Other than an interest in divining the future, investment advisers and fortune-tellers don’t have much in common.

Except for one thing: People who pay them expect their predictions to be accurate.

With that in mind, and in the spirit of transparency, permit me to review the predictions I made at this time last year…

- “There will be a strong post-holiday stock market rally.” Nailed it!

- “Bitcoin will suffer a big correction.” Ditto!

- “Markets will continue higher in the second quarter.” Right again!

- “The dollar will weaken in the third quarter, and the Fed will pass on expected rate increases.” Uh … what was I thinking?

- “The World Trade Organization will act against U.S. tariff increases.” Oh, that’s what I was thinking.

- “U.S. equities will become increasingly volatile in the third quarter.” Woohoo!

- “The gold price will begin to tick upward in the third quarter.” Spot on!

- “Stock prices will stabilize at a lower level before year-end, leading to annual gains for 2018 of half or less than those of 2017.”

I got that last item half right. Annual gains for 2018 are almost certain to be less than 2017.

But price stabilization in the fourth quarter? Well … at least I did better than the average fortune-teller.

What about 2019? What’s my big prediction for next year?

If you’re a Bauman Letter subscriber, you’ve already seen it … and it’s a shocker.

Age + Risk = Investment Strategy

For many people, all things considered, you’ll be better off avoiding the stock market in 2019.

Now, let me get one thing out of the way right up front.

I am absolutely, positively not saying that everyone should sell their stock holdings.

Let me repeat that: There is no need to sell everything. And there is no need to forgo new investments if they are right for you.

Reinforcing that point is important. For understandable reasons, many people see the stock market in black-or-white terms: in or out.

Many stocks will do well in 2019 and beyond. If you are in a position to take advantage of them, you should. That includes buying them at a dip if the opportunity arises.

But what is that position? To put it simply, if you can absorb potential losses by waiting for stocks to rebound from a dip, by all means, go ahead and play the market.

But if you have any doubts about your financial position and are in what I call the “red zone” — five years before and five years after retirement — then the principle of risk adjustment says keep your powder dry.

Investor, Adjust for Risk!

“Risk-adjusted return” is how much return your investment makes relative to the amount of risk the investment has exposed you to over a given time-frame.

If two or more investments have the same nominal return, the one that has the lowest risk will have a better risk-adjusted return.

Over longer time-frames, risk-adjusted return tends to even out. Over years of investing, the ups and downs of even the most volatile assets smooth out to reveal a long-term rate of return.

But over short periods — like a year, say 2019 — risk-adjusted return is significant.

The shorter the time-frame, the lower the probability that a dip in an asset’s price will be countered by a subsequent rise in price.

Most investors understand this instinctively. People who buy gold, for example, know that its price goes up and down over time.

But they also know that gold tends to enjoy stable value over long periods … some people say thousands of years.

Similarly, investors who hold stock in stable, dividend-producing companies often ignore their stock prices for years at a time. There’s no point in worrying about the short-term variations.

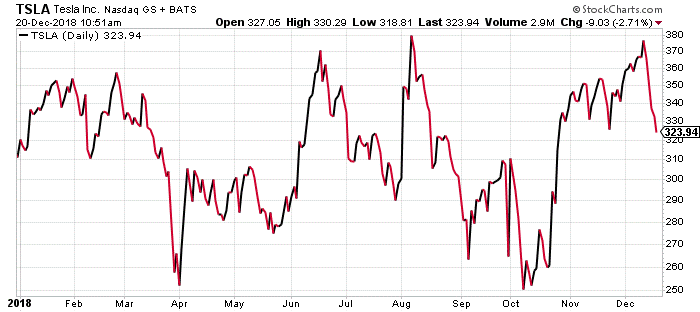

On the other hand, stocks of innovative companies like Tesla Inc. (Nasdaq: TSLA) are often highly volatile over the short term.

In a short time-frame, the potential of substantial short-term gains is offset by the equal likelihood of losses. This has the effect of reducing TSLA’s risk-adjusted return:

And the Winner Is…

People sometimes say I am biased.

I admit it. I am biased toward the needs of the thousands of people who write in to The Bauman Letter every month worried about how little they have saved for retirement.

I know there’s a whole other investment world out there, the more aggressive one … but wealth protection is my beat.

That’s why my recommendation is that for 2019, for many people, the risk-adjusted returns of the stock market will probably not exceed the safe, guaranteed returns they can earn elsewhere.

So for 2019, put your money elsewhere: Treasurys. Certificates of deposit. Money market accounts. Ultra-short bond funds.

Even a simple savings account … some of which are earning over 2.5% right now!

After all, if I’m wrong, you can always withdraw it and jump back into the market.

But if I’m right, jumping in the other direction won’t be so easy.

Kind regards,

Ted Bauman

Editor, The Bauman Letter