As the Federal Reserve gets set to meet next week, concerns of tighter monetary policy are growing. After all, the Fed’s easy money has fueled the bull market in stocks since 2009. If the Fed pulls back, can the gains continue?

To answer that question, we need to think about how the Fed helped the stock market.

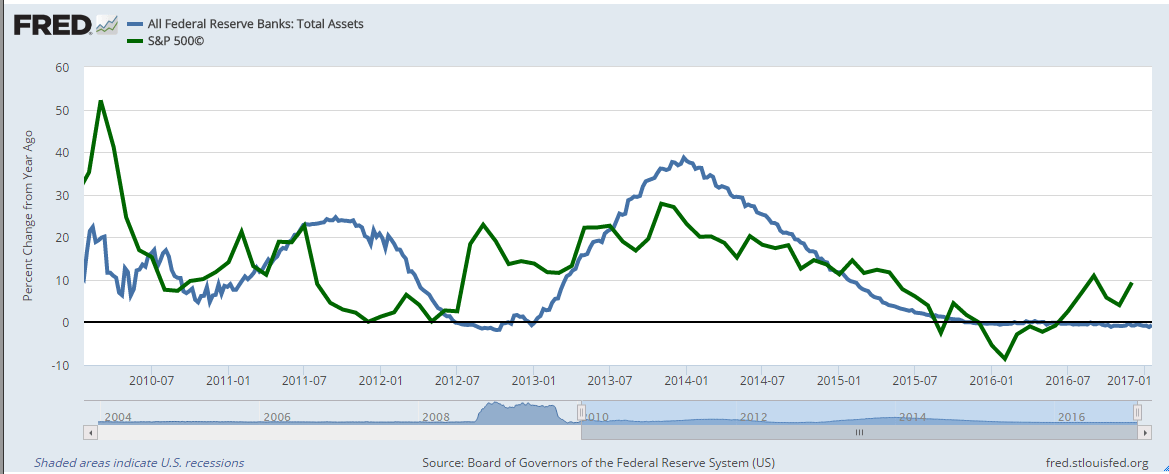

The Fed is important to the stock market because it takes money to make prices go up. As the Fed kept interest rates low and bought bonds through unprecedented quantitative easing programs, stocks rallied. One glance at the chart below shows how much the Fed mattered throughout the bull market…

Changes in the S&P 500 (the green line in the chart) generally followed changes in the Fed’s balance sheet (the blue line). The Fed’s balance sheet ballooned as they bought bonds and pushed dollars into the hands of big Wall Street firms that seemed to invest the money in stocks.

If the Fed reverses course, as it seems likely to do this year, analysts are wondering what could fuel further gains in stocks.

There are actually three potential sources of money that could allow the bull market to continue:

- Government deficit spending could replace the Fed as a source of dollars. This is possible given President Donald Trump’s emphasis on infrastructure spending and tax cuts.

- Corporate spending on new factories, expansion projects, share buybacks or increased dividends is another potential source of money to boost the stock market. This might not be enough in ordinary times … but we are living in extraordinary times. Corporations have stockpiled at least $2 trillion overseas in unproductive tax-avoidance strategies, and Trump is working on bringing that money back to the U.S.

- A third source of capital for the bull market is the $2.2 trillion sitting in money market funds. Lacking confidence in the economy, investors piled money over the past few years into funds returning less than 0.1% a year in many cases. As confidence returns, those assets could boost stocks.

Normally, it is bearish when the Fed tightens. For now, nothing about the political, economic or business environment is normal, and we have trillions of dollars that could be put to work.

This bull market could deliver even larger gains before it ends.

Regards,

Michael Carr, CMT