Yesterday’s rate cut shocked the market. And that was precisely the point.

The U.S. Federal Reserve holds tremendous power over the U.S. economy. By setting benchmark rates, it dictates the terms for interbank lending — and in turn, the borrowing costs for virtually every business and household in America.

But aside from raising or lowering those rates, the Fed has very few meaningful ways to interact with the larger economy (excluding emergency measures, of course).

So controlling the flow of information, controlling the perception and expectation of rate cuts, becomes one of the Fed’s most powerful tools.

One of Powell’s goals has always been to keep market participants uncertain and balanced in their expectations. If he told everyone exactly what the FOMC will do and when, the market would essentially front-run their actions and neutralize much of the Fed’s power.

That’s why he waited longer than absolutely necessary to start his cutting cycle. He wanted to keep the market on its toes.

Powell weathered the criticisms and doubt as he bided time. With 10-year Treasury rates down around 3%, market consensus was growing that the Fed waited too long. Powell was accused of being “behind the curve” and risking a crash in the final moments of his soft landing.

Then, this Wednesday, he delivered a rate cut that was twice the size of what many investors expected.

By staying patient, Powell let the economy speak for itself — showing weakening inflation and solid employment numbers — before delivering a substantial cut, and proving that he meant business.

But as PIMCO’s CIO Dan Ivascyn said publicly on Monday, we shouldn’t get too hung up on the exact size of this month’s rate cut. 50 basis points vs 25 basis points isn’t the real story here…

Reading Between the Lines from Powell’s Announcement

This week’s most important news is that both the Fed and the markets seem to agree that, for now at least, both the economy and the labor market are in a fairly solid position.

Neither are particularly fragile or stretched to an unsustainable extreme, putting us in something of a “Goldilocks” zone for future growth.

So this rate-cut cycle is more about normalizing the higher rates there were necessary to fight inflation, and not so much about saving the economy or labor market from a downward spiral, or even a “stall speed” scenario.

Bottom line: The economy is growing. Employment is healthy. It looks like the soft landing is becoming a reality. And that will create a window of opportunity for investors that should last for the next year at least.

We’ve now officially entered a rate-cutting cycle. And the best way to cash in on this kind of cycle is with small-cap value.

We can see that in Vanguard’s Small-Cap Value Index ETF (VBR), up more than 10% since July 10, the day before falling inflation was confirmed by new Consumer Price Index (CPI) data. During that same period, Vanguard’s Large-Cap Growth Index ETF (VUG) is down nearly 3%. That’s through 11am September 19, inclusive of the post-cut reaction where large-cap growth gained a bit of a bounce.

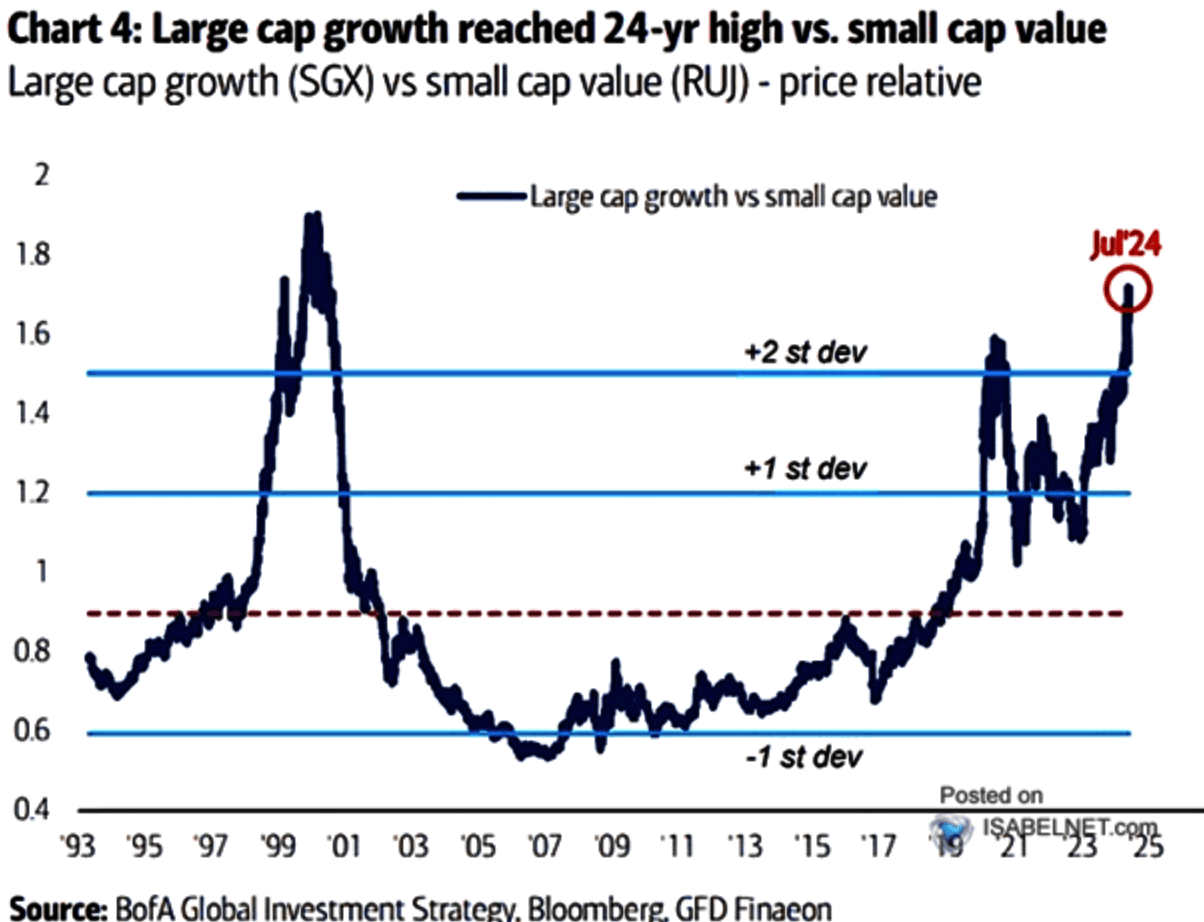

Here’s a chart that shows the relative valuations of large-cap growth versus small-cap value going back to the early 90s:

As of July 2024, large-cap growth was relatively overvalued to a degree we’ve seen outdone only one other time in history — during the peak of the dotcom boom — and more than two standard deviations above the average relationship between large-cap growth and small-cap value.

Mark my words: This will revert. Small-cap value will outperform large-cap growth by some meaningful measure during this rate-cut cycle.

Any approach that favors small-cap stocks and stocks will lower valuation metrics is poised to make hay in this new “normalizing” market.

To good profits,

Chief Investment Strategist, Money & Markets