Article Highlights:

- I ran a screen to sort through thousands of stocks.

- Only 33 of those made the list of potential investments.

- After digging deeper, only one company meets my strict criteria.

When times are tough, it’s smart to find out who’s handling it the best.

We want to either connect with those who are doing things well or copy them.

This is true in a big storm … but I don’t write about hurricane preparedness. Instead, I want to show you one way you can find investments that will treat you right in turbulent times.

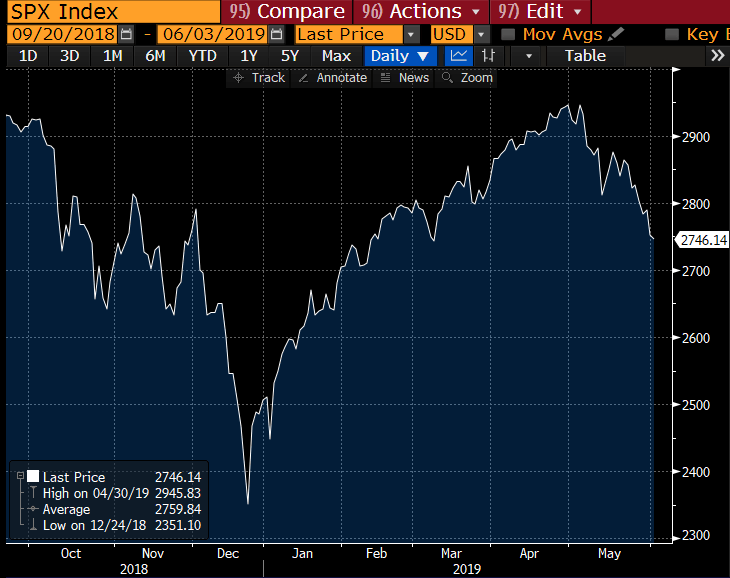

The S&P 500 Index hit its 2018 high on September 20 of last year. Since then, it’s been all over the place.

It fell hard, then zoomed higher. By the end of April, it hit a higher high than in September. And now it’s falling again.

Turbulent Times for the S&P 500

It may surprise you to learn which stocks have fared the best during this period. And only one of them has the resilience to remain strong…

Screening for Gold

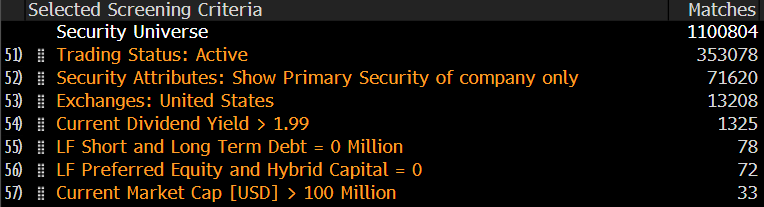

In order to find hearty stocks that can withstand a tough market, I like to use screens.

For those of you who aren’t familiar, “running screens” is a way to find investments by entering whatever criteria you want to use, such as market cap, dividends, liquidity and debt.

Screening helps you reduce the size of your list of potential investments.

After all, it’s hard to find the best options if your list has hundreds of names.

Searching for Safety

I was looking for safe investments that trade on U.S. exchanges.

I noted the two-year, three-year and five-year Treasurys were all yielding less than 2% at the end of May.

So, I asked my Bloomberg database for stocks with a market cap of at least $100 million that yield 2% or more. Meaning, their dividends were at least 2% of their share price.

I was looking for a yield greater than a Treasury and the potential capital gains of stocks.

Next, because I’m looking for safe stocks, I removed any with debt. It’s much less likely for a company to file for bankruptcy when it has no debt.

Would you believe, with just these criteria, my potential investments dropped to 33?

Peeling Back the Layers of the Onion

Next, I removed any names that are energy-related.

Energy stocks are cyclical. And they’ve been having a tough time recently. That cut my list to 28.

Removing the one cyclical base metals name cut the list to 27.

Next, I removed any names that had seen their:

- Cash flow fall at least 10% since last year, or

- Price fall at least 7% since the market’s high last September.

The last factor was consistent with the market. It fell more than 6% since September 20. I sought names that did as well or better than that.

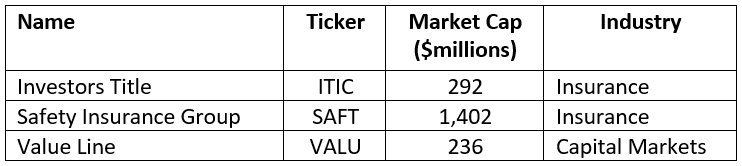

That cut my list to three names:

Three’s a Crowd

The names that remained were all from the financial sector:

Since the S&P 500 peaked in 2018, these names have fared better than the market. And they have better fundamentals than their peers based on the screening criteria I discussed.

Digging a little deeper led me to wonder about a couple of them, though.

Investors Title Co.’s dividend yield is greater than 2%, but only because it paid a special dividend last year. It has done that for the past two years, but there’s no guarantee it will do so this year.

If it doesn’t pay the special dividend, its yield will be less than Treasurys. So I’m going to remove it.

Value Line Inc. has a storied history of providing investment advice to independent and professional investors. However, the stock doesn’t do much volume.

We want to buy liquid stocks that we can sell easily, if we have to. As such, I’m going to remove this name also.

We’re left with Safety Insurance Group Inc. (Nasdaq: SAFT). And it’s exactly what we’re looking for when the market’s moving all over the place.

A Steady Performer

If you think insurance is a boring business, that’s fine. But please don’t think it can’t make you money.

When the CEO of Geico, Tony Nicely, stepped down last year, his boss, Berkshire Hathaway CEO Warren Buffett, lavished praise upon him. Buffett estimated Geico had increased Berkshire Hathaway’s intrinsic value by more than $50 billion.

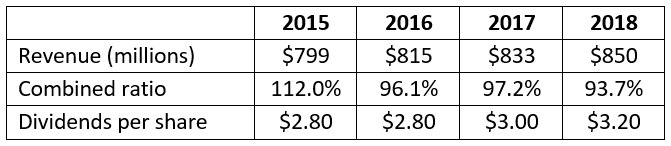

Safety is like Geico, but smaller. It offers property and casualty insurance in the Northeast.

It has been a steady performer. Take a look at some of its numbers:

Combined ratio is important for insurance companies. It compares the losses and expenses the firm must pay out to the premium it earns.

Insurance companies want this ratio to be less than 100% over time. There will be years when the amount is greater than that, but they need to be infrequent.

You can see Safety has been earning premiums in excess of its payouts for several years in a row. That’s the key to insurance.

This is the kind of stock you should seek out when the market is shaky.

Good investing,

Brian Christopher

Editor, Insider Profit Trader

P.S. I just recommended another property and casualty insurance stock in my Insider Profit Trader service.

This name has struggled a bit more than Safety Insurance due to big storms in some of its markets the past couple years. But Wall Street is pricing it like it’s going out of business.

It isn’t. In fact, I believe it has 50% upside from these levels.

Click here to get access to this name … and to learn more about my service.

It isn’t like a traditional newsletter. I recommend stocks, but I also remind you about things we don’t always consider in life. The feedback I’ve received shows subscribers appreciate that, too.