Here we go again.

Several countries in Europe are heading back into lockdown to control the COVID-19 outbreak.

According to the European Commission President Ursula von der Leyen, Europe is “deep in the second wave … this year’s Christmas will be a different Christmas.”

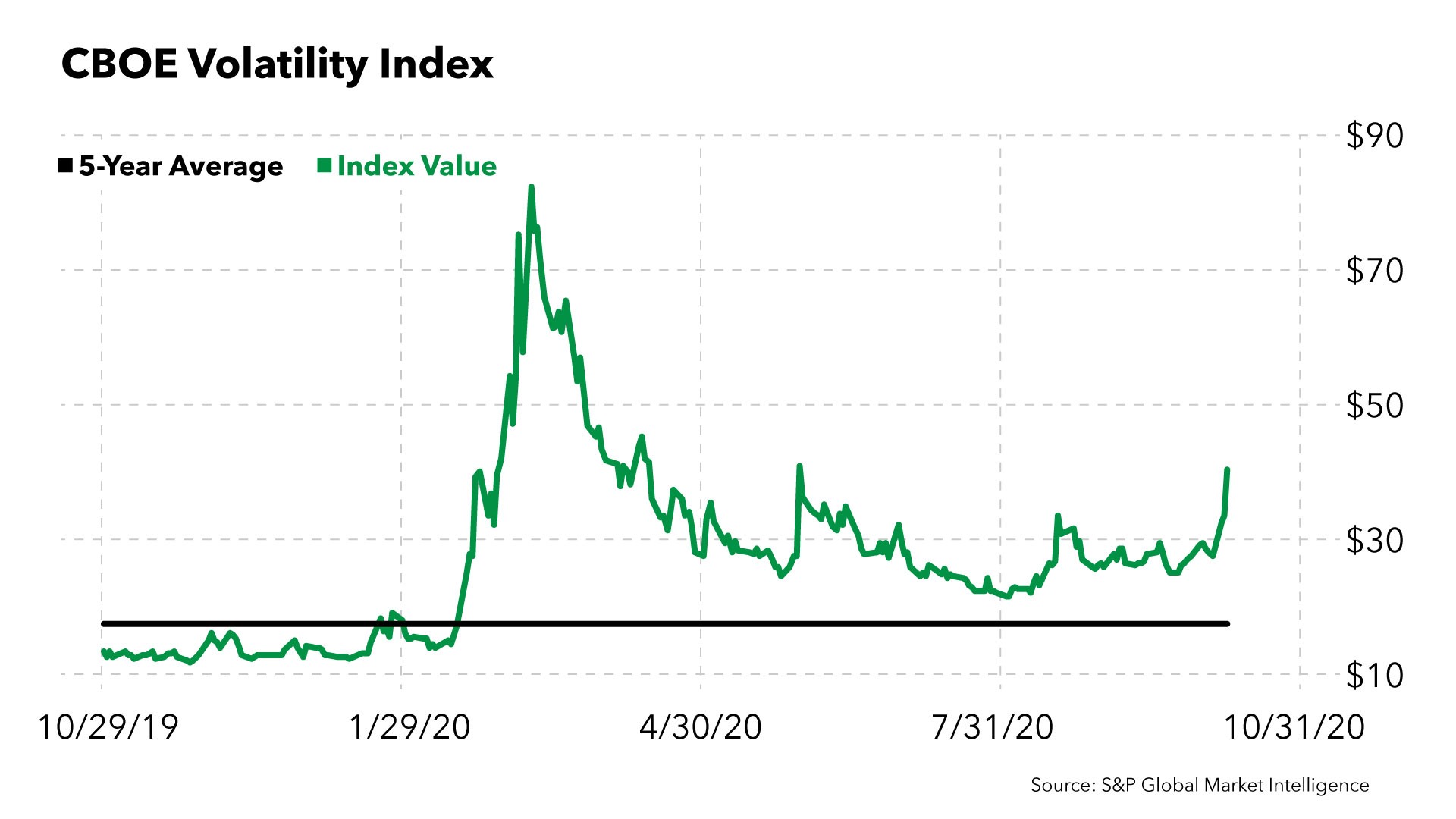

Add in the uncertainty over the election, and the S&P 500 has been all over the place. Wall Street’s favorite volatility gauge — the VIX — spiked to a four-month high this past Wednesday.

In fact, after a large spike in March, the VIX has been trading above its five-year average since the pandemic. It typically stays in the 10 to 30 range.

Take a look…

Now, I’m showing you this chart because I want you to understand that the past year has been out of the ordinary, even in the financial markets.

But that doesn’t mean that every investor needs to accept any losses.

See, in times like this — when volatility is high — there’s actually an under-the-radar strategy that the pros turn to. And at American Investor Today, our goal is to make sure you have every tool you need to secure your financial future…

How the Pros Profit From Volatility

You don’t need us to tell you that these volatility spikes are causing mispricings in the stock market. Just this week, we saw Microsoft report fantastic earnings … only to see its stock fall 5%. That’s insane. And intelligent investors are taking advantage of these opportunities.

But what you may not know is that this volatility leads to even bigger mispricings in the options market. And that’s what we love to see. When the market is dead wrong about value — that’s where the real money is made.

I know that when we say “options,” some people get nervous. But that’s on purpose — Wall Street puts a lot of effort into making investors think options are out of their depth.

But that’s not the truth.

As our options expert Chad Shoop likes to tell me: Options are just like anything else in the financial markets. You invest when the market gets something wrong — and sit tight while the market realizes its mistake.

And Chad knows what he’s talking about. He holds a Chartered Market Technician distinction, which means he’s spent countless hours proving that he can spot these opportunities. Whether the market is headed up or down … or just making waves … he has a strategy to take advantage.

To learn how to get into these opportunities, just check out Chad’s Weekly Options Corner. He walks subscribers through options basics, completely free, every single week.

He’s covered puts and calls, how to read an option symbol and even walked readers through a real trade that he recommended on Facebook.

Again, this weekly options education is completely free. And with volatility so high, now is the perfect time to learn how to tap into this market. Sign up here.

Look for Opportunities in Unexpected Places

We talk a lot about mispricings in American Investor Today. And the team showed you several opportunities this week…

- The “Subscription of Everything” industry is one way to stand up to this stormy market. It will be worth $300 billion in the coming years — and we have two ways for you to profit.

- Speaking of mispricings in the market … there’s one strategy that will always profit, and it has made millionaires out of janitors.

- There are special stock opportunities out there that regular investors don’t often see. They are easy to spot once you know what you’re looking for. And they’ll show you how to spot them too.

- Meanwhile, an American COVID-19 vaccine is likely on the way sooner than you expect. And the market is chomping at the bit to make a profit. But is the hype around Gilead too early?

As we continue to navigate 2020, the American Investor Today team will keep bringing you everything you need to know to spot these opportunities.

As always, if you have any questions or topics you’d like us to cover, you can reach out to us at AmericanInvestor@BanyanHill.com.

Regards,

Annie Stevenson

Managing Editor, Winning Investor Daily