-it-yourself movement from a nationwide lockdown.

Well, it isn’t just dinner that’s become do-it-yourself again.

That’s going to hit a lot of industries. But one in particular is the café experience that Starbucks Corp. (Nasdaq: SBUX) championed.

Trapped in their homes, fewer people are driving out to get their daily cup of Starbucks.

The stock took a hit when the market collapsed last month.

And the hits will keep on coming for Starbucks.

Here’s why I see a chance to grab up to triple-digit gains trading options around this stock by June.

Shares Set to Fall 20%

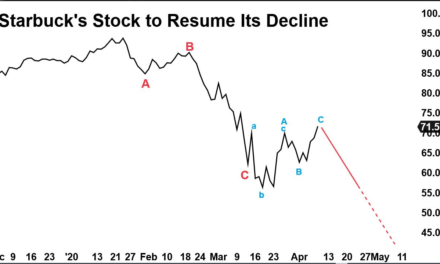

The black line is the share price of Starbucks.

The red A-B-C pattern denotes the stock’s downtrend.

The blue A-B-C pattern denotes the stock’s recent rebound.

I use these red and blue letters to predict price trends. It’s the framework for my Apex Movement Patterns, or AMPs.

Prices are driven by basic emotions. AMPs help me identify when investors switch from fear to greed — and vice versa.

My analysis tells me investors are going to become fearful about Starbucks again.

The stock’s greed-driven rebound of the last two weeks is a countertrend move. AMPs suggest the rebound has run its course, and its downtrend will resume with a new fear.

I’m calling it a downtrend extension since I believe the stock will reach a new low.

Starbucks just pulled its full-year 2020 earnings guidance.

It expects fiscal second quarter numbers (January through March) will be half of what we saw during the same period last year.

Third quarter numbers will be worse. And the hit will last into the second half of the year.

When all is said and done, Starbucks is set to lose all the ground it clawed back since the market stabilized 20 days ago. And then some.

I expect an initial 20% decline to roughly $56.25 per share.

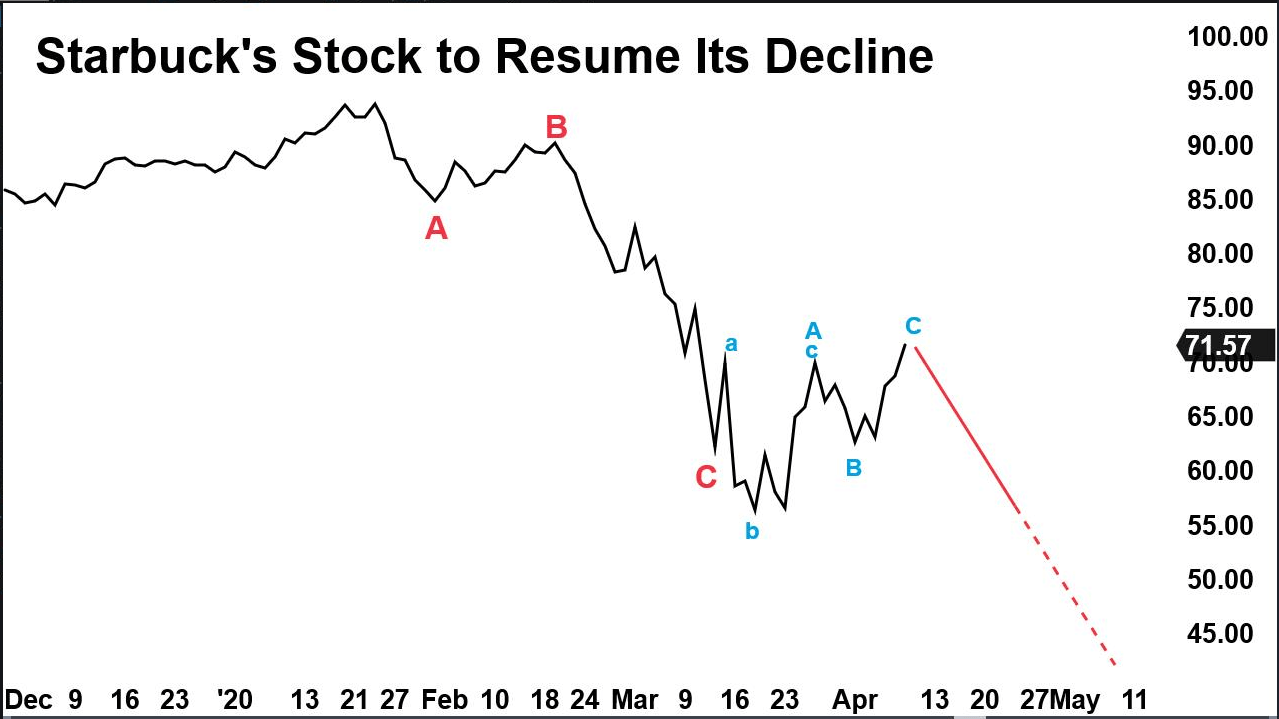

Your Trade Setup

To benefit from the downside in Starbucks, you can buy a put option. The value of the put will rise as the stock declines.

Since the expected move is two months, we can use the June 19, 2020 expiration date to take advantage of it.

With the stock trading around $70.10, we can buy the $70 strike price for roughly $5.50.

That gets us in a position to double our money as the stock price moves towards $56 a share over the next couple of months.

Since this is a bonus opportunity, we won’t be updating you on what action to take next. A good rule of thumb is to set a limit order to sell half at whatever would net you a 50% gain.

For example, if you buy the put option for $5.50, you can set a limit order to sell half at $8.25.

But you’ll also want to watch your downside risk. Look to preserve capital if it falls below a 50% loss.

Here’s a table with the trade setup:

Reach out to us at winninginvestor@banyanhill.com with questions or feedback!

Good investing,

Editor, Apex Profit Alert