Bitcoin dropped about 10% this week. Ethereum is down even more. And this comes after a prolonged sell-off over the last month.

It seems like a lot of retail investors are getting out of the crypto markets. But there’s some positive news for cryptos behind the scenes in the institutional space.

According to a new report, institutional investors are taking advantage of lower prices to increase their exposure to cryptos.

In today’s Market Insights video, Steve Fernandez and I discuss why the “smart money” is still buying cryptos and what that means for the crypto markets in the months ahead.

(If you’d prefer to read a transcript, click here.)

What Has Been Happening in the Crypto Markets

Ian: All right, we have a lot to cover today and I want to first start with what’s been happening in the crypto markets.

We’ve got bitcoin down about 10% on the week. Ethereum is down, even more, about 15%, although both those cryptocurrencies are off their lows of the last couple of days.

And this comes after a prolonged sell-off in the last month that saw cryptocurrency prices drop about 50% across the board.

But, Steve, there’s some positive news going on right now behind the scenes in the institutional space. Can you let our viewers in on what you’re seeing right now?

Steve: Absolutely. So, Andreessen Horowitz, a venture capital firm, is adding crypto exposure. It’s the A16 Crypto Fund, and this is its third iteration of a crypto fund. This one is at $2.2 billion. And that’s very high for any venture capital fund in general.

But if you look at their previous iterations, the second fund was $515 million, and the first was $300 million. So, the firm is sizing up to take advantage of this recent downturn in the crypto market.

Ian: Yeah. Interestingly enough, it seems like a lot of retail sellers are getting out at the same time that institutions are getting in.

Retail Investors Out, “Smart Money” In

Ian: Now, you know, some people call institutions the “smart money” (although retail investors like to think they’re smarter than the average institutional investor).

In the context of inflows and outflows, we also get weekly and monthly reports on institutions and whether or not they’re adding to positions or they’re taking away from their cryptocurrency positions.

What does the latest monthly report tell us about what the institutions are doing in the crypto space right now?

Steve: Yes, so, institutions are seeing more broad-based exposure to the crypto markets.

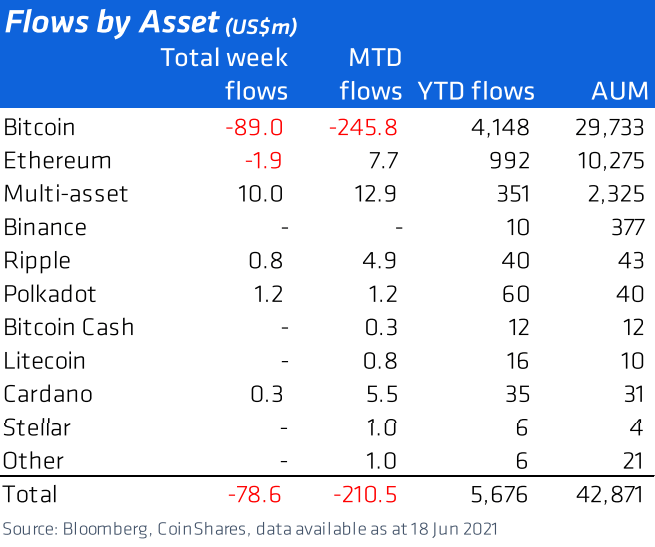

According to a report from CoinShares, in the last month, bitcoin is the only crypto it tracks that has seen a monthly outflow. It has a $246 million outflow in the month of June.

And if you look at the other cryptos like Ethereum, Ripple, Polkadot, and Cardano and add those up, it’s going to equate to about $35 million in inflows.

As you can see, institutions are taking this opportunity to add exposure to other cryptos, and they’re taking advantage of the lower prices when some retail investors may expect lower prices in the future.

So, there’s a disconnect between what institutions are doing and what retail investors are doing.

Migrating into Crypto

Ian: It’s really interesting because in the crypto markets, everyone always seems focused on price.

You want the prices to go up. You want to make money on your investments. But if you kind of pull back from the price and the noise and the chaos of what’s been happening in the crypto markets, you not only see institutional money flowing into the space. From what I read and from the people I talked to, the smartest entrepreneurs and the smartest developers are all migrating into crypto.

What that tells me is this might not come to fruition overnight, but the applications and the use cases of crypto are going to grow exponentially in a year or two, or maybe three to five years down the road just because of how much talent is moving into this space right now.

It’s a similar moment to what we saw during dot-com after the bubble burst, where everyone who initially wanted to work in finance after getting out of business school then wanted to go work for a dot-com startup. By the time 2010 rolled along, you had this path for a lot of these companies that had started in the late 2000s, whether it be Uber or Airbnb, or DoorDash. And then 10 years down the road, these are some of the largest companies in the world.

So, I think because of this — the institutional moment where the money is flowing into the space, and then you also have entrepreneurs and the smartest people in the room moving into crypto — I think that this will keep a lid on prices.

It’s possible we could suffer the same type of bear market that we had in 2018, which was prolonged and led to an 83% pullback in bitcoin. And if you look at what an 83% pullback in bitcoin would be from its highs, you’re looking at about $8,000 a bitcoin.

But I think the worst-case scenario, from my analysis, is bitcoin drops to about $20,000, which would be equivalent to the 2017 highs, and also where we broke out just a few months ago in December.

So, what do you think about that, Steve? I mean, have you read about or do you have friends that are moving into the crypto space and looking to start projects in your peer group?

Steve: Yeah, I know a few developers like that. It sounds cliché, but blockchain is the future. So, it’s no surprise that talent is migrating into the crypto space, because if you look at the crypto market and the opportunity, I mean, the crypto market is just so small in relation to more traditional markets, even after what we’ve seen in the last couple of years.

Institutions as well are catching on to this, and it’s almost like a light bulb went off in their head. In late 2020, early 2021, not only were the people behind the scenes making these protocols work, they were migrating over at a rapid pace.

Institutions are now saying we need more crypto in our portfolios. So, long term, that should spark everybody’s interest.

But these institutional investors are the data-driven investors as opposed to retail investors who, you know, they might pull up CNBC or Barron’s, which are sometimes meant to be entertainment, and they look at these headlines and make their investment decisions based on those headlines.

So, I know I, and you as well, like to follow what the smart money is doing.

Ian: Mm-hmm. Steve, that’s a great answer. And just so our followers know, you’re not planning on leaving us. You’re a smart guy. You’re not leaving us for a cryptocurrency anytime soon, right?

Steve: I’m not planning on leaving Banyan Hill or Smart Profits Daily, no.

Ian: Sounds good. We’ll make sure that we hold you to that.

Have a great weekend everyone, and we’ll speak to you soon. Thank you.

Regards,

Editor, Strategic Fortunes