In periods of volatility, there are usually two safe-haven assets investors recommend — gold and bonds.

If interest rates can remain capped at current levels, bonds could end up being a nice place to park cash.

But gold is the clear winner.

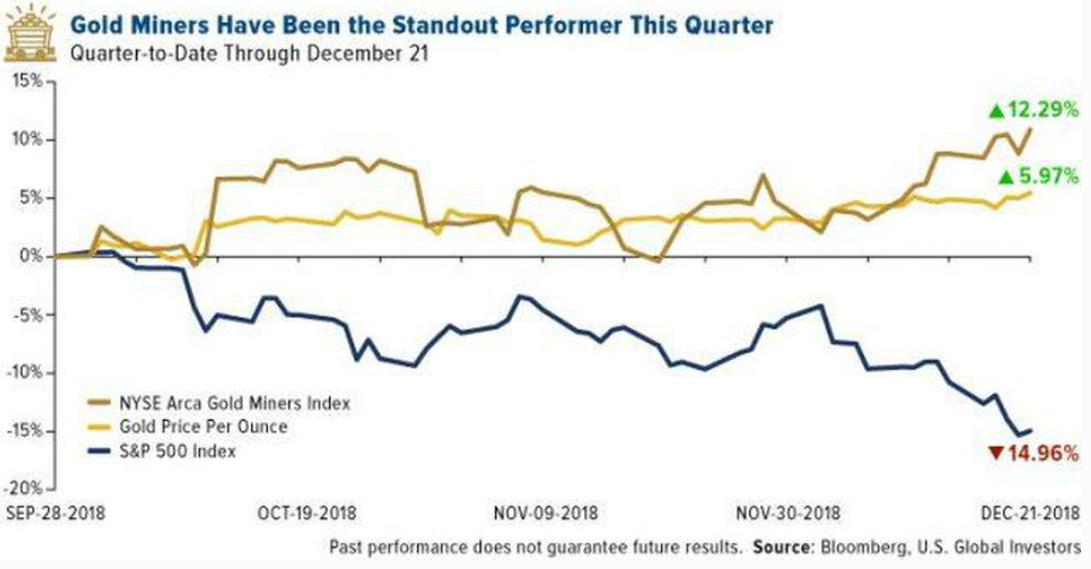

Amidst all the volatility, gold managed to climb nearly 6%.

The S&P 500 Index was down nearly 15% over the same period — September 28 through December 21.

There was an even better alternative, though, than both gold and bonds.

It was gold miners.

These are stocks that benefit heavily from a rise in gold prices but remain way more volatile than gold itself.

While it’s not the best place to park cash to avoid volatility, it is a great investment opportunity as gold continues to rally.

Take a look:

This chart shows gold’s and gold miners’ outperformance since September 28.

But the move in gold miners isn’t over yet.

They are just entering their prime season — historical seasonal trends that show enormous potential.

I track these for several major sectors, but recently jumped into a gold position to benefit from the metal miners’ prime season.

It lasts until February 1. However, as gold continues to climb, it could prolong the rally in gold mining stocks.

So if you are simply looking for an asset to stabilize your portfolio during volatile periods, gold is a good option.

But if you are more opportunistic and looking to make a significant return, keep gold mining stocks in your account as well.

They are volatile. But as gold prices trend higher, they offer a massive reward for holding a riskier asset.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert