I’ll be back next week with a brand-new Mega Trend Thursday video on the Winning Investor Daily YouTube channel.

But before then, I must tell you about a hot-ticket item!

Your washing machine.

Here’s why…

We’re running out of semiconductor chips. These power everything from smartphones to cars.

And industrial companies are getting desperate.

In fact, some industrials are harvesting chips from old washing machines!

Bottom line: A perfect storm created the chip shortage.

But get this…

Despite the global shortage, semiconductor demand is surging.

In this current market, I know you’re worried about stocks.

However, I’m going to show you why you should hold firm right now.

When you peel back the FUD (fear, uncertainty, doubt), you’ll see semiconductors are ripe for a MAJOR comeback.

The U.S. Senate’s action on Wednesday, July 27, was a huge turning point. It set the stage for a $52 billion windfall. That wave is about to collide into the chip market.

And I’ll tell you about one stock that could boom as a result.

Demand, Growth, $52 Billion … Stay IN Semiconductors

Consumers and businesses around the world depend on chips.

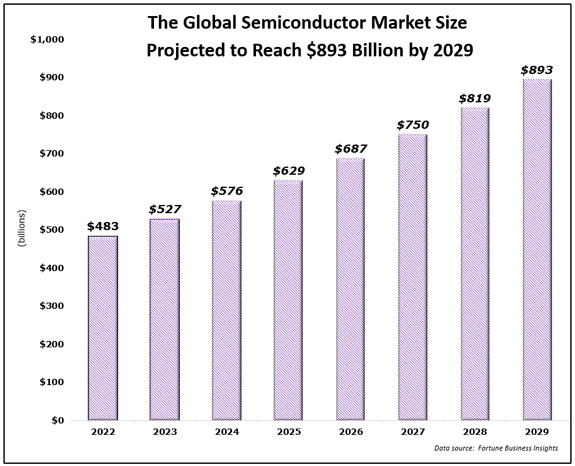

This demand is projected to grow over the coming years.

Our powerful mega trends like:

- Electric vehicles.

- 5G technology.

- Robotics and artificial intelligence.

- The Internet of Things.

… are all powered by chips.

These trends are ushering in next-generation technologies.

The global semiconductor market is projected to grow from $483 billion to $893 billion by 2029. That’s a healthy compound annual growth rate of 9.2%.

But the chip shortage has had one positive outcome: It’s sparked innovation.

And as industrials manufacture chips in new ways, the semiconductor market is primed for a comeback.

And stateside, the industry is about to get a helpful multibillion-dollar boost.

Yesterday, the U.S Senate passed a significant piece of legislation. In short, it will pour billions into semiconductor manufacturing.

This bill will now move quickly to the House of Representatives for final passage this week.

The Creating Helpful Incentives to Produce Semiconductors (CHIPS) for America Act will provide about $52 billion for semiconductor manufacturing.

The idea is to increase U.S. companies’ competitiveness in this market. Plus, chip plants should receive about $24 billion in investment tax credits to boost U.S. semiconductor production.

The bill has the potential to construct 10 to 15 new semiconductor factories in the U.S.

Imagine $52 billion dollars (or more) flowing into this sector!

Now’s the time to buy semiconductor stocks while the market is on sale.

Remember, it’s never easy, but it will be worth it.

This is promising news for U.S. chip manufacturers like Micron Technology (Nasdaq: MU).

Micron announced late last year that it will invest up to $150 billion over the next decade to expand its chip fabrication capabilities.

If you don’t own this stock yet, consider adding this chipmaker to your investment portfolio.

“Technology Increases Prosperity Around the World!”

Chips are vital to our digital way of life.

That’s why my colleague Ian King, editor of Strategic Fortunes, has recommended next-generation chip stocks in his model portfolio.

The way Ian sees it … technology, like semiconductors, increases prosperity around the world.

If you’d like to be part of this opportunity, please click here to learn more!

Until next time,

Director of Investment Research, Strategic Fortunes

Disclaimer: We will not track any stocks in Winning Investor Daily. We are just sharing our opinions, not advice. If you want access to the stocks in our model portfolio with tracking, updates and buy/sell guidance, please check out Strategic Fortunes.