Article Highlights:

- The market is certain the Federal Reserve will cut interest rates by at least 25 basis points.

- A rate cut will mean more and bigger deals for investment banks.

- Two of these firms are on a roll … and they’re dirt cheap right now.

Lower interest rates offer many benefits.

The market says it is certain the U.S. Federal Reserve will lower rates at its meeting on July 31. The question is how much.

Most believe the cut will be 25 basis points, or 0.25%. Although, the market says there’s a chance the Fed will lower rates by 50 basis points.

Either way, this is good for businesses that need to raise money.

For example, companies and firms looking to buy companies or assets.

When rates fall, it becomes cheaper to raise the money to do these kinds of deals. And there is a select group of stocks that will benefit as a result.

The market is still realizing this, so you can get in now at the right price…

The Other Kind of Bank: Investment Banks

When people think of banks, they generally think of retail banks they visit to deposit checks … or now visit online to transfer money. Places such as Chase, Bank of America and Citibank.

You may be less familiar with investment banks.

Historically, these were names such as Goldman Sachs and Merrill Lynch.

Investment banks trade stocks, bonds and other securities. They also advise companies or wealthy individuals who want to buy other companies or assets.

In many ways, investment banks are “Wall Street.”

Today, Goldman Sachs has a retail bank … and Merrill Lynch is a part of Bank of America.

But there are still some firms that just provide investment banking services.

And today, I expect they are getting busier. Economic conditions remain decent overall. This means their customers should do more deals as interest rates fall.

It’s still early enough that we can get into this space at the right price.

A Tough Run: Cheapest Stocks to Buy

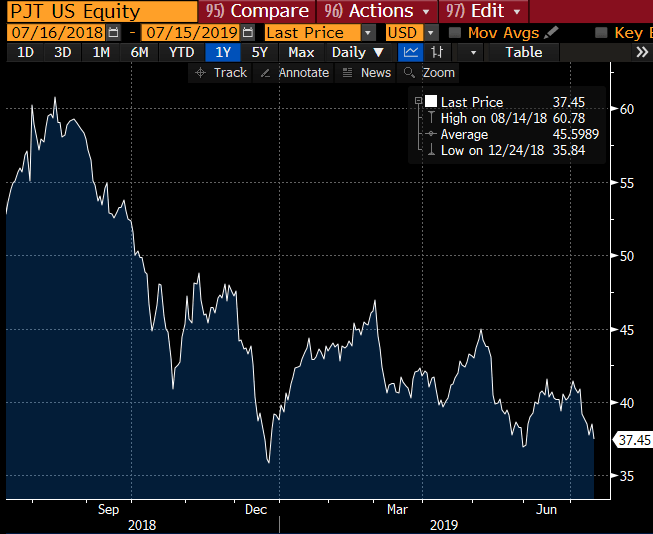

Take a look at the chart of PJT Partners.

PJT’s founder, chairman and CEO is Paul J. Taubman. He spent nearly 30 years as a banker at Morgan Stanley prior to founding PJT in 2014.

He even counts Blackstone CEO Stephen Schwarzman as one of his largest shareholders. Blackstone spun off one of its services businesses into PJT in 2015.

But the stock has had a tough run recently:

Everyone knows the end of 2018 was tough. PJT rebounded at the beginning of the year but couldn’t maintain the momentum.

However, deal flow for it and some of its peers is looking up.

League Tables

I have worked with, and have many friends who are or were, investment bankers. And I can tell you … bankers love league tables.

They use them to compare their firm with its peers. And bankers are super competitive.

Bankers use league tables to rank firms based on certain criteria.

These may include the number of deals on which the firm advised, total deal value, market share and more.

As such, they can give us an indication of which firms are doing well … and vice versa.

For example, take a look at this table:

The table shows the deals each of these investment banks advised on in 2015 and in the first half of 2019. The two right columns only show six months of activity.

Some of the numbers are consistent.

Greenhill advised on 44 deals in 2015 and 24 so far this year. If it continues at this pace, it’ll do 48 deals this year. That’s in the ballpark.

To continue with this analogy, some of these numbers are home runs.

