Financial markets are forward-looking. At least that’s what business school professors teach us.

They believe traders look at the future and decide how much a stock will be worth in 10 years. The current price is based on that future price.

You might be shaking your head in disbelief. But that’s what Wall Street analysts do.

They create spreadsheets to forecast the future. Then they make assumptions about interest rates, and the spreadsheets tell them what to pay for a stock.

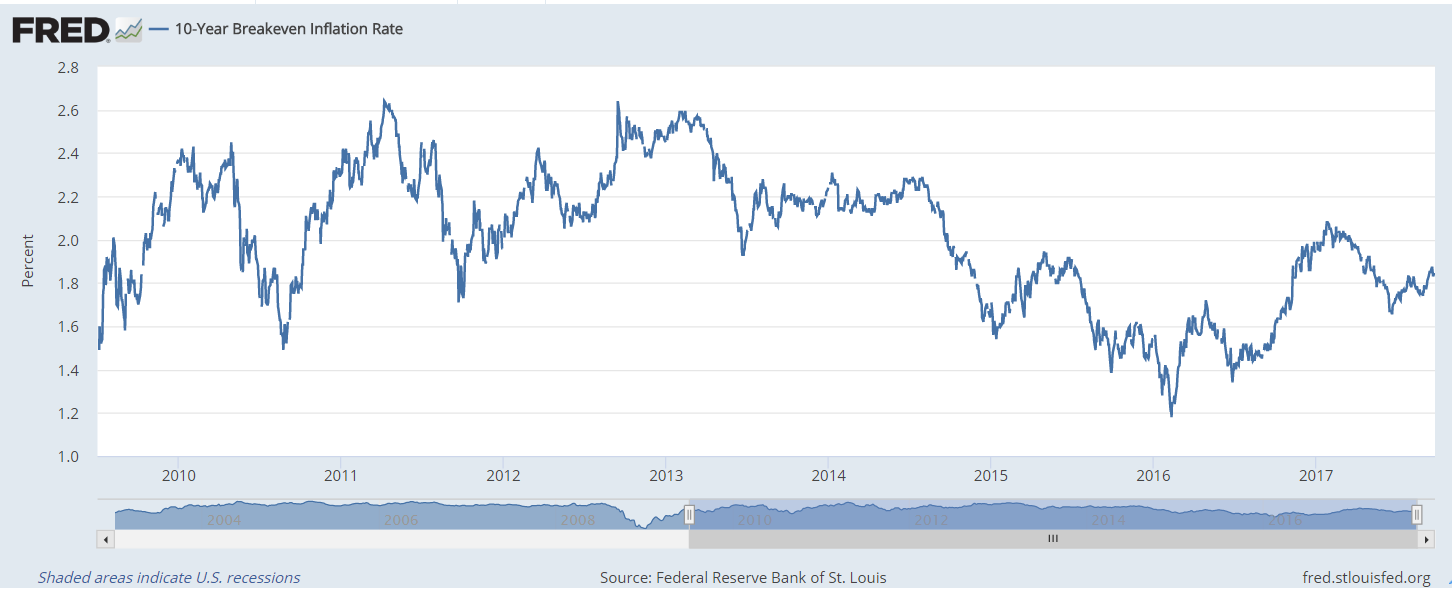

It sounds scientific, but it’s not. The whole process depends on the chart below.

(Source: Federal Reserve)

This is a chart of what investors believe inflation will average over the next 10 years. It’s based on what the current interest rates are.

It’s always close to the current rate of inflation. In other words, investors believe inflation will stay about the same.

That’s a surprisingly accurate assumption. Inflation generally does stay within a narrow range.

But when it unexpectedly jumps, like it did in 1968, the stock and bond markets fall.

The Federal Reserve calls this important metric “inflation expectations.” It understands that if expectations are stable, markets are fine.

But if inflation jumps, expectations will jump. The Fed’s goal is to manage expectations.

When inflation jumped in 1968, expectations stayed high for more than 20 years. Stocks suffered four distinct bear markets from the next 15 years. A bear market in this case is a decline of at least 20% in the S&P 500.

If inflation and inflation expectations jump, that will happen again.

Investors will see volatility and declines more often. Consumers will suffer as prices rise at stores. Overall, it will simply be terrible.

And it’s likely to happen within the next few years.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader