I was stuck.

It was a hard thing to admit to myself, and judging from the snickering I could hear from the ground, my brother knew it too.

My younger brother introduced me to indoor rock climbing, and we loved it. Neither of us had any kind of formal training, and I think we both liked it that way. It was just you and the wall, learning and growing with each failure and achievement.

After a short class on how to manage the rope that would stop the person from falling two stories or more to the hard concrete floor below, we’d take turns on a variety of walls, conquering different footholds and handholds.

It didn’t take me long to figure out that I had to keep moving if I was going to make it to the top. Considering that I hadn’t spent a great deal of time working out my arms and legs, my strength and stamina were limited. Balanced on tiny footholds and clinging to the wall with little more than my fingertips, I needed to always know where my next handhold and foothold were going to be. The longer I hesitated, planning my next move, the quicker my energy drained.

And this time, I was at a critical crossroads. My energy was waning fast after making it three-quarters of the way up the wall. The next handhold was far enough away that I would have to jump for it, and chances weren’t great that I’d make it. Or I could backtrack and choose another, easier route.

The market is facing a very similar crossroads with the newest employment report, and the odds of stock indexes continuing their ascent is in question…

An Employment Boom

The Bureau of Labor Statistics gave Federal Reserve Chair Janet Yellen a massive gift today in the form of a strong jobs report.

In February, the U.S. added 235,000 new jobs, beating estimates for an increase of 221,000. In fact, during the first two months of 2017, nearly half a million jobs have been created. Meanwhile, job totals for January and December were revised higher by 9,000.

The headline unemployment rate dropped from 4.8% to 4.7%, while the broader unemployment rate — which includes people who want to work but have stopped searching and people who are working part-time jobs but want full-time work — dropped from 9.4% to 9.2%.

Digging deeper into the employment figures, we find that the construction sector added 58,000 jobs — the largest increase since March 2007 — boosted by the second-warmest February on record.

Manufacturers added 28,000 new jobs, marking the largest gain since August 2013.

The health care sector added 27,000 new jobs.

Average wages increased by 0.2% to $26.09 per hour and are up 2.8% over the past 12 months.

And this is all good news for the Fed.

Not So Fast…

Wall Street is seeing this as a green light for the Fed to boost interest rates at the close of the Federal Open Market Committee meeting on Wednesday, March 15.

Right now, the futures market is pricing in a 93% chance of the Fed boosting interest rates by 25 basis points to between 0.75% and 1%.

