The Federal Reserve is committed to its policy. Fed Chairman Jerome Powell made this clear Sunday night.

In an interview with 60 Minutes, he said: “I think it’s highly unlikely that we would raise rates anything like this year.”

He added: “I’m in a position to guarantee that the Fed will do everything we can to support the economy for as long as it takes to complete the recovery.”

That’s consistent with Fed policy for the past year.

However, the facts have changed over the past year. It could be time for the Fed to consult boxer Mike Tyson for insight on how to react to changing conditions.

When asked how he would respond to an opponent’s style, Tyson said: “Everybody has a plan until they get punched in the mouth.”

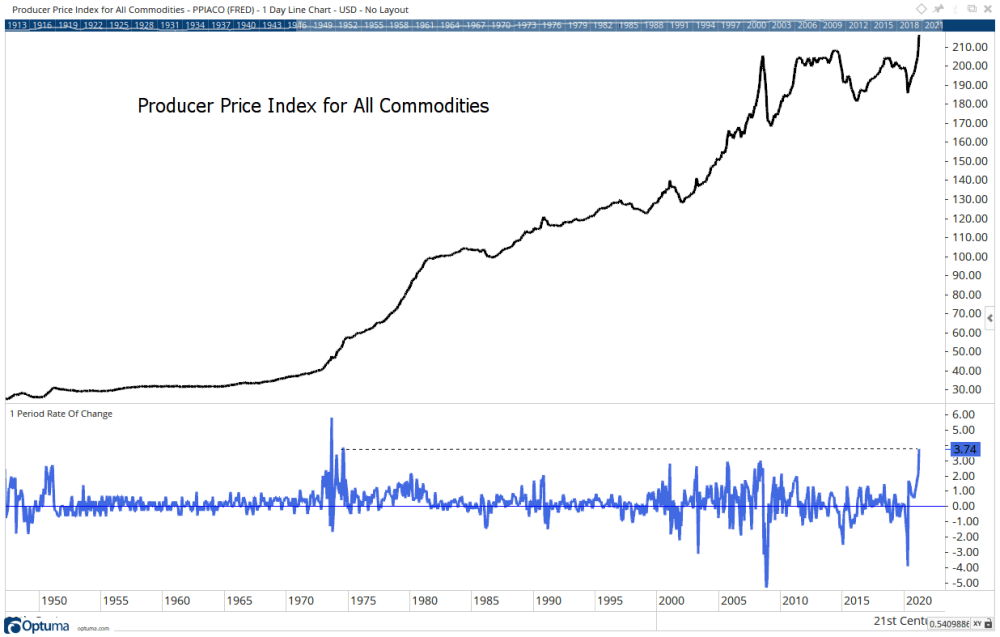

Right now, the economy seems to be punching the Fed in the mouth. Last week’s drastic change in Producer Price Index (PPI) data was one hit.

The Economy Is Punching the Fed’s Plan in the Mouth

According to CNBC, PPI for final demand jumped 1% last month after increasing 0.5% in February. In the past year, PPI surged 4.2%.

That was the biggest year-over-year increase since September 2011. And it surprised the experts. Economists polled by Reuters expected a 0.5% increase in March and a 3.8% year-over-year gain.

PPI for final demand is the headline number. Looking deeper in the report, we find even more troubling data.

PPI for commodities jumped 3.7% compared to a month ago. That’s the largest one-month change since July 1974.

PPI Rate of Change from 1950 to 2020

(Source: Optuma.)

Commodities are initial inputs to the manufacturing process. Price gains in commodities are the first step toward higher prices for consumers.

That’s what happened after the 1974 surge in commodity prices. The Consumer Price Index (CPI) was above 12% by the end of that year.

CPI is likely to rise in the coming months — and the Fed should pay attention to the data.

More importantly, the Fed should also consider Tyson’s wisdom.

The economy is punching the Fed’s plan in the mouth. If the Fed doesn’t adapt quickly, the economy will soon look like one of Tyson’s opponents, sprawled on the mat wondering how a plan could fail so badly.

Regards,

Editor, One Trade