“Well, aren’t you worried about a major crash in the stock market?”

I was grabbing lunch with a friend from high school whom I still keep in touch with.

As he expressed his concern, and fear of a market crash, I replied right away.

“Not really. We make money when stocks fall just as easy as when they rise.”

He shrugged.

I eased his fears. But I realized that his concern spoke to the ways we can profit from downward moves in the market. These are resources that we have at our fingertips as individual investors in today’s market.

In 2008, the last time the stock market crashed more than 50% in less than two years, profiting from the plunge wasn’t easy for everyday investors.

And brokers, who get paid to keep you invested and keep your accounts with them, told almost everyone not to worry: “It will bounce back.”

We don’t have to wait for the market to bounce back. We can profit while it’s on the way down.

Even with the strong start the market had this year, it’s always a good time to consider how you’ll make money when a pullback comes.

And it will come. It’s a matter of when, not if.

That’s why I wanted to share with you a unique pattern I discovered that is calling for a pullback in a particular sector to start any day now — and I’ll give you a way to profit from it.

Let me explain…

Extended Pullback Ahead for the Energy Sector

This may not be the start of another 50% crash, but who knows exactly when that will begin?

We all have our assumptions, but more often than not, they will be wrong.

So, instead of trying to time the big market crash, I continue to pinpoint opportunities where we can make money from pullbacks.

And when the big one comes, we’ll be in a position to make enormous profits as stocks fall — just as we do when stocks rise.

This particular opportunity comes from a technical pattern I follow constantly: seasonal trends.

I look at seasonal trends based on sectors of the market, not individual stocks.

I believe these sectors have a general pull on the market, and that carries into the individual stocks more so than each stock’s own seasonal trend. This has led us to significant profits over the years, which reinforce my belief.

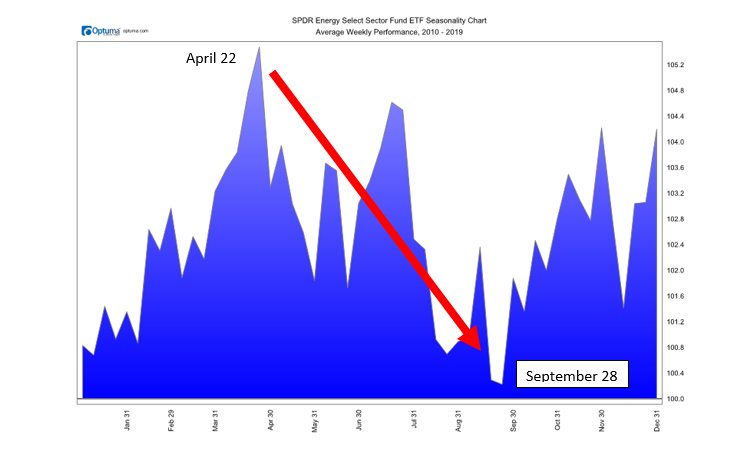

The energy sector is tracked by the SPDR Energy Select Sector exchange-traded fund (ETF), and its seasonal trend is pointing to an extended pullback.

Take a look at the Seasonality Average Weekly Performance Chart:

The blue area highlights how the sector has traded over the past 10 years, creating its seasonal pattern.

The red arrow and dates highlight the pullback I look to profit from. It lasts from today through September 28.

During this seasonal trend, which shifts a few days each year to the ideal trend, the sector has declined by 6.5% on average.

We’ve been able to turn this decline into profits.

And while flipping the decline to a positive return, a 6.5% profit doesn’t sound like too much. But we’re profiting as stocks are falling. That makes profiting from pullbacks even more beneficial.

This is possible for everyday investors thanks to new developments in ETFs.

You can take advantage of this pullback today.

To learn more about this seasonal pullback, watch my video below.

Your Pullback Plan Is an Inverse ETF

ETFs have cleared the way for our possibilities to profit from declining shares. They started out as expanded fashion just over a decade ago — now they are common trading tools to exploit short-term moves.

And that’s exactly what we are using today to profit from the energy sector pullback.

By using an ETF designed to profit from a decline, you don’t need any special functionality with your account — like shorting stocks or buying put options.

Instead, you can buy an ETF just like you would a stock, except this ETF, known as an inverse ETF, will rise in value as energy stocks fall.

A great way to profit from this expected pullback is ProShares UltraShort Oil & Gas (NYSE: DUG).

Since it is an inverse ETF, it benefits as the Dow Jones U.S. Oil & Gas index declines. The index is composed of stocks that are in the oil and gas sector, making this a clear play on a pullback in energy stocks.

While the prime season will be key in determining when to jump in, it does shift slightly from year to year.

That’s why in my premium service Automatic Profits Alert, I use a momentum indicator to help us time the turning points before we buy in.

If you want to learn more about my complete strategy and how I use prime seasons to profit throughout the entire year, click here.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert

P.S. Have you checked out my new YouTube channel? Click here, and hit the subscribe button to be notified when I post new content.