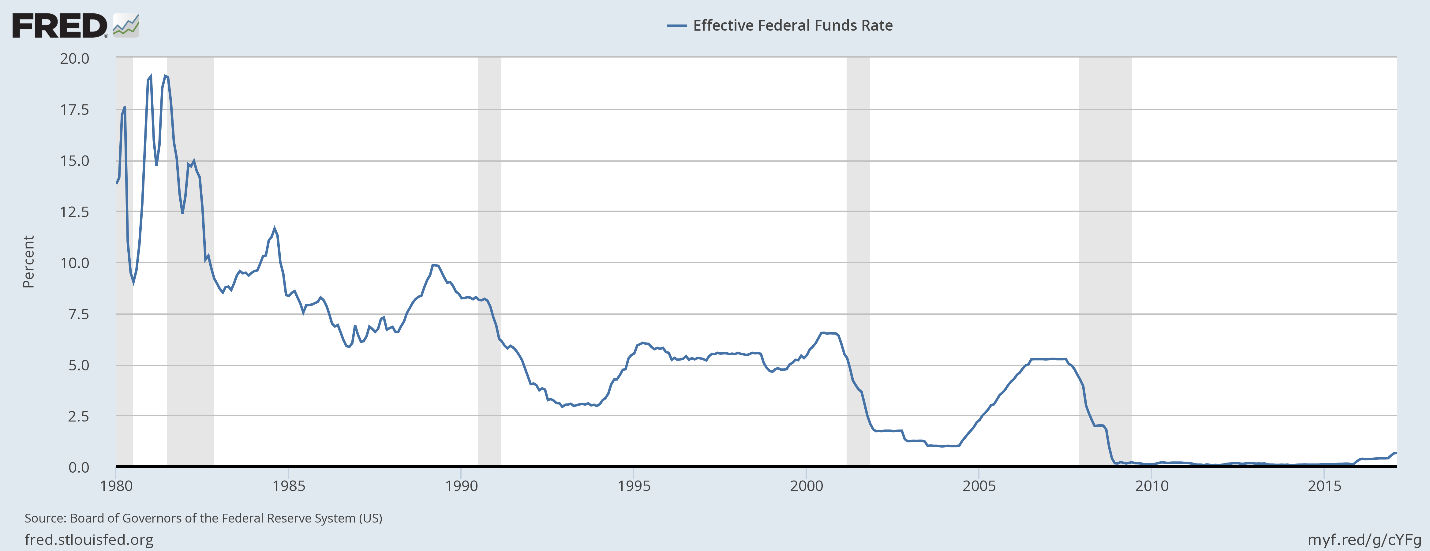

A quarter-point rate hike would lift interest rates up to levels not seen since October 2008.

And that could be just the beginning. The Fed hinted at up to three rate hikes in 2017, potentially bringing interest rates into a range of 1.25% to 1.50%.

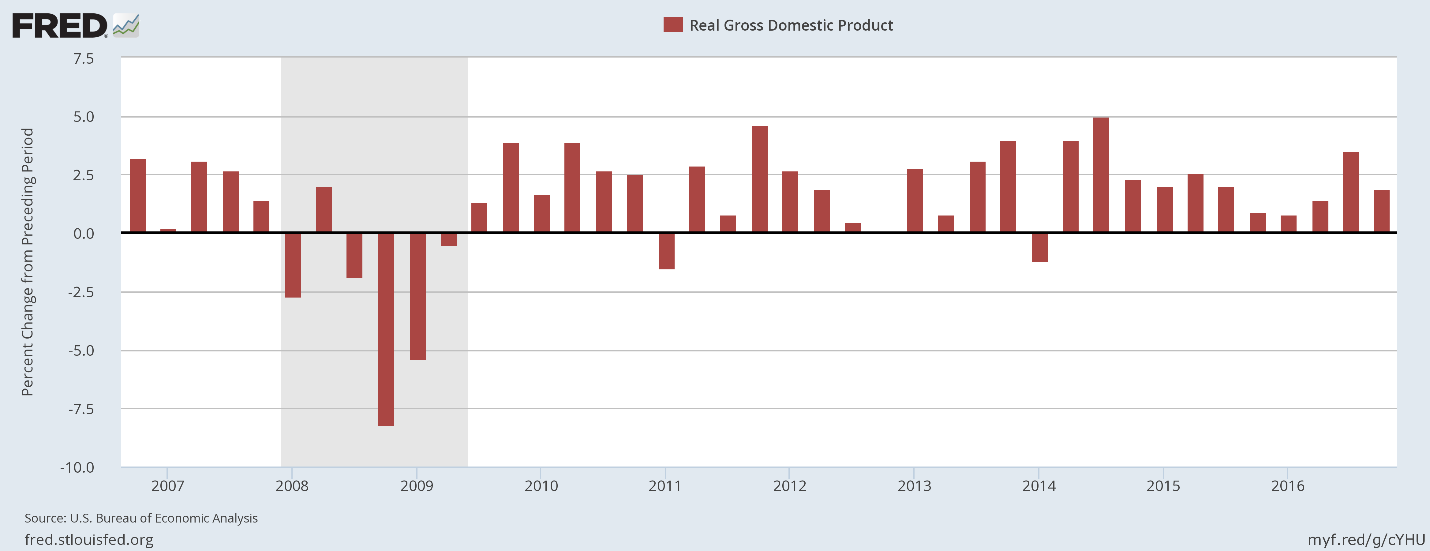

But while the employment picture is starting to look quite rosy, the Fed rushing forward with rate hikes could quickly derail any growth that we’re seeing. While companies may be hiring again, we are still seeing lackluster growth in our economy.

Over the past two years, quarterly gross domestic product growth has averaged less than 2%.

And as Chad Shoop pointed out in this morning’s Winning Investor Daily, the Atlanta Fed is now forecasting a nasty slowdown in growth.

While a rate hike on Wednesday might not trigger a massive sell-off, it will put the market in a more precarious position. Higher interest rates on existing debt will put a squeeze on spending. Higher interest rates will also likely attract more interest in the U.S. dollar, making it stronger and hurting multinational companies as their products become less attractive overseas.

It’s a delicate balancing act, and the Fed is poised to tip the scales. It’s important that you have your portfolio properly positioned to weather any tricky developments as stocks struggle to keep climbing.

Regards,

Jocelynn Smith

Sr. Managing Editor, Sovereign Investor Daily