Evercore’s average deal size is more than 50% greater in 2019. And if it does the same number of deals in the second half, its deal count will increase 34%.

Jefferies’ average deal value has more than doubled. At this pace, it’ll close 22% more deals.

But PJT is the clear winner here.

The Best of the Bunch

PJT’s average deal value has nearly tripled while doing 55% more deals (if this pace continues).

These numbers aren’t consistent every year.

Over this period, Evercore’s average deal value has ranged between $1.6 billion and this year’s $3.6 billion.

Jefferies’ and PJT’s average deal values are the greatest in each firm’s history.

Even more impressive … in the past six months, each of these firms has advised on a greater dollar value of deals than in any of the preceding four years.

What to Do

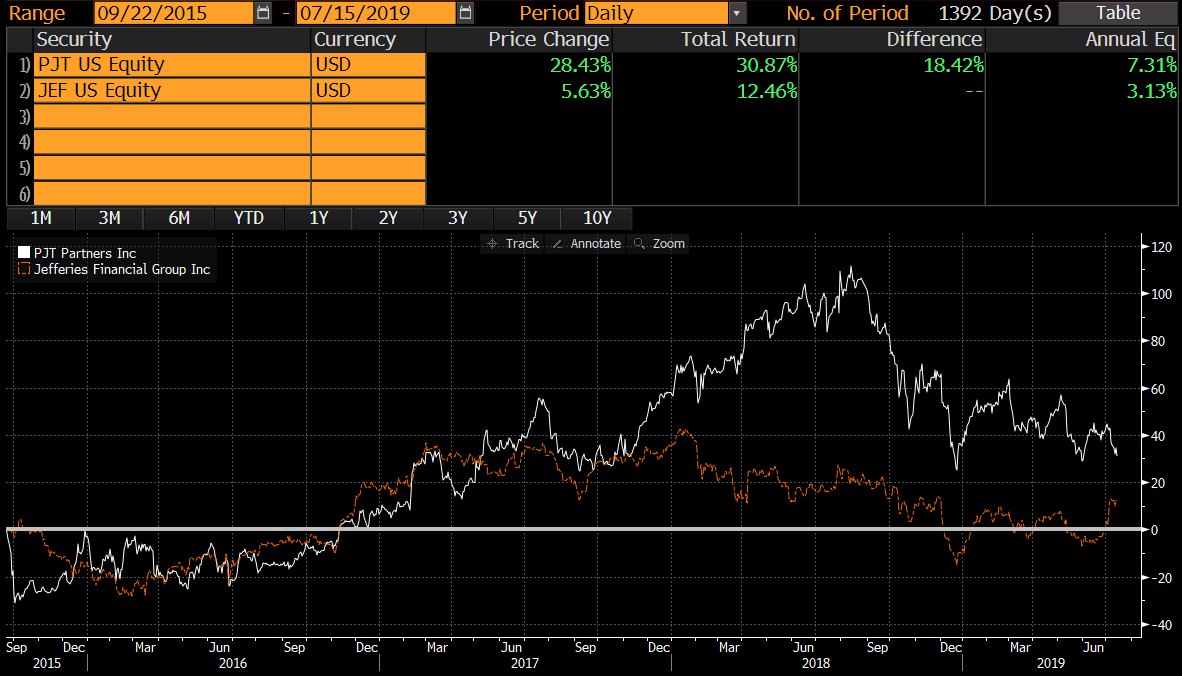

If we compare their price histories and total returns as far back as possible, we can see neither of these firms have had stellar returns:

This chart starts in September 2015 because that’s when PJT began trading.

Over this period, the S&P 500 Index returned more than double these two firms’ returns.

But the league tables suggest business has improved at these investment banks.

And, as you can see, their prices haven’t responded … yet. Both firms are still at least 33% below their all-time highs.

I recommend you look into PJT Partners Inc. (NYSE: PJT) and Jefferies Financial Group Inc. (NYSE: JEF).

Lower rates suggest we should see more deals, not less. And these two firms are on a roll.

The market should soon realize it has failed to price in this improvement.

Good investing,

Brian Christopher

Editor, Insider Profit Trader